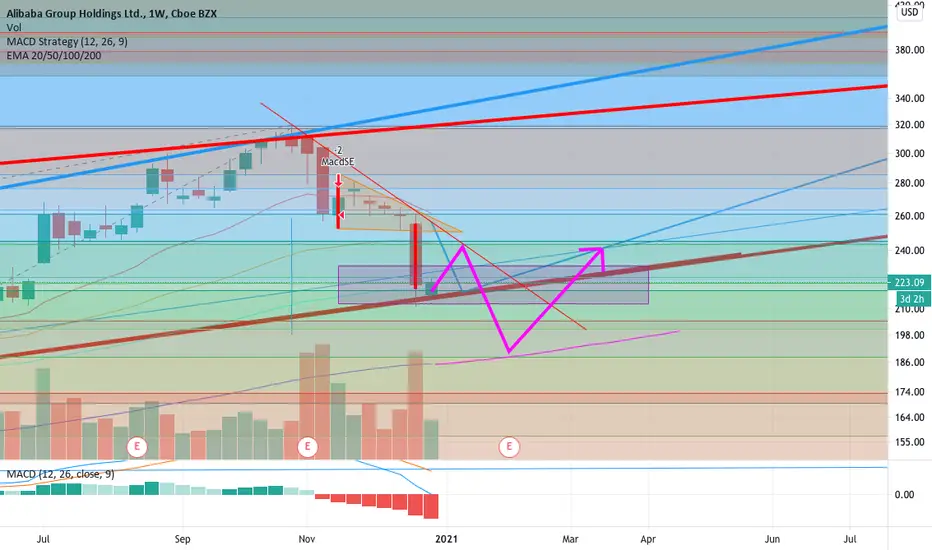

Updating my previous idea:

IMO it's possible to see a short-term rebound till $240 where the confluence of fib. retracement 0.5 (ATH to march '20 low) and fib. retracement 0.618 (ATH to dic '18 low) are.

Then, expecting more downside until aprox. $190 were the Weekly 200 EMA is. Just before the february earnings where trend reversal is possible if strong growth continue.

My last short Price Target was perfectly touched.

Thoughts?

Please like, comment and subscribe if it's helpful for you.

Stay safe.

IMO it's possible to see a short-term rebound till $240 where the confluence of fib. retracement 0.5 (ATH to march '20 low) and fib. retracement 0.618 (ATH to dic '18 low) are.

Then, expecting more downside until aprox. $190 were the Weekly 200 EMA is. Just before the february earnings where trend reversal is possible if strong growth continue.

My last short Price Target was perfectly touched.

Thoughts?

Please like, comment and subscribe if it's helpful for you.

Stay safe.

Note

$229 in pre market following my idea.Possible turndown in $235 aprox. so people with aversion to risk can set their PT to $234.

This is a +5% in 2 days. You’re welcome.

Note

$231.5 in pre market. Target achieved today? This volatility can be so lucrative.Note

Low risk target at $234 done.Let’s see if we break $235 and then $240.

5% selling at $240

Note

$235 reached.Adjusting lines and upwarding PT at $244.2 246

Trade closed: stop reached

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.