🐉

📈 Strong RSI. Institutional Accumulation. Gamma-juiced upside.

Momentum is building — timing is key.

⸻

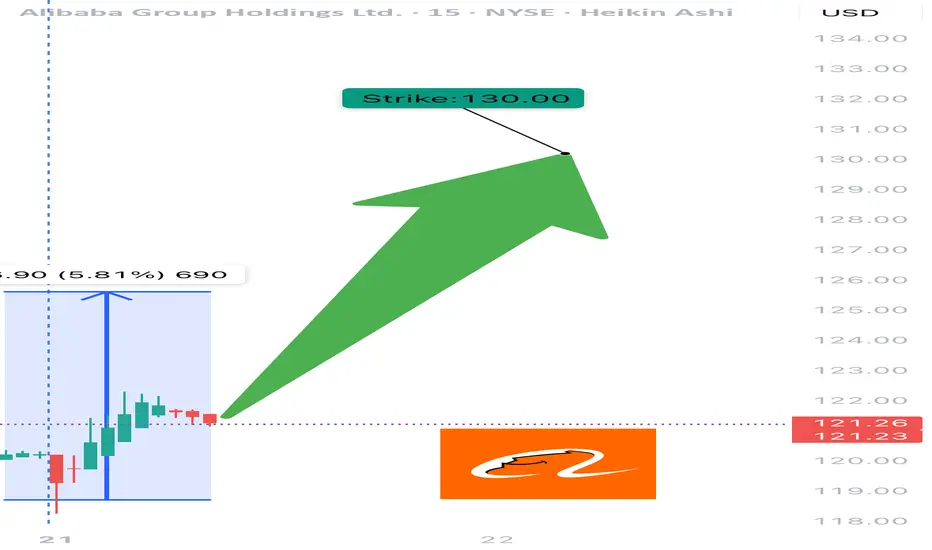

📊 Trade Setup

🔹 Type: Long Call

🎯 Strike: $130.00

📆 Expiry: July 25, 2025 (4 DTE)

💰 Entry Price: $0.52

🎯 Profit Target: $0.74 (📈 +42%)

🛑 Stop Loss: $0.30 (~40% Risk)

📈 Confidence: 70%

🕰️ Timing: Enter at Monday Open

📦 Size: 1 Contract (or scale accordingly)

⸻

🔍 Why This Trade?

✅ Daily RSI = 68.3 → Bullish momentum building

✅ Volume = 1.3x week-over-week → Institutional buying confirmed

📊 Neutral Call/Put Flow → Sentiment not overheated = better entry

🧠 Multiple models agree on MODERATE BULLISH bias

🌬️ VIX stable = ideal for controlled option premium entries

💎 Gamma risk manageable, but monitor price spikes at resistance near $130–132

⸻

⚠️ Risk Management Notes

🔸 RSI near breakout zone → monitor for fakeouts

⏳ Only 4 days to expiry → time decay risk accelerates

📉 Watch for rejection near key levels ($130.50–132.00)

🛑 Respect the stop: If momentum stalls early, exit fast

⸻

📌 Execution Strategy

🔹 Enter clean, single-leg naked call

🔹 Exit partial at 30% profit, full by Thursday unless breakout is strong

🔹 Avoid spreads: delta exposure preferred for upside spike capture

⸻

🏁 Verdict:

All models point to upside, but not full conviction.

This is a momentum + positioning trade, not a breakout gamble.

Tight structure. Moderate aggression. Execute with precision.

⸻

#BABA #OptionsTrading #CallOption #WeeklyTrade #MomentumPlay #UnusualOptionsActivity #TradingViewIdeas #GammaFlow #FlowBasedSetup #Alibaba

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.