💵 AUD/USD "AUSSIE" Forex Bank Heist Plan (Swing/Day Trade) 🐨🔥

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰💸✈️

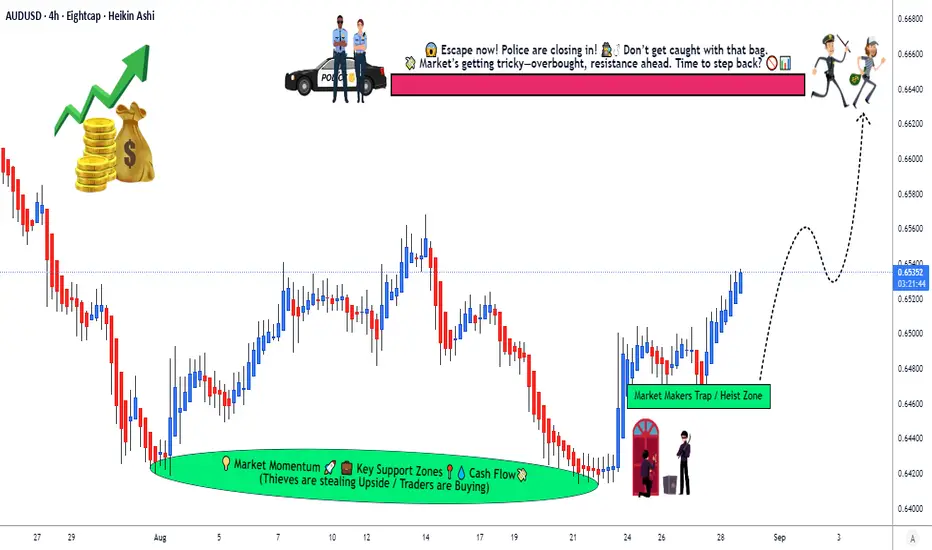

Based on the 🔥Thief Trading style technical & fundamental analysis🔥, here is our master plan to rob the Aussie Forex vault! 🏦💣

We’re pulling off a Bullish Heist on AUD/USD, and the doors are wide open! 🚪🔓

🎯 Entry (Loot Grab Point)

📈 “Any price level is a chance to rob the vault!”

Thief strategy = Layering multiple limit orders 🧩💎

Buy Limit Layers: 0.65000 / 0.65100 / 0.65200 / 0.65300

You can increase the limit layers based on your arsenal & bankroll 💼💵

🕵️ Remember, Thief OG’s never enter with one bullet – multiple shots, multiple loot bags.

🛑 Stop Loss (Police Patrol Spot)

This is the Thief SL 🚨 @ 0.64600

But… dear Thief OG’s, adjust SL based on your risk appetite & lot sizing strategy. 📉💼

We don’t all escape the same way 😉

🎯 Target (Escape Point)

⚠️ Police barricade spotted @ 0.66600 🚧👮

So we take our loot escape route at 0.66400 🏃💨💰 before they catch us!

📰 Thief Fundamental Reminder

📌 AUD/USD heist depends on Fed whispers, Aussie data releases & risk sentiment.

📌 Avoid new robberies during major news drops (NFP, CPI, RBA statements).

📌 Manage positions smartly: use trailing stops to lock in stolen profits 💼🔐.

💖 Supporting our robbery plan 💥Hit the Boost Button💥 will power up the Thief Crew! 🏆💪🤝❤️🎉🚀

Every day in this market, we rob smart, escape clean, and count profits like legends. 🤑🐱👤

⚠️ Disclaimer: This is a robbery plan, not financial advice. Follow at your own risk.

#AUDUSD #ForexHeist #ThiefTrader #LayeringStrategy #DayTrading #SwingTrading #ForexCommunity #BankHeistPlan #ForexSignals

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰💸✈️

Based on the 🔥Thief Trading style technical & fundamental analysis🔥, here is our master plan to rob the Aussie Forex vault! 🏦💣

We’re pulling off a Bullish Heist on AUD/USD, and the doors are wide open! 🚪🔓

🎯 Entry (Loot Grab Point)

📈 “Any price level is a chance to rob the vault!”

Thief strategy = Layering multiple limit orders 🧩💎

Buy Limit Layers: 0.65000 / 0.65100 / 0.65200 / 0.65300

You can increase the limit layers based on your arsenal & bankroll 💼💵

🕵️ Remember, Thief OG’s never enter with one bullet – multiple shots, multiple loot bags.

🛑 Stop Loss (Police Patrol Spot)

This is the Thief SL 🚨 @ 0.64600

But… dear Thief OG’s, adjust SL based on your risk appetite & lot sizing strategy. 📉💼

We don’t all escape the same way 😉

🎯 Target (Escape Point)

⚠️ Police barricade spotted @ 0.66600 🚧👮

So we take our loot escape route at 0.66400 🏃💨💰 before they catch us!

📰 Thief Fundamental Reminder

📌 AUD/USD heist depends on Fed whispers, Aussie data releases & risk sentiment.

📌 Avoid new robberies during major news drops (NFP, CPI, RBA statements).

📌 Manage positions smartly: use trailing stops to lock in stolen profits 💼🔐.

💖 Supporting our robbery plan 💥Hit the Boost Button💥 will power up the Thief Crew! 🏆💪🤝❤️🎉🚀

Every day in this market, we rob smart, escape clean, and count profits like legends. 🤑🐱👤

⚠️ Disclaimer: This is a robbery plan, not financial advice. Follow at your own risk.

#AUDUSD #ForexHeist #ThiefTrader #LayeringStrategy #DayTrading #SwingTrading #ForexCommunity #BankHeistPlan #ForexSignals

Trade active

Note

📊 AUD/USD Market Report - 02 September 2025💸 Real-Time Exchange Rate

24-Hour Change: +0.10% 📈

Weekly Change: +1.82% 🌟

Monthly Change: +1.62% 📅

Yearly Change: -3.82% 📉

😊 Trader Sentiment

Retail Traders:

Bullish (Long): 55% 🐂

Bearish (Short): 45% 🐻

Institutional Traders:

Bullish (Long): 40% 🐂

Bearish (Short): 60% 🐻

😨 Fear & Greed Index

Current Mood: Neutral (50/100) 😐

Fear: 40% 😟

Greed: 60% 😄

Interpretation: Balanced sentiment, with slight greed bias but no extreme emotions driving the market.

📉 Fundamental Score

Score: 45/100 📊

Key Factors:

RBA Interest Rate: 3.60% (recent 25bps cut) 🔽

US Fed Rate: 4.25%-4.50% (steady, 2 cuts expected by year-end) ⚖️

China Economic Data: Mixed PMI (Manufacturing 49.4, Services 50.3) 🇨🇳

US Economic Data: Strong consumer spending (+0.5% in July) 🇺🇸

🌍 Macro Score

Score: 40/100 🌎

Key Influences:

Geopolitical Risks: Rising global trade tensions (US tariffs) ⚠️

Australian Growth: Weak Q3 data, RBA cut bets increase 📉

US Economy: Resilient growth, strong USD pressure 💪

China Correlation: Weak yuan drags AUD lower 📉

📈 Overall Market Outlook

Score: 42/100 (Bearish) 🐻

Outlook: Short-term bearish bias due to USD strength and Australian economic softness. Potential for volatility with upcoming US ISM Manufacturing PMI and Australian GDP data. 📅

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.