*investment opportunity*

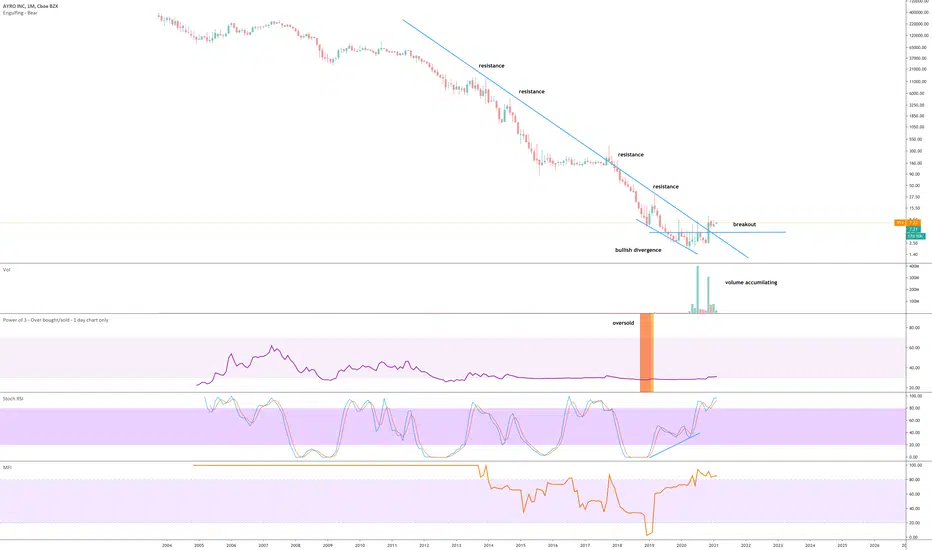

On the above monthly chart 7 years of price action resistance comes to an end following an oversold condition (orange column) with price action breakout. There now exists a number of reasons to be bullish on AYRO, they include:

1) Regular bullish divergence. Price action made lower lows as the oscillators made higher highs - very bullish.

2) Together with point (1) volume is accumulating. Someone knows something I don’t!

3) On the 6-month chart (below) there is a large ‘morning star’ candle with bullish engulfing candle confirmation. Very bullish on this scale making a trend reversal highly probable.

4) Lastly on the weekly chart (below) we have the 21-week (yellow) moving average crossing up the 50-week (Green) moving average. Been over 14 years since that happened.

Institutions such Blackrock, amongst others, make up for 3% of the shareholders of this stock.

A buy from $4.25 is excellent.

Weekly chart:

6-month chart:

On the above monthly chart 7 years of price action resistance comes to an end following an oversold condition (orange column) with price action breakout. There now exists a number of reasons to be bullish on AYRO, they include:

1) Regular bullish divergence. Price action made lower lows as the oscillators made higher highs - very bullish.

2) Together with point (1) volume is accumulating. Someone knows something I don’t!

3) On the 6-month chart (below) there is a large ‘morning star’ candle with bullish engulfing candle confirmation. Very bullish on this scale making a trend reversal highly probable.

4) Lastly on the weekly chart (below) we have the 21-week (yellow) moving average crossing up the 50-week (Green) moving average. Been over 14 years since that happened.

Institutions such Blackrock, amongst others, make up for 3% of the shareholders of this stock.

A buy from $4.25 is excellent.

Weekly chart:

6-month chart:

Trade active

50% in 24 hours ?!Trade active

Good long entry point as price action lands on the golden ratio.Note

Just had an alarm go off on this one to inform me the downtrend in price action resistance is now broken. That's a positive.BTC

bc1q2eckdzh0q8vsd7swcc8et6ze7s99khhxyl7zwy

Weblink: patreon.com/withoutworries

Allow 3-6 months on ideas. Not investment advice. DYOR

bc1q2eckdzh0q8vsd7swcc8et6ze7s99khhxyl7zwy

Weblink: patreon.com/withoutworries

Allow 3-6 months on ideas. Not investment advice. DYOR

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

BTC

bc1q2eckdzh0q8vsd7swcc8et6ze7s99khhxyl7zwy

Weblink: patreon.com/withoutworries

Allow 3-6 months on ideas. Not investment advice. DYOR

bc1q2eckdzh0q8vsd7swcc8et6ze7s99khhxyl7zwy

Weblink: patreon.com/withoutworries

Allow 3-6 months on ideas. Not investment advice. DYOR

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.