Technical Analysis for AMZN (Dec. 10, 2024)

Price Action:

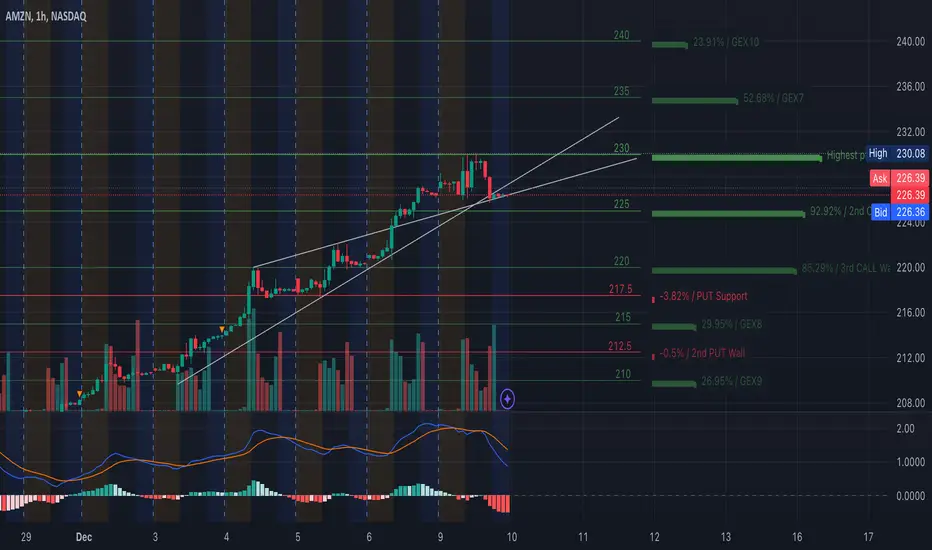

* Opening Movement: AMZN opened with bullish momentum, continuing its trend from the previous session. It tested the $230 resistance level, coinciding with the Highest Positive GEX and psychological significance.

* Mid-Day: The price started consolidating between $225 (support) and $230 (resistance), showing indecision among buyers and sellers.

* Closing Trend: Towards the end of the session, AMZN slightly pulled back, hovering near the $226 zone but still maintaining its uptrend structure above key moving averages and trendlines.

Key Indicators Observed:

1. GEX Indicator:

* $230 Level: Marked as the highest positive gamma resistance, AMZN struggled to break above this level due to the options market hedging activity. Gamma levels acted as a natural resistance barrier.

* $225 Support: This level, corresponding to the 2nd Call Wall, provided strong support during intraday pullbacks, confirming its significance.

* Put Support at $217.5: Below $220, this zone indicates a potential area of buying interest if the price dips further.

2. Trend Lines:

* AMZN respected an upward-sloping trendline throughout the session, demonstrating a bullish sentiment.

* The price held above this trendline, reinforcing it as intraday support.

3. MACD:

* The MACD is currently bearish, with a downward crossover. The histogram is trending negative, signaling reduced bullish momentum and a potential pullback in the short term.

4. Volume:

* A spike in volume was observed during the test of the $230 resistance, indicating significant activity in this region. However, volume decreased during the consolidation phase, hinting at market indecision.

GEX Indicator Insights:

The Gamma Exposure (GEX) indicator highlighted key levels that directly influenced AMZN’s price action:

* Resistance at $230: This level acted as a ceiling, supported by high positive gamma levels, which increased market makers' hedging activity, limiting further upward movement.

* Support at $225: GEX provided a reliable support zone, giving traders confidence to enter long positions during pullbacks.

* Value of GEX in Trading:

* GEX helps traders identify where significant resistance or support levels lie based on options market activity.

* It enhances confidence by revealing hidden forces that shape price movements, offering clarity in volatile conditions.

* Without GEX: Traders may miss understanding why prices consolidate or reverse at specific levels, reducing their ability to predict market movements.

Trading Plan for Tomorrow:

Scalping Strategy:

1. Entry Points:

* Long Above $230: Look for a breakout above $230 with strong volume. Target $235.

* Short Below $225: Enter short if the price breaks below $225, targeting $220 or $217.5.

2. Stop-Loss: Use tight stops of $1 above or below entry points.

Swing Trading:

1. Bullish Scenario:

* If AMZN holds above $225, expect a retest of $230. A breakout could target $235 and $240 in the coming sessions.

2. Bearish Scenario:

* A break below $225 could lead to a decline towards $220 and potentially $217.5.

Disclaimer:

This analysis is for informational purposes only and should not be construed as financial advice. Always perform your due diligence before making any trading decisions.

Price Action:

* Opening Movement: AMZN opened with bullish momentum, continuing its trend from the previous session. It tested the $230 resistance level, coinciding with the Highest Positive GEX and psychological significance.

* Mid-Day: The price started consolidating between $225 (support) and $230 (resistance), showing indecision among buyers and sellers.

* Closing Trend: Towards the end of the session, AMZN slightly pulled back, hovering near the $226 zone but still maintaining its uptrend structure above key moving averages and trendlines.

Key Indicators Observed:

1. GEX Indicator:

* $230 Level: Marked as the highest positive gamma resistance, AMZN struggled to break above this level due to the options market hedging activity. Gamma levels acted as a natural resistance barrier.

* $225 Support: This level, corresponding to the 2nd Call Wall, provided strong support during intraday pullbacks, confirming its significance.

* Put Support at $217.5: Below $220, this zone indicates a potential area of buying interest if the price dips further.

2. Trend Lines:

* AMZN respected an upward-sloping trendline throughout the session, demonstrating a bullish sentiment.

* The price held above this trendline, reinforcing it as intraday support.

3. MACD:

* The MACD is currently bearish, with a downward crossover. The histogram is trending negative, signaling reduced bullish momentum and a potential pullback in the short term.

4. Volume:

* A spike in volume was observed during the test of the $230 resistance, indicating significant activity in this region. However, volume decreased during the consolidation phase, hinting at market indecision.

GEX Indicator Insights:

The Gamma Exposure (GEX) indicator highlighted key levels that directly influenced AMZN’s price action:

* Resistance at $230: This level acted as a ceiling, supported by high positive gamma levels, which increased market makers' hedging activity, limiting further upward movement.

* Support at $225: GEX provided a reliable support zone, giving traders confidence to enter long positions during pullbacks.

* Value of GEX in Trading:

* GEX helps traders identify where significant resistance or support levels lie based on options market activity.

* It enhances confidence by revealing hidden forces that shape price movements, offering clarity in volatile conditions.

* Without GEX: Traders may miss understanding why prices consolidate or reverse at specific levels, reducing their ability to predict market movements.

Trading Plan for Tomorrow:

Scalping Strategy:

1. Entry Points:

* Long Above $230: Look for a breakout above $230 with strong volume. Target $235.

* Short Below $225: Enter short if the price breaks below $225, targeting $220 or $217.5.

2. Stop-Loss: Use tight stops of $1 above or below entry points.

Swing Trading:

1. Bullish Scenario:

* If AMZN holds above $225, expect a retest of $230. A breakout could target $235 and $240 in the coming sessions.

2. Bearish Scenario:

* A break below $225 could lead to a decline towards $220 and potentially $217.5.

Disclaimer:

This analysis is for informational purposes only and should not be construed as financial advice. Always perform your due diligence before making any trading decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.