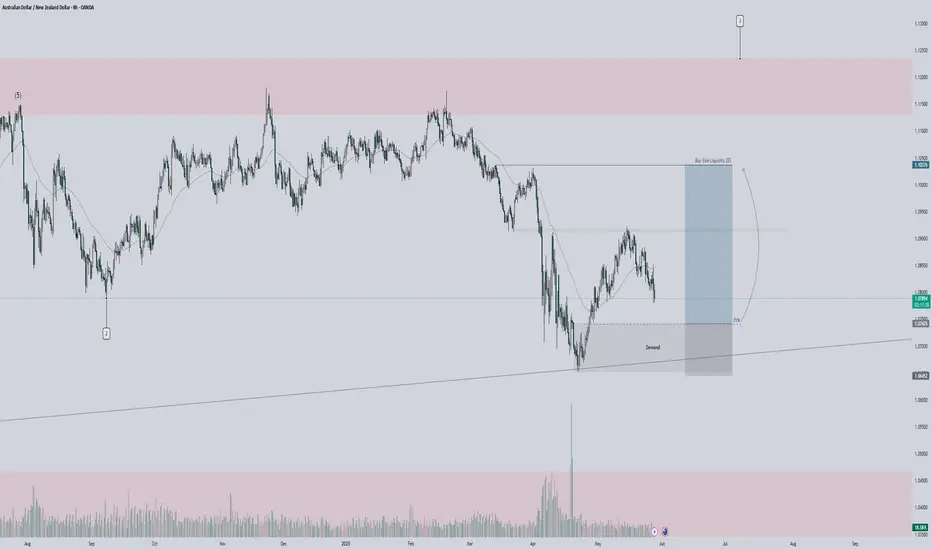

🔥 AUD/NZD 8H Bullish Setup – Demand Zone + Liquidity Grab

📍 Current Structure:

Price is pulling back into a refined demand zone, perfectly aligned with the 71% Fibonacci retracement.

This zone also holds trendline support from the higher timeframe — strong structural confluence.

Price is forming a corrective wave, likely completing a classic ABC pattern down into demand.

📊 Volume Insight:

A volume spike at the lows hints at aggressive buying — likely institutional.

Smart money may be accumulating just before a bullish push.

📈 Play Idea:

Looking for price to react inside the 71% zone, potentially forming a bullish engulfing or BOS (break of structure).

Clear target is Buy Side Liquidity (BSL) above recent highs — that's where stops are clustered.

🧠 Confluences:

Demand Zone ✅

71% Fib Level ✅

Trendline Support ✅

Volume Spike ✅

Buy Side Liquidity Target ✅

🎯 Bias: Strongly Bullish

Waiting for a clean trigger — bullish candle confirmation or BOS.

This setup screams smart money accumulation.

📍 Current Structure:

Price is pulling back into a refined demand zone, perfectly aligned with the 71% Fibonacci retracement.

This zone also holds trendline support from the higher timeframe — strong structural confluence.

Price is forming a corrective wave, likely completing a classic ABC pattern down into demand.

📊 Volume Insight:

A volume spike at the lows hints at aggressive buying — likely institutional.

Smart money may be accumulating just before a bullish push.

📈 Play Idea:

Looking for price to react inside the 71% zone, potentially forming a bullish engulfing or BOS (break of structure).

Clear target is Buy Side Liquidity (BSL) above recent highs — that's where stops are clustered.

🧠 Confluences:

Demand Zone ✅

71% Fib Level ✅

Trendline Support ✅

Volume Spike ✅

Buy Side Liquidity Target ✅

🎯 Bias: Strongly Bullish

Waiting for a clean trigger — bullish candle confirmation or BOS.

This setup screams smart money accumulation.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.