Hello?

Dear traders, nice to meet you.

"Like" is a huge force for me.

By "following" you can always get new information quickly.

Thank you for always supporting me.

-------------------------------------------------- -----

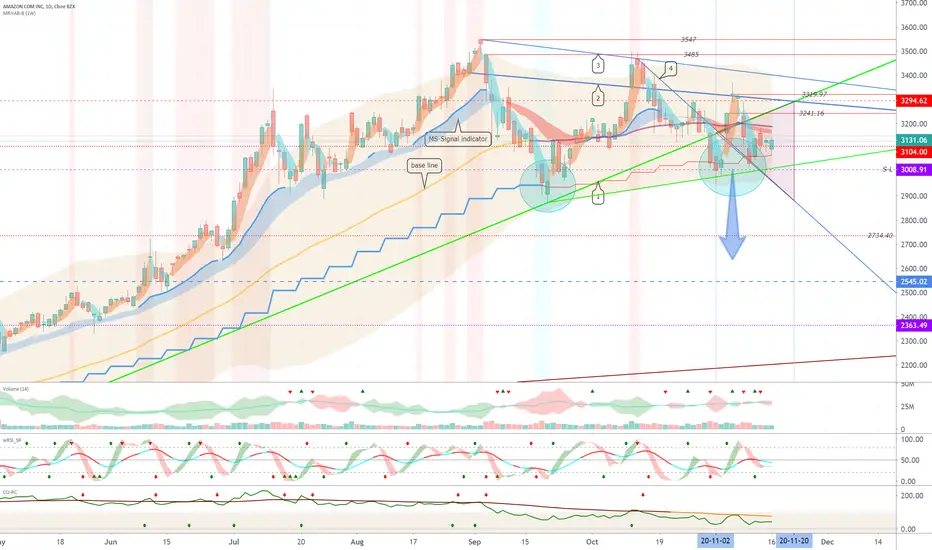

It started with a drop in the gap (3128.81-3093.20) and closed at 0.07%.

We have to see if we can get support at 3104.0 by around November 20th.

-------------------------

(DJI 1D chart)

It started with the gap (29479.8-29672.4) rising and closed at 1.60%.

-------------------------

(IXIC 1D chart)

It started with the gap (11829.3-11847.1) rising and closed at 0.80%.

-------------------------

(SPX 1D chart)

It started with the gap (3585.2-3600.2) rising and closed at 1.16%.

-------------------------

(GOLD 1D chart)

It started with a drop in the gap (25.89-25.80) and closed at -0.12%.

----------------------------

(XAUUSD 1D chart)

You should check for any movement that deviates from 1871.828-1899.330.

If you go down from 1855.500, you may fall towards 1803.382, so you need to trade carefully.

A move above 1899.330 and gaining support is expected to rise above 1940.498.

-------------------------------------------------- -------------------------------------------

** Check support, resistance, and abbreviation points.

** Support or resistance is based on the closing price of the 1D chart.

** All explanations are for reference only and do not guarantee profit or loss on investment.

Explanation of abbreviations displayed on the chart

R: A point or section of resistance that requires a response to preserve profits

S-L: Stop-Loss point or section

S: A point or segment that can be bought for profit generation as a support point or segment

(Short-term Stop Loss can be said to be a point where profits and losses can be preserved or additionally entered through installment trading. You should trade from a short-term investment perspective.)

GAP refers to the difference in prices that occurred when the stock market, CME and BAKKT exchanges were closed because they are not trading 24 hours a day.

G1: closing price when closed

G2: Market price at the time of opening

Dear traders, nice to meet you.

"Like" is a huge force for me.

By "following" you can always get new information quickly.

Thank you for always supporting me.

-------------------------------------------------- -----

It started with a drop in the gap (3128.81-3093.20) and closed at 0.07%.

We have to see if we can get support at 3104.0 by around November 20th.

-------------------------

(DJI 1D chart)

It started with the gap (29479.8-29672.4) rising and closed at 1.60%.

-------------------------

(IXIC 1D chart)

It started with the gap (11829.3-11847.1) rising and closed at 0.80%.

-------------------------

(SPX 1D chart)

It started with the gap (3585.2-3600.2) rising and closed at 1.16%.

-------------------------

(GOLD 1D chart)

It started with a drop in the gap (25.89-25.80) and closed at -0.12%.

----------------------------

(XAUUSD 1D chart)

You should check for any movement that deviates from 1871.828-1899.330.

If you go down from 1855.500, you may fall towards 1803.382, so you need to trade carefully.

A move above 1899.330 and gaining support is expected to rise above 1940.498.

-------------------------------------------------- -------------------------------------------

** Check support, resistance, and abbreviation points.

** Support or resistance is based on the closing price of the 1D chart.

** All explanations are for reference only and do not guarantee profit or loss on investment.

Explanation of abbreviations displayed on the chart

R: A point or section of resistance that requires a response to preserve profits

S-L: Stop-Loss point or section

S: A point or segment that can be bought for profit generation as a support point or segment

(Short-term Stop Loss can be said to be a point where profits and losses can be preserved or additionally entered through installment trading. You should trade from a short-term investment perspective.)

GAP refers to the difference in prices that occurred when the stock market, CME and BAKKT exchanges were closed because they are not trading 24 hours a day.

G1: closing price when closed

G2: Market price at the time of opening

Note

(NFLX 1D chart)It started with a drop in the gap (482.84-480.0) and closed at -0.77%.

We have to see if we can quickly climb above the 485.23 point.

We need to make sure we can get support at point 465.91.

If it does not deviate from the downtrend line (3), the downtrend is maintained.

It remains to be seen if volatility around November 18th (November 17-19) can break off the downtrend line (3).

Other content (coins, stocks, etc.) is frequently posted on X.

X에 다른 내용(코인, 주식 등)이 자주 게시.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

X에 다른 내용(코인, 주식 등)이 자주 게시.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Other content (coins, stocks, etc.) is frequently posted on X.

X에 다른 내용(코인, 주식 등)이 자주 게시.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

X에 다른 내용(코인, 주식 등)이 자주 게시.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.