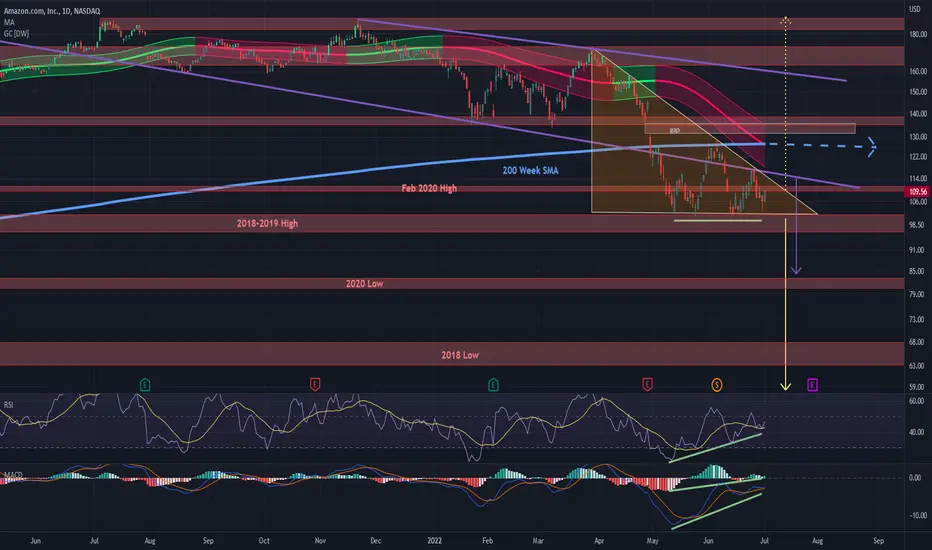

Amazon is giving mixed signals but the bias is toward the downside, especially with S&500 and NASDAQ looking not so good. Descending triangles are usually bearish. The descending channel's support line has been broken, and just like with the gaussian channel and 200 week SMA, flipped into resistance. Bullish divergences on the RSI and MACD suggest a pump but one of the troubles with divergences is sometimes their result is lackluster. Thus a small rally to the descending traingle resistance line might be all it means. They are also exaggerated divergences which are usually less reliable than regular ones. But it could also do enough to invalidate the triangle and form some sort of W bottom. There is also a gap overhead but it doesn't mean it will get filled soon. Targets for the descending triangle are the 2021 high or the 2018 low. We'll have to wait and see where it breaks.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.