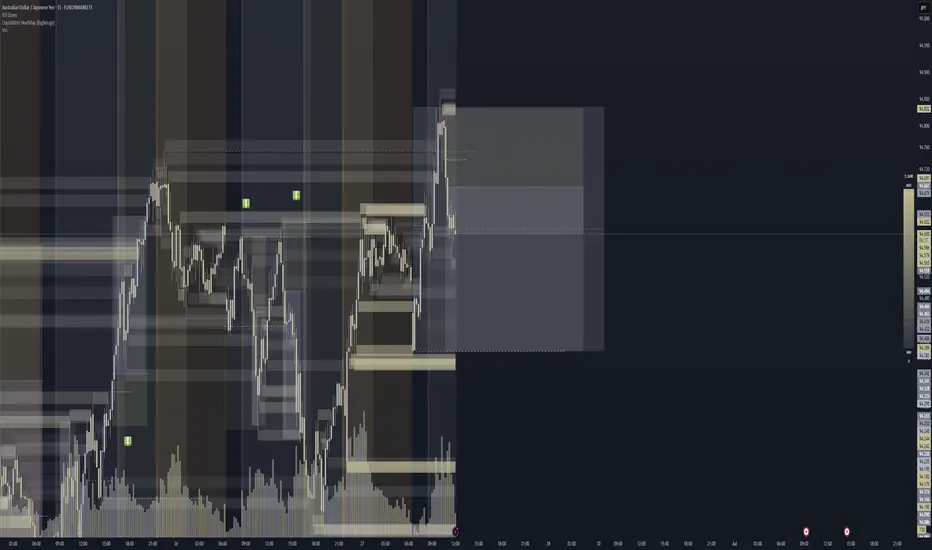

Price swept buyside liquidity at 94.753, forming the second leg of an extended M pattern within the premium zone of the defined box. A clean bearish shift followed, confirmed with a strong-bodied close and short upper wick. Entry was executed post-shift, with confluence from Bright Gold liquidity clusters identified in discount using the HeatMap.

TP set at the box low (94.383), aligning with a major sellside liquidity draw. Stop Loss placed just above the box high, maintaining structure integrity.

Thesis:

- Buyside liquidity sweep + extended M in premium

- Structure shift + bearish intent confirmed

- HeatMap + box theory aligned with short narrative

- Letting price seek liquidity beneath equilibrium

DISCLAIMER: NOT RECOMMENDED TO TRADE SHORT WHEN YOU SEE THIS. MOST OF MOVE IS ALREADY DONE. THIS IS JUST TO PREVIEW AND LEARN THAT TAKING TRADES LIKE THIS CAN BE POSSIBLE

Trade closed manually

Profit Secured!!!Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.