Fundamentals:

It has been a hawkish month for the Reserve Bank of Australia. The recent meeting suggests that their guidance ramps up into a more hawkish tone. Both monetary and fiscal policies are aussie positive, so far. One thing I keep in mind is their fiscal policy in response to the current covid-19 lockdowns.

I believe that the Reserve Bank of New Zealand is overly hawkish, given their currency price. For the next few weeks, the AUD currency give us a more underdog positioning to exploit versus the NZD currency.

Technicals:

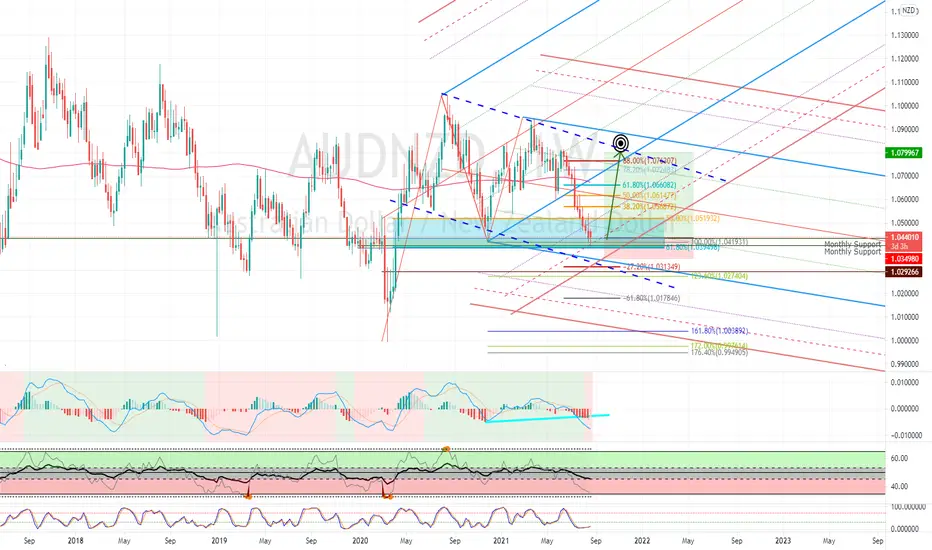

(1) Monthly support

(2) 61.8% fib

(3) Oversold indicators

(4) Divergence

(5) RSI at extreme levels

Daily:

Weekly:

It has been a hawkish month for the Reserve Bank of Australia. The recent meeting suggests that their guidance ramps up into a more hawkish tone. Both monetary and fiscal policies are aussie positive, so far. One thing I keep in mind is their fiscal policy in response to the current covid-19 lockdowns.

I believe that the Reserve Bank of New Zealand is overly hawkish, given their currency price. For the next few weeks, the AUD currency give us a more underdog positioning to exploit versus the NZD currency.

Technicals:

(1) Monthly support

(2) 61.8% fib

(3) Oversold indicators

(4) Divergence

(5) RSI at extreme levels

Daily:

Weekly:

Capturing the swings of the stock market & currency market. It's a dirty job and equity/currency traders must do it.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Capturing the swings of the stock market & currency market. It's a dirty job and equity/currency traders must do it.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.