Financial Performance (March Quarter 2025)

* Revenue: Alibaba reported a 7% year-over-year increase in revenue, reaching RMB236.5 billion (approximately USD 33.4 billion).

* Adjusted EBITDA: The company's adjusted EBITDA rose by 36% year-over-year to RMB32.6 billion (USD 4.5 billion).

* Net Income: Non-GAAP net income increased by 22% to RMB29.8 billion (USD 4.1 billion), while GAAP net income stood at RMB12 billion (USD 1.7 billion).

E-Commerce Initiatives

* Taobao Instant Commerce: Launched recently, this new portal has surpassed 40 million daily orders within a month, offering 60-minute delivery by integrating merchants from Ele.me into the Taobao platform.

* Domestic E-Commerce: The Taobao and Tmall Group experienced nearly 9% revenue growth, driven by increased consumer engagement and a rise in orders.

* International Expansion: Alibaba's International Digital Commerce Group reported a 24% increase in retail revenue, primarily due to growth in platforms like AliExpress and Trendyol.

Cloud Computing and AI Investments

* Revenue Growth: Alibaba Cloud's revenue grew by 18% year-over-year to RMB30.1 billion (USD 4.2 billion), with AI-related product revenue maintaining triple-digit growth for the seventh consecutive quarter.

* Strategic Investment: The company announced plans to invest over $52 billion in AI and cloud infrastructure over the next three years, aiming to enhance its position as a leading global cloud provider.

* SAP Partnership: Alibaba has entered into a strategic partnership with SAP to accelerate cloud transformation, focusing on AI-powered digital solutions.

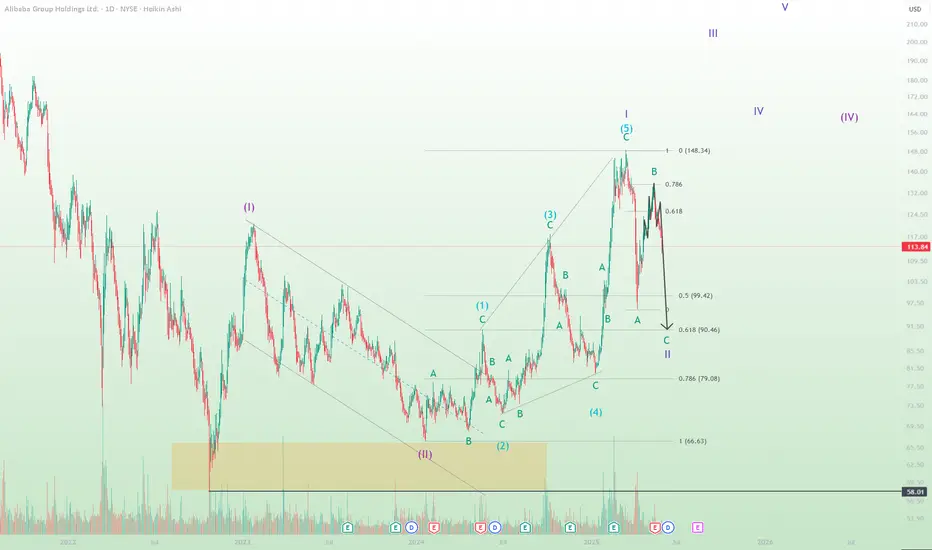

Stock Performance

As of May 31, 2025, Alibaba's stock price stands at $113.84, reflecting a recent decline of 2.7%

* Revenue: Alibaba reported a 7% year-over-year increase in revenue, reaching RMB236.5 billion (approximately USD 33.4 billion).

* Adjusted EBITDA: The company's adjusted EBITDA rose by 36% year-over-year to RMB32.6 billion (USD 4.5 billion).

* Net Income: Non-GAAP net income increased by 22% to RMB29.8 billion (USD 4.1 billion), while GAAP net income stood at RMB12 billion (USD 1.7 billion).

E-Commerce Initiatives

* Taobao Instant Commerce: Launched recently, this new portal has surpassed 40 million daily orders within a month, offering 60-minute delivery by integrating merchants from Ele.me into the Taobao platform.

* Domestic E-Commerce: The Taobao and Tmall Group experienced nearly 9% revenue growth, driven by increased consumer engagement and a rise in orders.

* International Expansion: Alibaba's International Digital Commerce Group reported a 24% increase in retail revenue, primarily due to growth in platforms like AliExpress and Trendyol.

Cloud Computing and AI Investments

* Revenue Growth: Alibaba Cloud's revenue grew by 18% year-over-year to RMB30.1 billion (USD 4.2 billion), with AI-related product revenue maintaining triple-digit growth for the seventh consecutive quarter.

* Strategic Investment: The company announced plans to invest over $52 billion in AI and cloud infrastructure over the next three years, aiming to enhance its position as a leading global cloud provider.

* SAP Partnership: Alibaba has entered into a strategic partnership with SAP to accelerate cloud transformation, focusing on AI-powered digital solutions.

Stock Performance

As of May 31, 2025, Alibaba's stock price stands at $113.84, reflecting a recent decline of 2.7%

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.