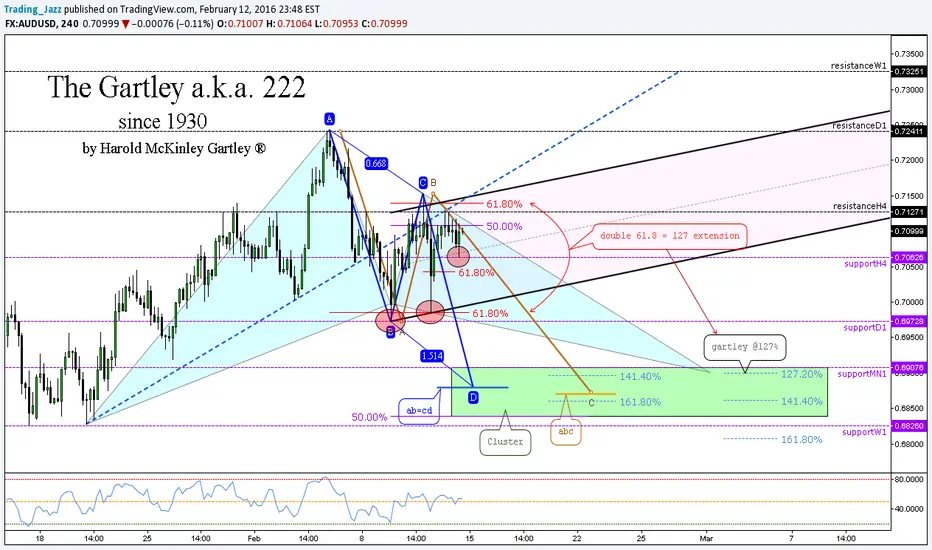

Gartley:

Point B:

61.8% can not touch 78.6% XA

Point C:

38.2% to 88.6% AB

Point D:

78.6% XA

127% ext AB

Target:

TP1 38.2% AD

TP2 61.8% AD

Price as rejected a close below the 618% retracement twice (at daily supportD1)... broke out the bullish structure, rejected one first time at 61.8%, tested previous structure, and rejected again at the 618% strengthen the daily supportD1 at $0.69728. Hereupon, "we" are trading between H4 resistance and H4 support, and waiting a decision.

We have a cluster - (check link below), one ABC correction or one ab=cd pattern will sink the price close to monthly support at 0.69076$ or below it at weekly support at 0.6826$.

Check also " (2h) The Bats // IF=THEN ® " - link below

Safe Trades;

open.spotify.com/track/08JbOQGSzcVVIHv33i8TMz

Harmonic Patterns | Market Analyst | Forex Analytix | Porto, Portugal

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Harmonic Patterns | Market Analyst | Forex Analytix | Porto, Portugal

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.