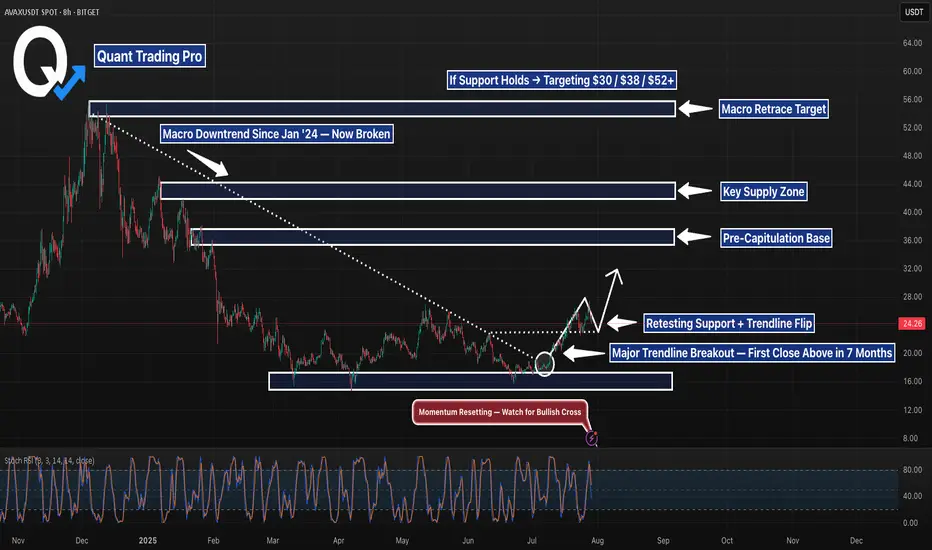

AVAX just closed above a 7-month macro downtrend and is now pulling back into a high-confluence retest zone. With the prior trendline now acting as potential support — and price holding above a multi-tap demand level — this is a high-stakes inflection point.

📊 Technical Breakdown:

Breakout:

The descending trendline that defined AVAX’s entire bear structure since January has finally broken. A clean candle close above that line marked a shift in control from sellers to buyers.

Retest Zone:

Price is now sitting directly on top of the broken trendline and the horizontal demand zone that’s held since Q1. This dual-level confluence offers a high-probability bounce area — or a decisive invalidation if lost.

Momentum Check:

Stochastic RSI is resetting — not overbought — giving bulls room to push higher if this retest holds.

Targets to the Upside:

$30 – Local breakdown zone from late Jan

$38 – Pre-capitulation base (March)

$44 – Major structural resistance

$52–53 – Full retracement target from the December high

🧠 Trade Context & Bias:

Bullish case:

A bounce here with strong volume confirms the trendline flip and opens the door for midterm continuation toward the $38–$44 zones.

Bearish case:

If AVAX breaks below $22 with momentum, this would invalidate the breakout structure and shift bias back toward range-bound or bearish continuation.

This is where structure meets opportunity. A successful retest could place AVAX at the front of the next altcoin rotation — but only if buyers defend this level with conviction.

📊 Technical Breakdown:

Breakout:

The descending trendline that defined AVAX’s entire bear structure since January has finally broken. A clean candle close above that line marked a shift in control from sellers to buyers.

Retest Zone:

Price is now sitting directly on top of the broken trendline and the horizontal demand zone that’s held since Q1. This dual-level confluence offers a high-probability bounce area — or a decisive invalidation if lost.

Momentum Check:

Stochastic RSI is resetting — not overbought — giving bulls room to push higher if this retest holds.

Targets to the Upside:

$30 – Local breakdown zone from late Jan

$38 – Pre-capitulation base (March)

$44 – Major structural resistance

$52–53 – Full retracement target from the December high

🧠 Trade Context & Bias:

Bullish case:

A bounce here with strong volume confirms the trendline flip and opens the door for midterm continuation toward the $38–$44 zones.

Bearish case:

If AVAX breaks below $22 with momentum, this would invalidate the breakout structure and shift bias back toward range-bound or bearish continuation.

This is where structure meets opportunity. A successful retest could place AVAX at the front of the next altcoin rotation — but only if buyers defend this level with conviction.

Try our strategy optimizer at quanttradingpro.com

Developing free strategies weekly stay tuned...

Join our discord discord.gg/2systG9frc

We provide education & tools.

Developing free strategies weekly stay tuned...

Join our discord discord.gg/2systG9frc

We provide education & tools.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Try our strategy optimizer at quanttradingpro.com

Developing free strategies weekly stay tuned...

Join our discord discord.gg/2systG9frc

We provide education & tools.

Developing free strategies weekly stay tuned...

Join our discord discord.gg/2systG9frc

We provide education & tools.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.