Bank Nifty Trading Plan for 21st October 2024

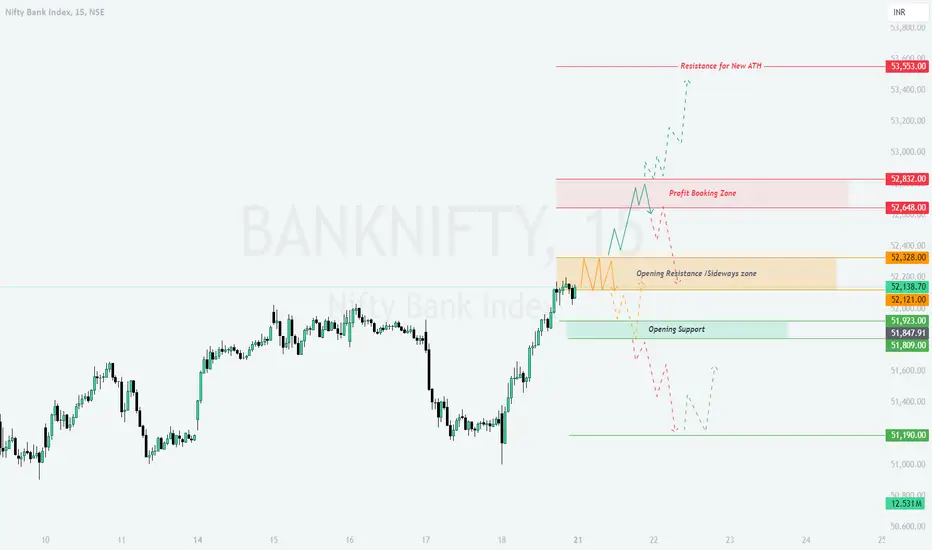

In the previous session, Bank Nifty moved significantly higher and encountered resistance near the 52,168 level, showing consolidation just below the Opening Resistance/Sideways zone at 52,328. The price action suggests that the market may face further resistance as it approaches the 52,648 Profit Booking Zone. Bank Nifty's trend for 21st October will depend heavily on the opening scenario and its ability to break above these key resistance levels or hold at support zones.

Gap-Up Opening (200+ Points):

In the previous session, Bank Nifty moved significantly higher and encountered resistance near the 52,168 level, showing consolidation just below the Opening Resistance/Sideways zone at 52,328. The price action suggests that the market may face further resistance as it approaches the 52,648 Profit Booking Zone. Bank Nifty's trend for 21st October will depend heavily on the opening scenario and its ability to break above these key resistance levels or hold at support zones.

Gap-Up Opening (200+ Points):

- If Bank Nifty opens with a gap-up near or above 52,328, it’s important to observe if the price sustains above this zone. A move above 52,328 can quickly lead to a test of the Profit Booking Zone between 52,648 and 52,832.

- Long positions can be considered above 52,328, targeting the 52,648-52,832 range. Partial profit booking is recommended near 52,648.

- Be cautious if Bank Nifty opens within the Profit Booking Zone (52,648-52,832), as a reversal is possible from these levels.

- Place a stop-loss below 52,328 for any long trades initiated after the gap-up opening to manage risk effectively.

[tab]

Flat Opening:- In case of a flat opening near the 52,138 level, wait for the first 30 minutes to see if the price can sustain above this level.

- If the price moves above 52,328, it can offer a good buying opportunity targeting 52,648-52,832.

- A failure to sustain above 52,138 could result in a retracement back towards the Opening Support zone at 51,923-51,847. Watch for a potential bounce from these levels for buying opportunities.

- Stop-loss should be placed below 51,923 for any long trades in case of a flat opening.

[tab]

Gap-Down Opening (200+ Points):- If Bank Nifty opens with a gap-down below 51,847, wait for a recovery towards 51,923 before considering any long positions.

- A failure to hold 51,847 could lead to further downside pressure, targeting 51,809 and potentially 51,190 (Major Support). Avoid taking aggressive long positions unless a reversal pattern is confirmed near these supports.

- For gap-down scenarios, a stop-loss just below 51,809 is recommended to minimize risk exposure.

- Avoid attempting to buy falling prices without clear confirmation of support near 51,809 or 51,190.

[tab]

Risk Management Tips for Options Trading:- Use hedged strategies such as bull call spreads or bear put spreads to limit risk, especially in volatile markets.

- Do not hold naked option positions overnight in case of large gap openings, as option premiums can decay rapidly due to time decay.

- For intraday options trades, always set defined stop-losses to avoid significant losses in case of sudden market reversals. For example, consider 52,328 as a key level for long call options or 51,809 for long put options.

- Ensure to book profits periodically, especially near key resistance or support zones, to avoid losing gains in a volatile market.

[tab]

Summary & Conclusion:

The key levels to watch for Bank Nifty on 21st October are 52,328 on the upside and 51,809 on the downside. A break and sustain above 52,328 could lead to a strong rally towards the Profit Booking Zone (52,648-52,832), while a breakdown below 51,809 may lead to a sharp correction toward 51,190. Traders should remain cautious within the Opening Resistance/Sideways zone (52,138-52,328) and manage their risk by placing appropriate stop-losses, especially when trading options. Stay disciplined and follow proper risk management strategies to safeguard against potential losses.

[tab]

Disclaimer: I am not a SEBI registered analyst. This plan is based on my personal analysis using technical parameters. Traders are advised to conduct their own research or consult with a financial advisor before making any trading decisions.

- Use hedged strategies such as bull call spreads or bear put spreads to limit risk, especially in volatile markets.

- If Bank Nifty opens with a gap-down below 51,847, wait for a recovery towards 51,923 before considering any long positions.

- In case of a flat opening near the 52,138 level, wait for the first 30 minutes to see if the price can sustain above this level.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.