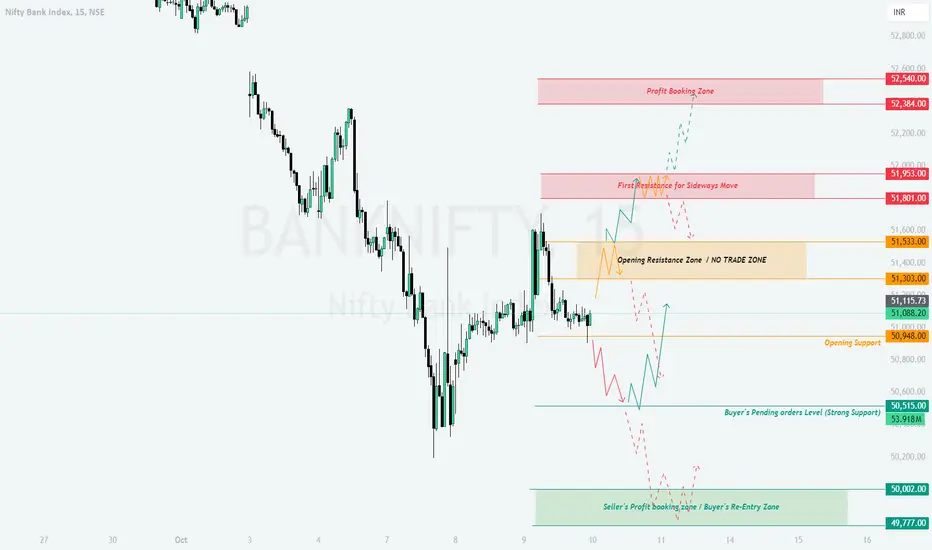

BankNifty Trading Plan for 10-Oct-2024

Previous Day's Chart Pattern Recap

In the last session, BankNifty performed at key levels as planned yesterday. but the lack of strong momentum resulted in a range-bound movement in the ending session of trading day. The chart indicates that Bank Nifty is awaiting a breakout or breakdown to define its next directional move. Based on this, we will explore key levels and scenarios for the upcoming session on 10th October.

Opening Scenarios

Risk Management Tips for Options Traders:

- Always wait for the first 15-30 minutes to let volatility settle before entering trades.

- Use defined stop losses for options trades based on key support/resistance levels. For example, near 51,000, consider at-the-money strikes for calls/puts depending on direction.

- Avoid holding options positions with large exposure overnight, as unexpected gap movements can lead to significant losses.

- Use spreads (like bull or bear spreads) to limit risk while maintaining profit potential.

Summary and Conclusion:

Bank Nifty is expected to move decisively depending on how it reacts to key levels in the opening session. A gap up will test the upper resistance levels, while a gap down could retest support zones. The flat opening within the resistance zone suggests a no-trade zone where traders should stay cautious. Patience and proper risk management will be essential to navigate through the volatility. Keep an eye on 51,533 on the upside and 50,948 on the downside for directional cues.

Disclaimer:

I am not a SEBI registered analyst. All trading ideas shared are for educational purposes. Please perform your own analysis or consult a financial advisor before executing any trades.

Previous Day's Chart Pattern Recap

In the last session, BankNifty performed at key levels as planned yesterday. but the lack of strong momentum resulted in a range-bound movement in the ending session of trading day. The chart indicates that Bank Nifty is awaiting a breakout or breakdown to define its next directional move. Based on this, we will explore key levels and scenarios for the upcoming session on 10th October.

Opening Scenarios

- Gap Up Opening (+200 points or more):

If Bank Nifty opens with a gap up and directly approaches the "First Resistance for Sideways Move" zone (51,801–51,953), traders should wait for a reaction at these levels. A sustained move above 51,953 could lead to further upside towards the profit booking zone near 52,540. However, if Bank Nifty fails to hold above 51,801, a potential reversal or consolidation could be in play.

Trade Setup:

- Buy above 51,953 with a stop loss below 51,800.

- Target 52,384 and 52,540.

- In case of reversal from 51,801, short with a target of 51,533 and 51,303. - Flat Opening:

A flat opening near the "Opening Resistance Zone" (51,303–51,533) could lead to indecisive market movement initially. Traders are advised to avoid taking positions within this zone and wait for a breakout or breakdown. A breakout above 51,533 will shift the market's focus towards higher resistance zones, while a breakdown below 51,303 could test support levels.

Trade Setup:

- Buy above 51,533 with targets of 51,801 and 51,953.

- If Bank Nifty breaks below 51,303, short with a target towards 50,948 and 50,515.

- Avoid trades within this zone to minimize the risk of whipsaws. - Gap Down Opening (-200 points or more):

A gap down opening near the "Opening Support" zone (50,948–51,000) may attract buying interest. If this zone holds, there is a possibility of a bounce towards 51,303. However, failure to hold the support could lead to further downside pressure, potentially testing the "Buyers' Pending Orders Level" around 50,515 or even the critical 50,000 level.

Trade Setup:

- Buy near 50,948 if support holds, with targets of 51,303 and 51,533.

- If the price breaks below 50,948, short with a target towards 50,515 and 50,000.

- Wait for confirmation at key levels before initiating trades, especially in case of sharp downward moves.

Risk Management Tips for Options Traders:

- Always wait for the first 15-30 minutes to let volatility settle before entering trades.

- Use defined stop losses for options trades based on key support/resistance levels. For example, near 51,000, consider at-the-money strikes for calls/puts depending on direction.

- Avoid holding options positions with large exposure overnight, as unexpected gap movements can lead to significant losses.

- Use spreads (like bull or bear spreads) to limit risk while maintaining profit potential.

Summary and Conclusion:

Bank Nifty is expected to move decisively depending on how it reacts to key levels in the opening session. A gap up will test the upper resistance levels, while a gap down could retest support zones. The flat opening within the resistance zone suggests a no-trade zone where traders should stay cautious. Patience and proper risk management will be essential to navigate through the volatility. Keep an eye on 51,533 on the upside and 50,948 on the downside for directional cues.

Disclaimer:

I am not a SEBI registered analyst. All trading ideas shared are for educational purposes. Please perform your own analysis or consult a financial advisor before executing any trades.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.