Bank Nifty Trading Plan for 22-Nov-2024

Introduction:

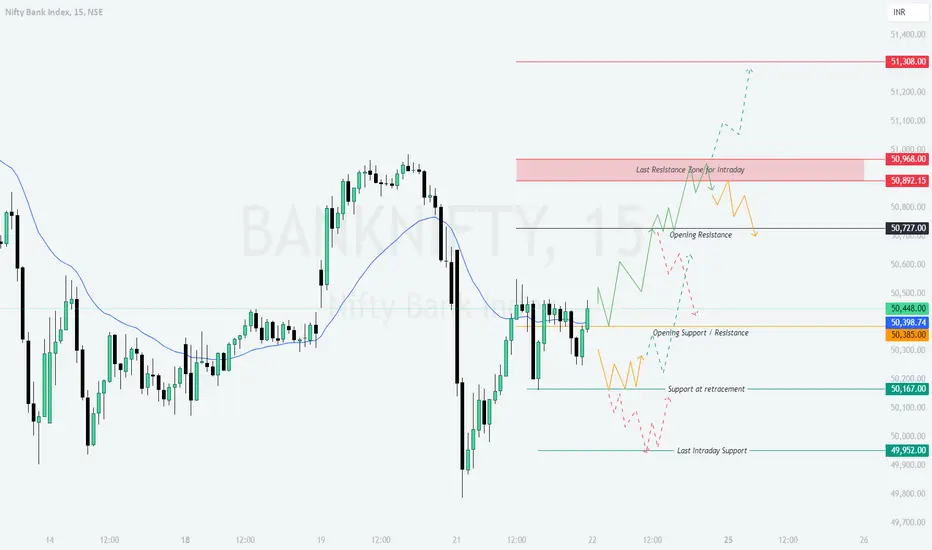

In the previous session, Bank Nifty displayed a choppy pattern with limited momentum around the 50,398 level. The price action hinted at indecision with a balanced tug-of-war between bulls and bears. The current levels suggest potential sideways consolidation (Yellow) with breakout possibilities (Green for bullish trends, Red for bearish trends) depending on how Bank Nifty reacts to key zones today.

---

Trading Scenarios for 22-Nov-2024:

Introduction:

In the previous session, Bank Nifty displayed a choppy pattern with limited momentum around the 50,398 level. The price action hinted at indecision with a balanced tug-of-war between bulls and bears. The current levels suggest potential sideways consolidation (Yellow) with breakout possibilities (Green for bullish trends, Red for bearish trends) depending on how Bank Nifty reacts to key zones today.

---

Trading Scenarios for 22-Nov-2024:

- Gap-Up Opening (200+ points):

If Bank Nifty opens above 50,727, the immediate resistance lies at 50,968. Monitor price action in this range:

- A clear breakout above 50,968 could propel prices to the next resistance at 51,308. This offers a buying opportunity if the level is sustained for an hourly candle.

- A rejection at 50,968 might lead to a pullback toward 50,727. Watch for bearish confirmation signals before taking a short position.

Avoid impulsive trades during the initial minutes; let the opening volatility settle.

- Flat Opening:

A flat opening near 50,448 would bring the support zone at 50,385 and resistance at 50,727 into play:

- A breakout above 50,727 can lead to a bullish trend targeting 50,968.

- Conversely, a break below 50,385 may invite bearish momentum toward 50,167.

Wait for a clear breakout or breakdown before entering trades. Initial movements could remain range-bound.

- Gap-Down Opening (200+ points):

If Bank Nifty opens below 50,167, it will likely test the critical support zone at 49,952:

- A sustained breakdown below 49,952 could trigger a sharp sell-off toward lower levels, targeting 49,800 or lower.

- On the other hand, if the index bounces back from 49,952, a recovery to 50,167 or 50,385 is possible.

Watch for strong candlestick patterns at key levels to confirm reversal or continuation before initiating trades.

---

Risk Management Tips for Options Trading:

- Focus on weekly options for lower premiums, but trade near-the-money strikes for better liquidity.

- Use defined stop-losses based on levels and avoid over-leveraging positions.

- Be cautious with aggressive trades during high volatility or news-driven sessions.

- Avoid holding trades beyond the day's range unless strong trends are observed.

---

Summary and Conclusion:

The market's trajectory today hinges on how Bank Nifty reacts to the zones around 50,727 and 50,385. These levels will act as key decision points for bullish or bearish momentum. Emphasize patience and wait for breakout confirmations to manage risk effectively.

Disclaimer: I am not a SEBI-registered analyst. The analysis shared is for educational purposes only. Please consult your financial advisor before making any trading decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.