Australia, NZ Dollars Near Major Resistance as US Yields Decline

The Australian and New Zealand dollars are approaching key resistance levels, driven by declining U.S. yields. The Reserve Bank of Australia (RBA) has adopted a notably hawkish stance on the economic outlook. Consequently, markets are currently pricing with only a 16% chance of a rate cut in September, with a 50% probability of a quarter-point reduction in November.

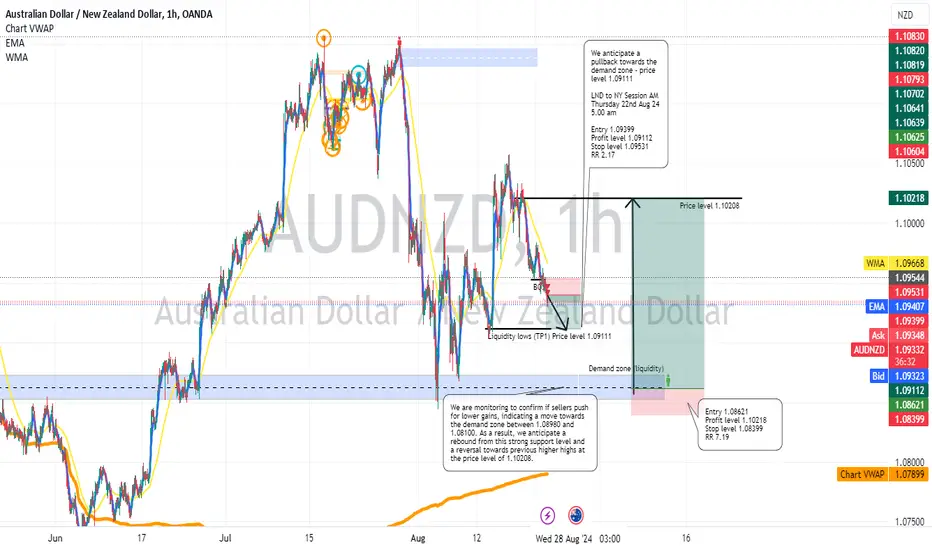

We are therefore tracking to confirm if Sellers push for lower gains indicating the Demand zone 1.08980 to 1.08100. As a result, we anticipate a rebound from the strong support level and reversal to previous higher highs and the price level of 1.10208.

Short trade idea...?

Date & Time: Thursday, 22nd August 2024, 5:00 AM

Session: London to New York Session (AM)

Entry Price: 1.09399

Profit Target: 1.09112

Stop Loss: 1.09531

Risk-Reward Ratio: 2.17

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.