AU Small Finance Bank (AUBANK)

Trade Plan:

Risk-Reward:

Educational Tip: Look for large green candles and volume spikes near the demand zone to confirm institutional interest before entering.

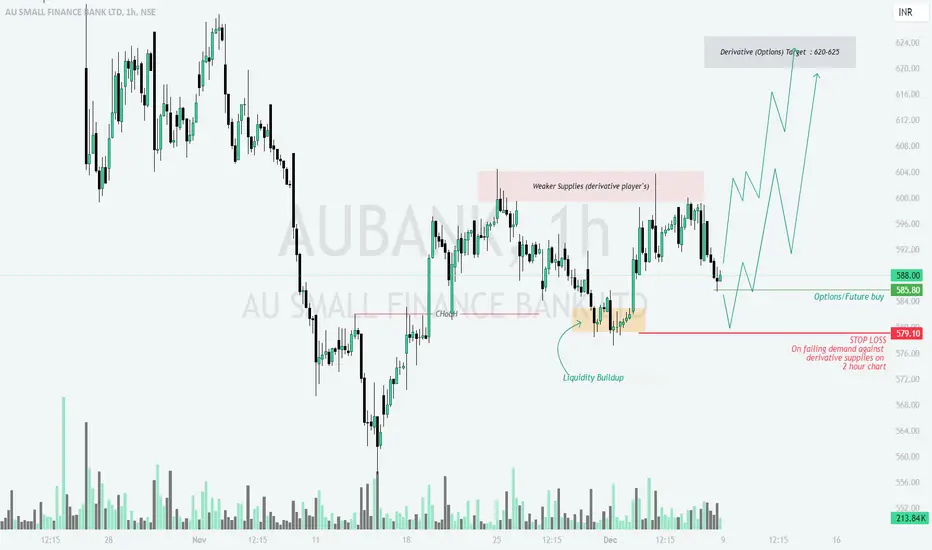

- []Liquidity Buildup: The ₹585-588 zone shows institutional buying activity, indicated by tight price ranges and volume consolidation. This zone acts as a demand area, where buying pressure is likely to sustain.

[]Weaker Supply Zone: Sellers dominate the ₹620-625 range but are weakening. If the price reaches this level again, a breakout is more probable. - Stop Loss Placement: Below ₹579, the demand zone fails, and the trade setup is invalidated.

Trade Plan:

- []Entry: Buy near ₹588 when the price approaches the demand zone with increasing volume.

[]Target: Exit around ₹620-625, aligning with historical supply resistance. - Stop Loss: Set at ₹579 to protect against demand failure.

Risk-Reward:

- []Risk (₹579): ₹9 below entry at ₹588.

[]Reward (₹625): ₹37 above entry. - R/R Ratio: 1:4 – an ideal setup for swing trades.

Educational Tip: Look for large green candles and volume spikes near the demand zone to confirm institutional interest before entering.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.