Hello?

Dear traders, nice to meet you.

"Like" is a huge force for me.

By "following" you can always get new information quickly.

Thank you for always supporting me.

-------------------------------------------------- -----

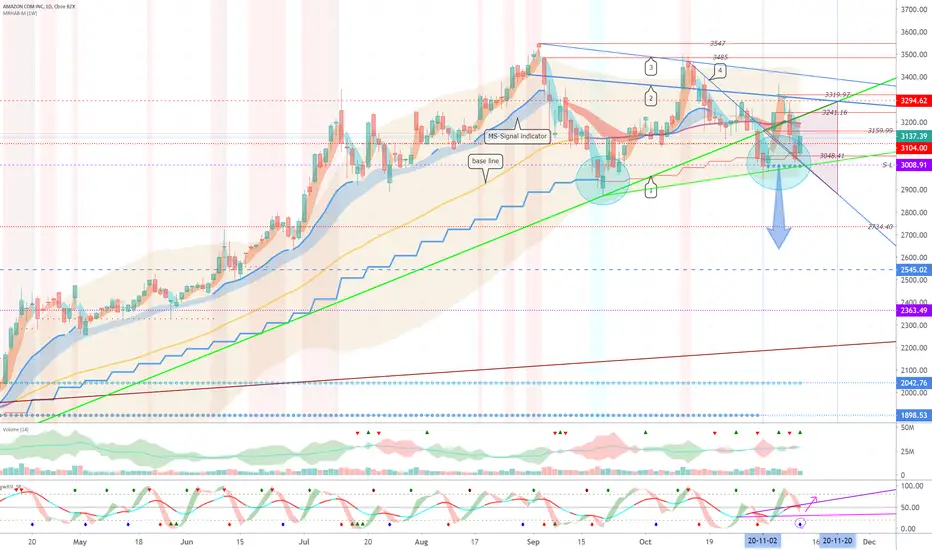

The gap (3035.02-3061.78) started with an increase and ended higher.

It remains to be seen if it will rise above 3159.99 and fill the previous gap (3048.41-3159.99).

If it is supported at 3104.0 in the short-term downtrend, it is expected to rise towards the 3294.62 point.

If it falls from the 3008.91 point, it is the Stop Loss point.

Secondly, I touched the support line.

I think it's time to get support at 3104.0 to get further up.

--------------------------------------

(DJI 1D chart)

The gap (29420.9-29524.4) started and closed with a rise.

------------------------------------

(IXIC 1D chart)

The gap (11424.6-11656.6) started with an increase and ended higher.

------------------------------------

(SPX 1D chart)

The gap (3545.5-3563.2) started with a rise and ended higher.

----------------------------------

(GOLD 1D chart)

You need to make sure you can get support at 25.75.

If you move down the downtrend line, you need to see if you get support at 22.51-24.07.

It remains to be seen if the rebound could increase more than 26.55 points.

-------------------------------------------------- -------------------------------------------

** Check support, resistance, and abbreviation points.

** Support or resistance is based on the closing price of the 1D chart.

** All explanations are for reference only and do not guarantee profit or loss on investment.

Explanation of abbreviations displayed on the chart

R: A point or section of resistance that requires a response to preserve profit

S-L: Stop-Loss point or section

S: A point or segment that can be bought for profit generation as a support point or segment

(Short-term Stop Loss can be said to be a point where profits and losses can be preserved or additionally entered through installment trading. You should trade from a short-term investment perspective.)

GAP refers to the difference in prices that occurred when the stock market, CME and BAKKT exchanges were closed because they do not trade 24 hours a day.

G1: Closed price

G2: Market price at the time of opening

Dear traders, nice to meet you.

"Like" is a huge force for me.

By "following" you can always get new information quickly.

Thank you for always supporting me.

-------------------------------------------------- -----

The gap (3035.02-3061.78) started with an increase and ended higher.

It remains to be seen if it will rise above 3159.99 and fill the previous gap (3048.41-3159.99).

If it is supported at 3104.0 in the short-term downtrend, it is expected to rise towards the 3294.62 point.

If it falls from the 3008.91 point, it is the Stop Loss point.

Secondly, I touched the support line.

I think it's time to get support at 3104.0 to get further up.

--------------------------------------

(DJI 1D chart)

The gap (29420.9-29524.4) started and closed with a rise.

------------------------------------

(IXIC 1D chart)

The gap (11424.6-11656.6) started with an increase and ended higher.

------------------------------------

(SPX 1D chart)

The gap (3545.5-3563.2) started with a rise and ended higher.

----------------------------------

(GOLD 1D chart)

You need to make sure you can get support at 25.75.

If you move down the downtrend line, you need to see if you get support at 22.51-24.07.

It remains to be seen if the rebound could increase more than 26.55 points.

-------------------------------------------------- -------------------------------------------

** Check support, resistance, and abbreviation points.

** Support or resistance is based on the closing price of the 1D chart.

** All explanations are for reference only and do not guarantee profit or loss on investment.

Explanation of abbreviations displayed on the chart

R: A point or section of resistance that requires a response to preserve profit

S-L: Stop-Loss point or section

S: A point or segment that can be bought for profit generation as a support point or segment

(Short-term Stop Loss can be said to be a point where profits and losses can be preserved or additionally entered through installment trading. You should trade from a short-term investment perspective.)

GAP refers to the difference in prices that occurred when the stock market, CME and BAKKT exchanges were closed because they do not trade 24 hours a day.

G1: Closed price

G2: Market price at the time of opening

Other content (coins, stocks, etc.) is frequently posted on X.

X에 다른 내용(코인, 주식 등)이 자주 게시.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

X에 다른 내용(코인, 주식 등)이 자주 게시.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Other content (coins, stocks, etc.) is frequently posted on X.

X에 다른 내용(코인, 주식 등)이 자주 게시.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

X에 다른 내용(코인, 주식 등)이 자주 게시.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.