Hello traders,

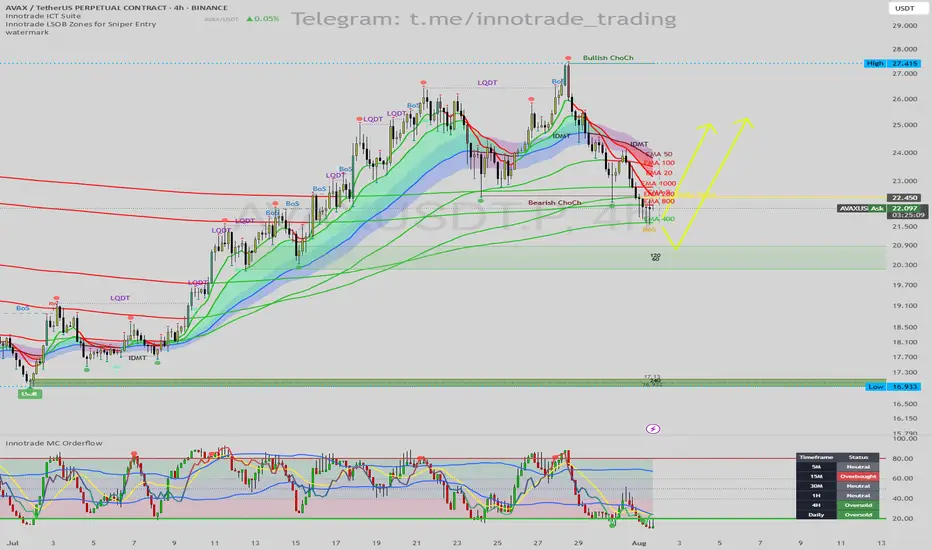

Today's analysis focuses on a high-probability long setup for AVAX/USDT on the 4H timeframe. The price has pulled back to a critical area where a confluence of powerful technical indicators suggests a significant bounce or reversal is imminent.

1. Trend & Context (The "Why")

Following a strong uptrend, AVAX entered a corrective phase, marked by a Bearish Change of Character (ChoCh). This correction has now brought the price to an A+ support zone.

Here are the key confluences for this bullish setup:

Major Support Cluster: The price is currently reacting to a critical support cluster formed by the EMA 200 and EMA 400. These long-term moving averages are major levels where institutions often step in to buy.

Momentum Exhaustion (MC Orderflow): The Innotrade MC Orderflow oscillator provides the critical confirmation that selling pressure is exhausted:

The oscillator is deep in the OVERSOLD territory on the 4H chart.

THE CRITICAL MTF CONFLUENCE: The Multi-Timeframe Cycle Table is the most important factor here. It shows that both the 4H and Daily timeframes are "Oversold". This alignment of higher timeframe momentum at a key technical support level is a very powerful signal for a reversal.

2. Entry, Stop Loss, and Targets (The "How")

The alignment of these factors gives us a clear and actionable trade plan with a great risk-to-reward profile.

Entry: An entry around the current price ($21.50 - $22.10) is ideal, as we are right at the MA support cluster.

Stop Loss (SL): $21.20. This places the stop loss safely below the EMA 400 and the recent swing low, providing a clear invalidation point for the setup.

Take Profit (TP) Targets:

TP1: $24.00 (Targeting the Bearish ChoCh level and the cluster of short-term EMAs).

TP2: $26.50 (The next major swing high, a logical area of resistance).

TP3: $27.40 (The major high of the entire range, a longer-term target if the uptrend resumes).

Conclusion

This trade setup is of very high quality due to the powerful confluence of a major MA support cluster with a confirmed multi-timeframe momentum exhaustion signal (4H and Daily). This synergy creates a high-probability environment for a significant bullish reversal.

Disclaimer: This is not financial advice. This analysis is for educational purposes only. Always conduct your own research and manage your risk appropriately.

Today's analysis focuses on a high-probability long setup for AVAX/USDT on the 4H timeframe. The price has pulled back to a critical area where a confluence of powerful technical indicators suggests a significant bounce or reversal is imminent.

1. Trend & Context (The "Why")

Following a strong uptrend, AVAX entered a corrective phase, marked by a Bearish Change of Character (ChoCh). This correction has now brought the price to an A+ support zone.

Here are the key confluences for this bullish setup:

Major Support Cluster: The price is currently reacting to a critical support cluster formed by the EMA 200 and EMA 400. These long-term moving averages are major levels where institutions often step in to buy.

Momentum Exhaustion (MC Orderflow): The Innotrade MC Orderflow oscillator provides the critical confirmation that selling pressure is exhausted:

The oscillator is deep in the OVERSOLD territory on the 4H chart.

THE CRITICAL MTF CONFLUENCE: The Multi-Timeframe Cycle Table is the most important factor here. It shows that both the 4H and Daily timeframes are "Oversold". This alignment of higher timeframe momentum at a key technical support level is a very powerful signal for a reversal.

2. Entry, Stop Loss, and Targets (The "How")

The alignment of these factors gives us a clear and actionable trade plan with a great risk-to-reward profile.

Entry: An entry around the current price ($21.50 - $22.10) is ideal, as we are right at the MA support cluster.

Stop Loss (SL): $21.20. This places the stop loss safely below the EMA 400 and the recent swing low, providing a clear invalidation point for the setup.

Take Profit (TP) Targets:

TP1: $24.00 (Targeting the Bearish ChoCh level and the cluster of short-term EMAs).

TP2: $26.50 (The next major swing high, a logical area of resistance).

TP3: $27.40 (The major high of the entire range, a longer-term target if the uptrend resumes).

Conclusion

This trade setup is of very high quality due to the powerful confluence of a major MA support cluster with a confirmed multi-timeframe momentum exhaustion signal (4H and Daily). This synergy creates a high-probability environment for a significant bullish reversal.

Disclaimer: This is not financial advice. This analysis is for educational purposes only. Always conduct your own research and manage your risk appropriately.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.