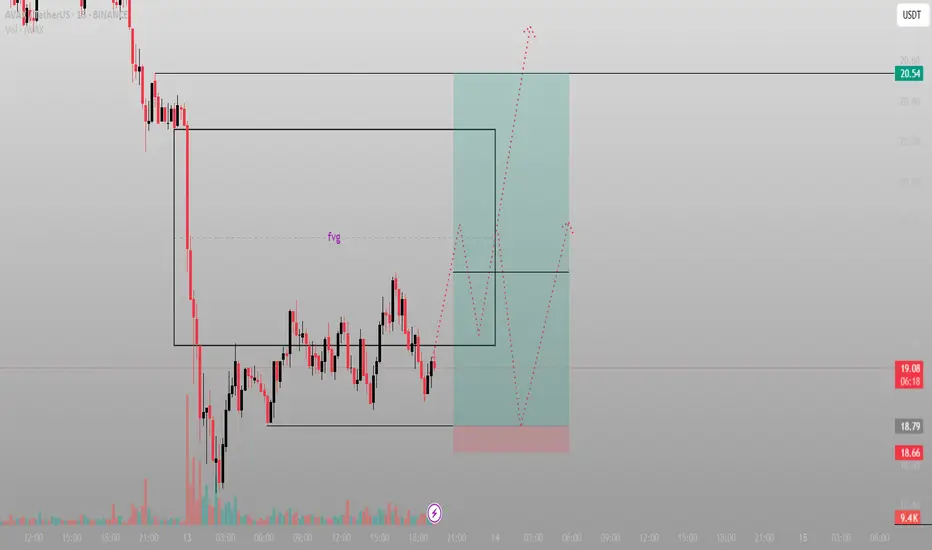

This isn’t a chop. It’s a setup. AVAX just printed the kind of consolidation Smart Money wants to see before delivery.

The setup:

After the impulsive drop, price carved out a micro-range with well-defined boundaries — compression structure nested inside inefficiency. The FVG above (marked in purple) hasn’t been mitigated, and price is now pressing upward into that void with rising volume.

But that’s not where the trade is. The real trade is in the retracement.

I’m watching for one of two entries:

Either we drive into the FVG first, then sweep back into the range floor to trap late longs

Or we sweep range low one more time, then rip straight into the imbalance

Either way, the invalidation is clean — below the swing low, under 18.66.

Execution plan:

Entry: 18.70–18.90 zone (post-sweep or reaction)

TP1: 19.80 fill (FVG midpoint)

TP2: 20.54 clean inefficiency clearance

Nothing about this is forced. Price is telling the story. I’m just listening.

Final thought:

“The range isn’t random. It’s the disguise Smart Money uses before they move size.”

The setup:

After the impulsive drop, price carved out a micro-range with well-defined boundaries — compression structure nested inside inefficiency. The FVG above (marked in purple) hasn’t been mitigated, and price is now pressing upward into that void with rising volume.

But that’s not where the trade is. The real trade is in the retracement.

I’m watching for one of two entries:

Either we drive into the FVG first, then sweep back into the range floor to trap late longs

Or we sweep range low one more time, then rip straight into the imbalance

Either way, the invalidation is clean — below the swing low, under 18.66.

Execution plan:

Entry: 18.70–18.90 zone (post-sweep or reaction)

TP1: 19.80 fill (FVG midpoint)

TP2: 20.54 clean inefficiency clearance

Nothing about this is forced. Price is telling the story. I’m just listening.

Final thought:

“The range isn’t random. It’s the disguise Smart Money uses before they move size.”

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.