BABA | Long | Strong AI & Seasonality Tailwinds (Aug 2025)

1️⃣ Quick Insight: Alibaba is showing strong AI-driven momentum, healthy fundamentals, and positive seasonality patterns. August–December tends to be bullish, and the stock is already holding up well despite recent dips.

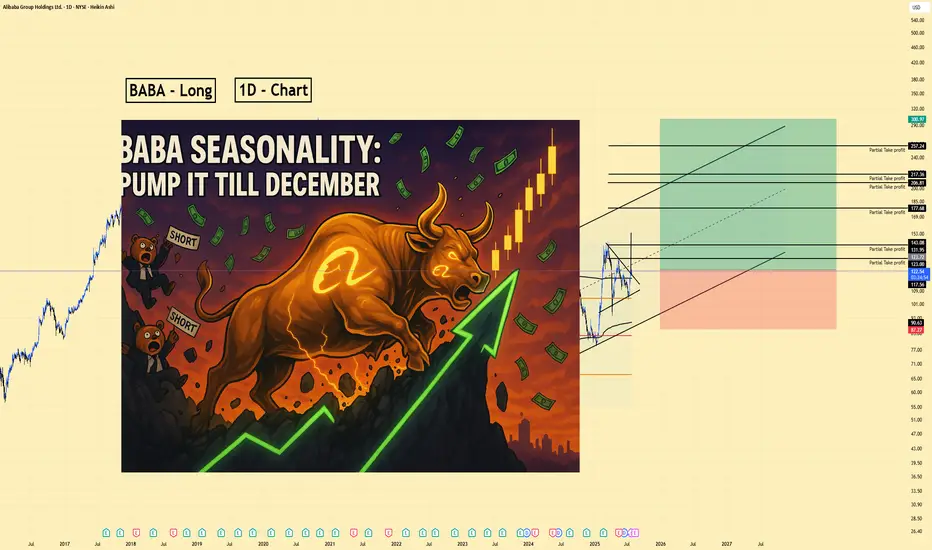

2️⃣ Trade Parameters:

Bias: Long

Entry: Current price zone (~$123)

Stop Loss: $87

Take Profits:

TP1: $131

TP2: $143

TP3: $177

TP4: $206

TP5: $217

TP6: $257

Extended Target: $300 (if momentum holds through the parallel channel)

3️⃣ Key Notes:

Alibaba’s fundamentals remain solid with revenue up on a yearly basis since 2021, even though some quarters have shown pressure. EPS is expected to grow annually, and institutional interest is strong (43% holding increase by Maridea Wealth Management). The AI pivot with Qwen LLM models and Quark AI glasses launch could be major catalysts. Seasonality supports upside through mid-December before potential reversals.

4️⃣ What to Watch:

AI & cloud revenue performance (Qwen adoption)

Cainiao and other potential spinoff IPOs

Regulatory updates and U.S.-China tensions

Seasonal strength: historically bullish until late November–early December

📊 Outlook: Analysts forecast $150–$160 in the next 12 months (~20–30% upside). Bull case targets range $200–$250 over 3–5 years, with potential extension if AI & international commerce expansions deliver.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always do your own research.

1️⃣ Quick Insight: Alibaba is showing strong AI-driven momentum, healthy fundamentals, and positive seasonality patterns. August–December tends to be bullish, and the stock is already holding up well despite recent dips.

2️⃣ Trade Parameters:

Bias: Long

Entry: Current price zone (~$123)

Stop Loss: $87

Take Profits:

TP1: $131

TP2: $143

TP3: $177

TP4: $206

TP5: $217

TP6: $257

Extended Target: $300 (if momentum holds through the parallel channel)

3️⃣ Key Notes:

Alibaba’s fundamentals remain solid with revenue up on a yearly basis since 2021, even though some quarters have shown pressure. EPS is expected to grow annually, and institutional interest is strong (43% holding increase by Maridea Wealth Management). The AI pivot with Qwen LLM models and Quark AI glasses launch could be major catalysts. Seasonality supports upside through mid-December before potential reversals.

4️⃣ What to Watch:

AI & cloud revenue performance (Qwen adoption)

Cainiao and other potential spinoff IPOs

Regulatory updates and U.S.-China tensions

Seasonal strength: historically bullish until late November–early December

📊 Outlook: Analysts forecast $150–$160 in the next 12 months (~20–30% upside). Bull case targets range $200–$250 over 3–5 years, with potential extension if AI & international commerce expansions deliver.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always do your own research.

2 Ways I can help you | Real Trades. Real Edge

1️⃣ The 4 Steps to Improve Your Trading Immediately: tradinggen.services/mohamad-link/

2️⃣ Get trade setups & breakdowns Here: t.me/TradeSimple_with_Mo

1️⃣ The 4 Steps to Improve Your Trading Immediately: tradinggen.services/mohamad-link/

2️⃣ Get trade setups & breakdowns Here: t.me/TradeSimple_with_Mo

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

2 Ways I can help you | Real Trades. Real Edge

1️⃣ The 4 Steps to Improve Your Trading Immediately: tradinggen.services/mohamad-link/

2️⃣ Get trade setups & breakdowns Here: t.me/TradeSimple_with_Mo

1️⃣ The 4 Steps to Improve Your Trading Immediately: tradinggen.services/mohamad-link/

2️⃣ Get trade setups & breakdowns Here: t.me/TradeSimple_with_Mo

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.