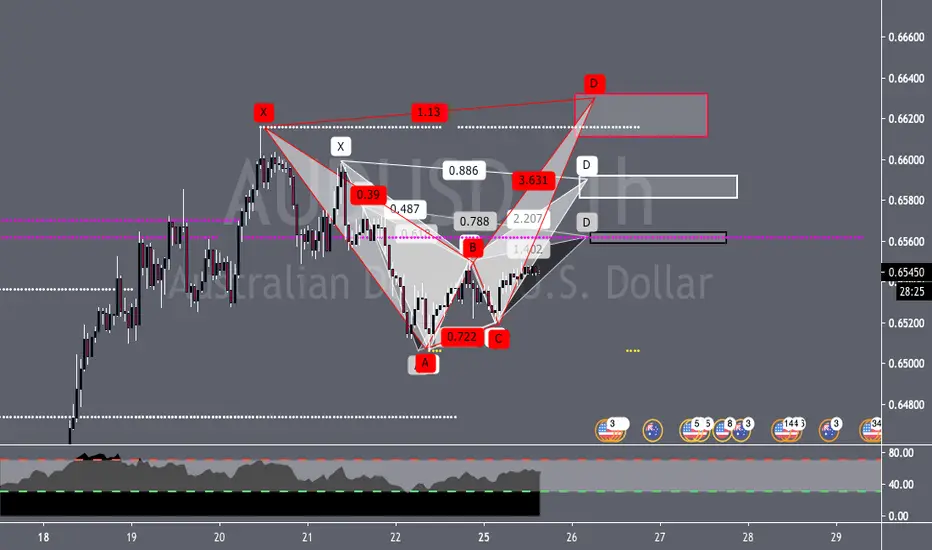

Okay, here is the Aussie/ Dollar (AUD/ USD). im trying something differnt nothing too out of the ordinary, but i have been researching the COT Report and I am able to "Swing" a few positions off the Hourly Analysis. So, here off the same structure we have three patterns. 1 the smallest one is a regular gartley now we do have the potential for a deep gartley with the 886 up near the Bat pattern thats the white outline one. which is Number 2. Number 3 is the Alternate Bat pattern which is outlined in red. I dont feel confident in the Alternate bat pattern and feel better about the Gartley Pattern.

Now, back to the COT on The AUD dollar the report is as follows ( i pulled this info off tradingster.com):

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Aussie Dollar COT Legacy Report (pulled from Tradingster.com)

Non-Commercial Commercial Total Non. -ortable

Long Short Spreads Long Short Long Short Long Short

25,301 64,859 558 91,226 39,980 117,085 105,397 15,712 27,400

Changes (Change In Open Interest: +3,533 )

+1,582 +5,715 -369. +1,540 +257 +2,753 +5,603 +780 -2,070

(CONTRACTS OF AUD 100,000) Open Interest: 132,797

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

United States Dollar Index COT Legacy Report: (pulled from tradingster.com)

Non-Commercial Commercial Total Non-Reportable

Long Short Spreads Long Short Long Short Long Short

24,515 7,218 1,090 2,851 21,258 28,456 29,566 3,021 1,911

Changes (Change In Open Interest: +354 )

+559 -288 +26 +213 +229 +798 -33 -444 +387

(U.S. DOLLAR INDEX X $1000) Open Interest: 31,477

So From what i have been reading we want to pay attention to the Non-Comercial reporting as they are the hedge funds... the commercial report are the large cooperations and banks that are hedging their risk which is why theyre on the direct opposite side of the commercial side. so with that being said there is a chang section of the report too. So, as we can see in the Changes section most of the hedge funds are switching their bias to the short side. Now, this is not surprising as we have been trading in a range for the past few weeks and we are nearing the top of the range to go back down. When you look at the total coloum there are more traders loading up on the short side than the long side... so what i think is that price will rise a little to the top of the range start wicking as more and more large players start entering the market and the floor will give out.

This is kinda backed up by the dollar index COT. we have the bug hedge funds loading up on the buy side of the dollar not only was the ratio of long/ shorts 3:1 we had more funds add to the buy side AND some people pulled from their short holdngs! So, again this suggests to me again PA will rise a bit because the total of shorts out weighs the longs in the total but as orders get filled i see PA reversing in the other direction.

So, on this pair expect PA to enter the PRZ of one of these three patterns Looking at the 886 Level and then giving way to seller pressure.

Let me remind you guys this is my very first week trying to incoperate the COT in my analysis. All this information is stuff i pulled from google and the website tradingster.com

i was also inspired to try and incoperate the COT in my analysis by @DaweFXHunter (tradingview.com/u/DaweFXHunter/) im not part of his teachings or classes i just like the idea of trading in the same direction of the big players ... i could be way off, but hey its an attempt to put more emphasis on patterns going in the same direction as the Big Players in this industry...

#RISKFREEORBUST

AUDUSD

AUDUSD

Now, back to the COT on The AUD dollar the report is as follows ( i pulled this info off tradingster.com):

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Aussie Dollar COT Legacy Report (pulled from Tradingster.com)

Non-Commercial Commercial Total Non. -ortable

Long Short Spreads Long Short Long Short Long Short

25,301 64,859 558 91,226 39,980 117,085 105,397 15,712 27,400

Changes (Change In Open Interest: +3,533 )

+1,582 +5,715 -369. +1,540 +257 +2,753 +5,603 +780 -2,070

(CONTRACTS OF AUD 100,000) Open Interest: 132,797

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

United States Dollar Index COT Legacy Report: (pulled from tradingster.com)

Non-Commercial Commercial Total Non-Reportable

Long Short Spreads Long Short Long Short Long Short

24,515 7,218 1,090 2,851 21,258 28,456 29,566 3,021 1,911

Changes (Change In Open Interest: +354 )

+559 -288 +26 +213 +229 +798 -33 -444 +387

(U.S. DOLLAR INDEX X $1000) Open Interest: 31,477

So From what i have been reading we want to pay attention to the Non-Comercial reporting as they are the hedge funds... the commercial report are the large cooperations and banks that are hedging their risk which is why theyre on the direct opposite side of the commercial side. so with that being said there is a chang section of the report too. So, as we can see in the Changes section most of the hedge funds are switching their bias to the short side. Now, this is not surprising as we have been trading in a range for the past few weeks and we are nearing the top of the range to go back down. When you look at the total coloum there are more traders loading up on the short side than the long side... so what i think is that price will rise a little to the top of the range start wicking as more and more large players start entering the market and the floor will give out.

This is kinda backed up by the dollar index COT. we have the bug hedge funds loading up on the buy side of the dollar not only was the ratio of long/ shorts 3:1 we had more funds add to the buy side AND some people pulled from their short holdngs! So, again this suggests to me again PA will rise a bit because the total of shorts out weighs the longs in the total but as orders get filled i see PA reversing in the other direction.

So, on this pair expect PA to enter the PRZ of one of these three patterns Looking at the 886 Level and then giving way to seller pressure.

Let me remind you guys this is my very first week trying to incoperate the COT in my analysis. All this information is stuff i pulled from google and the website tradingster.com

i was also inspired to try and incoperate the COT in my analysis by @DaweFXHunter (tradingview.com/u/DaweFXHunter/) im not part of his teachings or classes i just like the idea of trading in the same direction of the big players ... i could be way off, but hey its an attempt to put more emphasis on patterns going in the same direction as the Big Players in this industry...

#RISKFREEORBUST

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.