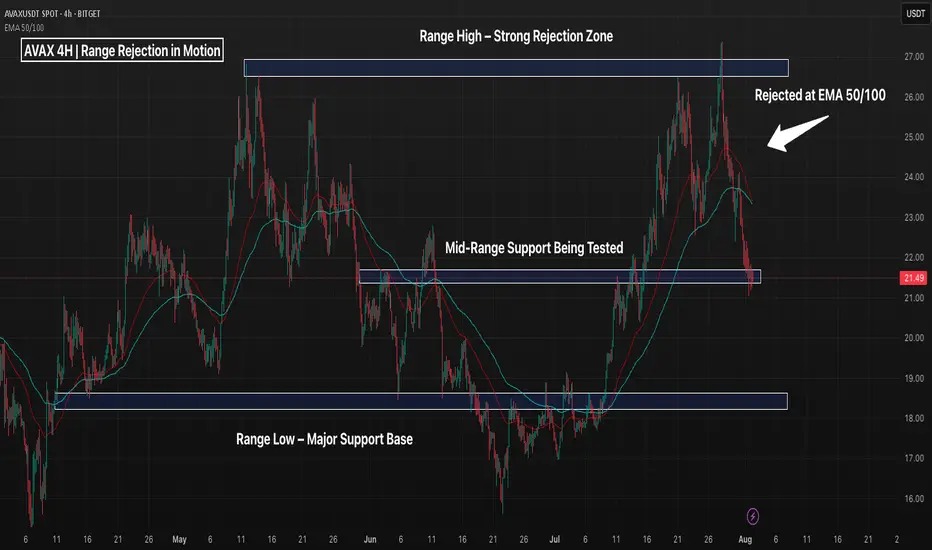

AVAX just printed a textbook range rejection from the $26–27 resistance zone, which has capped price action since April. After rejecting the 50/100 EMA cluster, price is now testing mid-range support around $21.50 — a level that has historically offered short-term bounce opportunities or clean breakdown setups.

📌 Key Zones:

Top Resistance (~$26.50–27): Strong sell zone — multiple rejections

Mid-Range (~$21.50): Currently being tested for a possible bounce

Bottom Support (~$18.20–19): Range base with prior reversal history

📉 Reclaiming the EMAs could suggest another trip toward the highs, but failure to hold $21.50 opens the door to a deeper move toward $19 — or even a range breakdown if broader momentum weakens.

This chart highlights the importance of range trading structure — clean rejection up top, bounce attempt in the middle, and final line in the sand at the bottom.

Trade Idea Scenarios:

Bullish: Bounce + reclaim of $23.50 EMAs = long toward $25+

Bearish: Breakdown below $21.50 = short toward $19 or lower

How are you playing this range? 👇

📌 Key Zones:

Top Resistance (~$26.50–27): Strong sell zone — multiple rejections

Mid-Range (~$21.50): Currently being tested for a possible bounce

Bottom Support (~$18.20–19): Range base with prior reversal history

📉 Reclaiming the EMAs could suggest another trip toward the highs, but failure to hold $21.50 opens the door to a deeper move toward $19 — or even a range breakdown if broader momentum weakens.

This chart highlights the importance of range trading structure — clean rejection up top, bounce attempt in the middle, and final line in the sand at the bottom.

Trade Idea Scenarios:

Bullish: Bounce + reclaim of $23.50 EMAs = long toward $25+

Bearish: Breakdown below $21.50 = short toward $19 or lower

How are you playing this range? 👇

Try our strategy optimizer at quanttradingpro.com

Developing free strategies weekly stay tuned...

Join our discord discord.gg/2systG9frc

We provide education & tools.

Developing free strategies weekly stay tuned...

Join our discord discord.gg/2systG9frc

We provide education & tools.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Try our strategy optimizer at quanttradingpro.com

Developing free strategies weekly stay tuned...

Join our discord discord.gg/2systG9frc

We provide education & tools.

Developing free strategies weekly stay tuned...

Join our discord discord.gg/2systG9frc

We provide education & tools.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.