1️⃣ Insight Summary

2️⃣ Trade Parameters

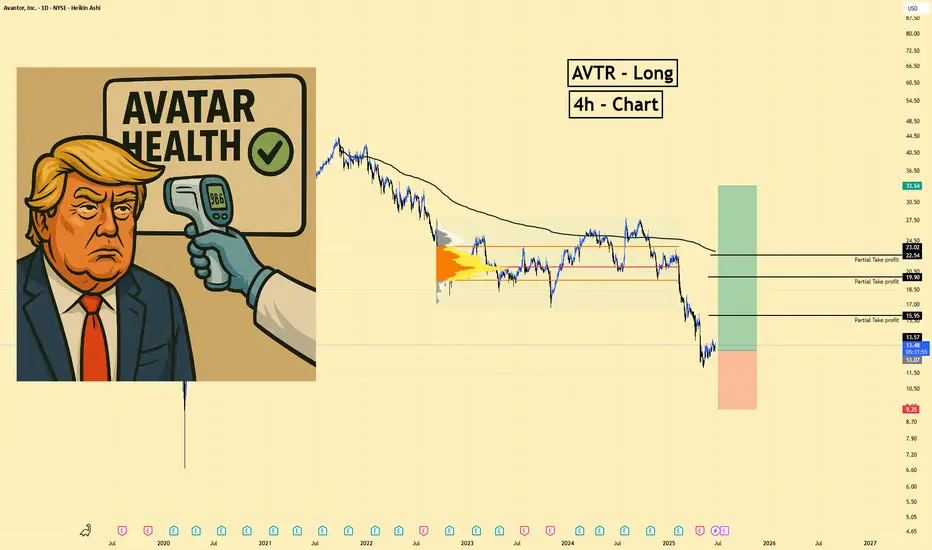

Bias: Long

Entry: Around $9.00–$9.35 (current price)

Stop Loss: Below $8.50

Take Profit 1: $15.95

Take Profit 2: $19.90

Take Profit 3: $23.00

Max Target: Holding long could stretch to $34.54 (prior major swing), depending on macro support

3️⃣ Key Notes

✅ Massive scale & history – Founded in 1904,

✅ Sector & services – Operates in healthcare distribution, advanced-tech, biopharma, education, and government sectors, giving broad exposure and stability.

✅ Capital flows – Capital inflow is strong; both retail (call volume) and institutions are showing buying interest.

✅ Technical outlook – With aggressive money flow and a recent consolidation near $9.35, a breakout could propel prices toward $15–23.

✅ Macro driver – Strength in the S&P 500 and healthcare sector momentum may support the run-up to the $34.54 zone.

4️⃣ Follow‑up Note

I’ll monitor market correlation with the S&P 500 and sector rotation. If flows continue and

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is the best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

2 Ways I Help Serious Traders Win | Real Trades. Ruthless Edge.

1️⃣ Fix Your Trading Fast – My 4-step:

tradinggen.services/mohamad-link/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

1️⃣ Fix Your Trading Fast – My 4-step:

tradinggen.services/mohamad-link/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

2 Ways I Help Serious Traders Win | Real Trades. Ruthless Edge.

1️⃣ Fix Your Trading Fast – My 4-step:

tradinggen.services/mohamad-link/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

1️⃣ Fix Your Trading Fast – My 4-step:

tradinggen.services/mohamad-link/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.