Nifty Trading Plan for 11-Oct-2024

Previous Day's Chart Pattern Recap

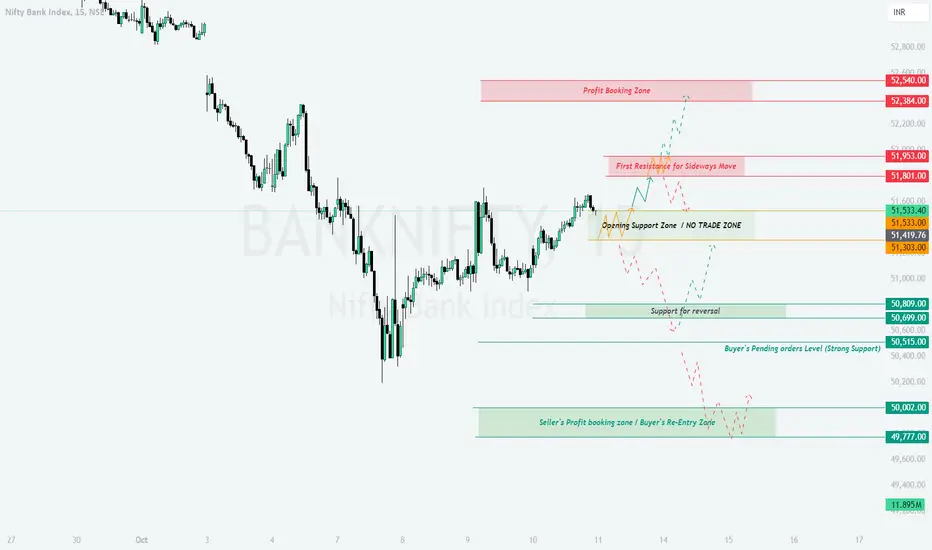

On 10th October, Nifty opened near support levels and recovered to the Resistance level of 51533 from the lows, after breaking this resistance prices could manage to hold this level. The price action suggests that Nifty might be preparing for a breakout or breakdown based on the opening scenario today. Key zones of resistance and support are well defined, and traders should be prepared for a move in either direction.

Opening Scenarios

Risk Management Tips for Options Traders:

- Avoid entering trades in the first 15-30 minutes to avoid whipsaw movements.

- Use stop-losses that respect key support/resistance zones, especially when trading at-the-money options.

- When volatility is high, consider using spreads (e.g., bull call or bear put spreads) to limit potential losses while maintaining profitability.

- Always set a defined risk level per trade, and do not over-leverage in options trading.

Summary and Conclusion:

Nifty is at a critical juncture with key resistance at 25,172 and support at 24,900. A gap-up could push Nifty towards profit booking zones, while a gap-down may test the lower support levels. Regardless of the opening scenario, patience and proper risk management are essential for capturing the best opportunities. Watch for price action confirmation at key levels before taking a trade.

Disclaimer:

I am not a SEBI registered analyst. All trading ideas shared are for educational purposes. Please conduct your own analysis or consult a financial advisor before executing any trades.

Previous Day's Chart Pattern Recap

On 10th October, Nifty opened near support levels and recovered to the Resistance level of 51533 from the lows, after breaking this resistance prices could manage to hold this level. The price action suggests that Nifty might be preparing for a breakout or breakdown based on the opening scenario today. Key zones of resistance and support are well defined, and traders should be prepared for a move in either direction.

Opening Scenarios

- Gap Up Opening (+100 points or more):

If Nifty opens with a gap up near the "Resistance for Sideways" at 25,299–25,322, there is a chance for profit booking around the 25,429–25,474 zone. A sustained move above 25,322 could signal further bullish momentum, while failure to hold this level could bring Nifty back down to test the "Opening Resistance" zone at 25,172.

Trade Setup:

- Buy above 25,322 with a stop loss below 25,250.

- Targets: 25,429 and 25,474.

- Look for short opportunities if Nifty fails to break above 25,322. - Flat Opening:

A flat opening around the current price level near 25,008 would put Nifty right at the "Opening Support" zone (24,965–25,008). This could lead to a period of sideways movement before a breakout. A breakout above 25,172 will take Nifty towards 25,299, while a breakdown below 24,965 may result in a test of lower support at 24,900.

Trade Setup:

- Buy above 25,172 with targets of 25,299 and 25,322.

- Short below 24,965 targeting 24,900 and 24,809.

- Wait for a clear breakout before entering any trades, as this scenario could see choppy price action. - Gap Down Opening (-100 points or more):

A gap down could bring Nifty closer to the "Opening Support" at 24,965–24,900. If Nifty holds above this zone, we might see a quick reversal back towards 25,172. However, if Nifty breaks below 24,900, it could test the next strong support near 24,809.

Trade Setup:

- Buy near 24,900 with targets of 25,008 and 25,172.

- Short below 24,900 with targets of 24,809 and 24,750.

- Gap-down scenarios tend to be volatile, so trade cautiously and wait for price confirmation.

Risk Management Tips for Options Traders:

- Avoid entering trades in the first 15-30 minutes to avoid whipsaw movements.

- Use stop-losses that respect key support/resistance zones, especially when trading at-the-money options.

- When volatility is high, consider using spreads (e.g., bull call or bear put spreads) to limit potential losses while maintaining profitability.

- Always set a defined risk level per trade, and do not over-leverage in options trading.

Summary and Conclusion:

Nifty is at a critical juncture with key resistance at 25,172 and support at 24,900. A gap-up could push Nifty towards profit booking zones, while a gap-down may test the lower support levels. Regardless of the opening scenario, patience and proper risk management are essential for capturing the best opportunities. Watch for price action confirmation at key levels before taking a trade.

Disclaimer:

I am not a SEBI registered analyst. All trading ideas shared are for educational purposes. Please conduct your own analysis or consult a financial advisor before executing any trades.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.