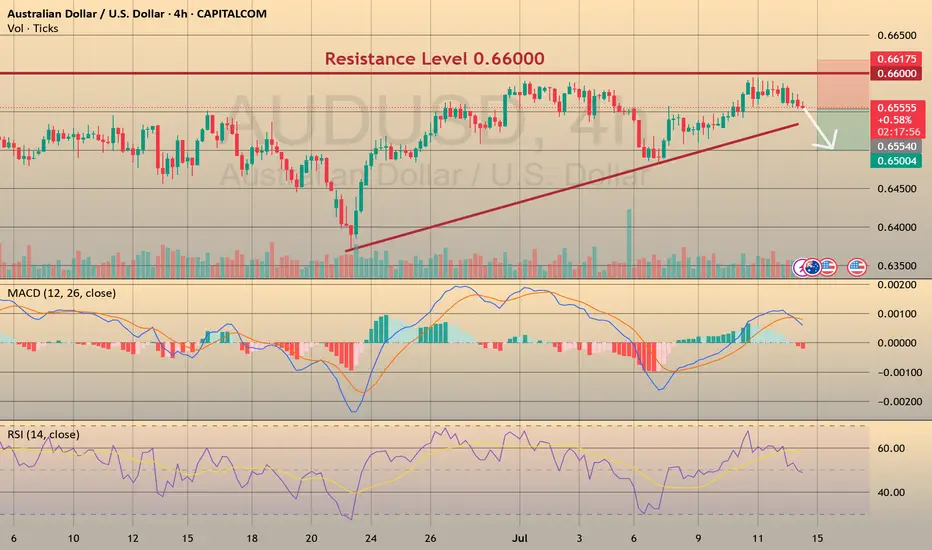

AUDUSD is hovering near a rising trendline, with price action compressing and signaling a potential downside break in the coming sessions.

Just above, the 0.65900 resistance zone has capped recent rallies, and the pair’s failure to clear this level strengthens the case for a reversal.

Later today, we will see Westpac Consumer Confidence data for Australia, which could act as a catalyst for a sharp move. A weaker-than-expected print would likely pressure the Aussie further.

📋 Entry Checklist:

✅ Testing rising trendline, signaling potential breakdown

✅ Strong resistance at 0.65900 holding rallies

✅ Key consumer sentiment data could trigger volatility

📈 Trade Plan:

🔻 Sell Entry: 0.65600

❌ Stop Loss: 0.66200

✅ Take Profit: 0.65000

(Tap 👉 Trade Now 👈 on mobile to copy SL & TP easily)

📰 Fundamental Snapshot:

The Reserve Bank of Australia (RBA) surprised markets by holding rates steady at 3.85%, diverging from expectations of a potential cut. The RBA remains cautious amid persistent inflation risks driven by high labor costs and weak productivity, suggesting rates may stay restrictive longer.

Governor Michele Bullock highlighted that inflation could remain above forecasts, while Deputy Governor Andrew Hauser emphasized monitoring global uncertainties, including U.S. tariff developments, reflecting the RBA’s sensitivity to external headwinds impacting growth and trade.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.