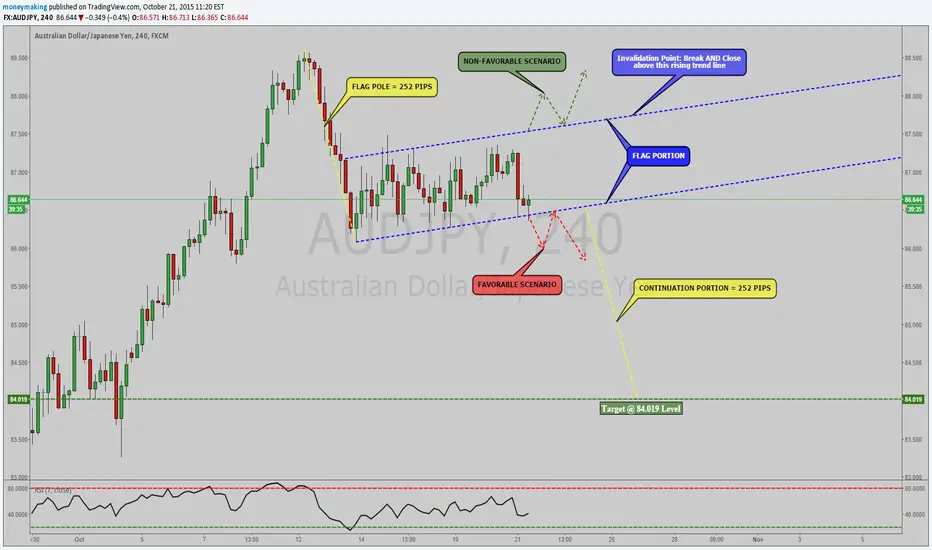

AUDJPY: BEARISH FLAG PATTERN FORMED, CLOSE TO BREAKOUT [4HR] !!!

Hello Traders,

Here we have a valid bearish flag pattern on

AUDJPY and currently we are sitting close to the potential breakout to the downside. Flag patterns are also consolidation patterns, just like any other harmonic patterns (cypher, bat, butterfly , crab , gartley). This pattern is usually formed after a strong movement in price action. There are 3 main parts to this pattern: the flag pole, flag portion, and the continuation portion. After a strong movement, a strong selloff in this case, the market starts to consolidate and we expect the market to breakout in the direction of the flag pole, in our case to the downside.

AUDJPY and currently we are sitting close to the potential breakout to the downside. Flag patterns are also consolidation patterns, just like any other harmonic patterns (cypher, bat, butterfly , crab , gartley). This pattern is usually formed after a strong movement in price action. There are 3 main parts to this pattern: the flag pole, flag portion, and the continuation portion. After a strong movement, a strong selloff in this case, the market starts to consolidate and we expect the market to breakout in the direction of the flag pole, in our case to the downside.

After getting the breakout, the target is equal to the length of the flag pole, which is 252 pips for this setup. Also a key point to keep in mind is that, the longer the market stays within the consolidation zone (flag portion), the stronger the breakout to the downside will be. The invalidation point for this flag pattern is when we get a break AND close above the upper rising trend line of the flag portion. See the chart above for more details.

Please feel free to AGREE or DISAGREE with this idea by leaving a comment below. Hit that thumbs up button (top left corner of this chart) if you like the idea. Thank you everyone for all the SUPPORT that you have given me so far, I truly appreciate it. Good luck everyone :)

Follow me on Twitter as well: moneymaking2016

Here we have a valid bearish flag pattern on

After getting the breakout, the target is equal to the length of the flag pole, which is 252 pips for this setup. Also a key point to keep in mind is that, the longer the market stays within the consolidation zone (flag portion), the stronger the breakout to the downside will be. The invalidation point for this flag pattern is when we get a break AND close above the upper rising trend line of the flag portion. See the chart above for more details.

Please feel free to AGREE or DISAGREE with this idea by leaving a comment below. Hit that thumbs up button (top left corner of this chart) if you like the idea. Thank you everyone for all the SUPPORT that you have given me so far, I truly appreciate it. Good luck everyone :)

Follow me on Twitter as well: moneymaking2016

Note

UPDATE #1: Hello traders, we recently got the breakout of the bearish flag pattern BUT it is not a convincing type of breakout. Stay cautious, don't need to rush into entering short. We need to see a strong breakout to the downside followed by a valid re-test before going short. Also note that after breaking and closing below the flag pattern, the candle right after that was able to close back above the broken level, which could be an early signal of a potential false breakout :)Note

UPDATE #3: No valid re-test of the broken level yet. Staying on the sidelines for now :)Note

UPDATE #6: Hello traders, after getting a strong breakout to the downside, I was waiting for a valid retest of the broken level by the market. Currently market has provided us with a 2618 trade setup right at the broken level. Selling at the completion of the 2618 trade setup, we will be risking 61 pips to make 252 pips. This is almost a 4:1 R:R trade, which I am willing to take any time it presents itself. Note

UPDATE #8: Hello everyone, just got stopped out for 62 pips, especially due to the 2 AUD high impact news events that came out today (Nov.11.2015) @ 7:30 pm. Note the bearish flag pattern has been invalidated by the market. I have another setup formed on this pair, so stay tune for that idea to be published :)Trade closed: stop reached

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.