Intro:

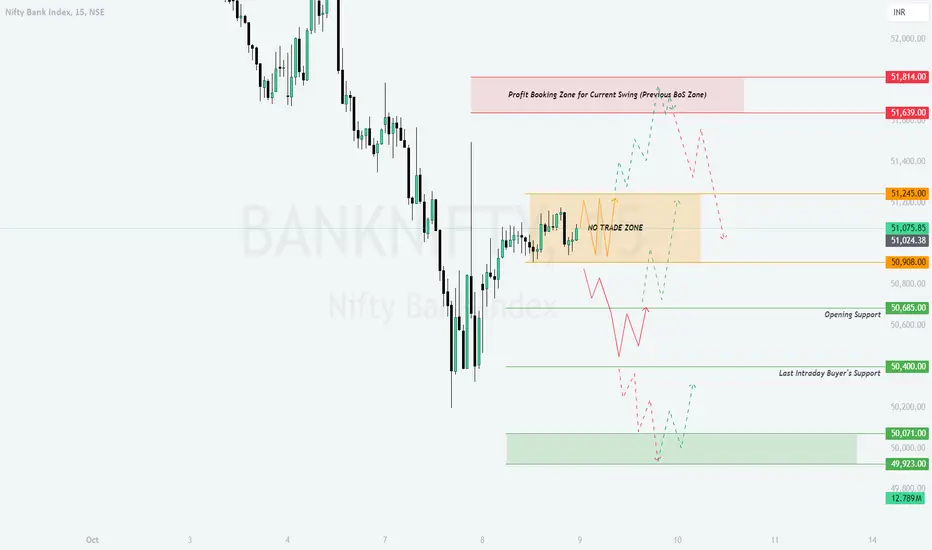

On 8th October 2024, Nifty Bank Index displayed a consolidation pattern after initial recovery from recent lows , remaining within a tight range, with expected key resistance levels above 51,245 and support around 50,685 for intraday. The chart highlights a "No Trade Zone", suggesting indecision and a possible buildup for a breakout. Traders need to focus on the next decisive move either above the resistance or below the support to gauge the direction for 9th October 2024.

Trading Plan for 9th October 2024:

Risk Management Tips for Options Trading:

- Avoid over-leveraging in volatile market conditions. Stick to predefined risk strategies like spreads and collars.

- Monitor implied volatility (IV) to prevent buying overpriced options. Enter trades when IV is lower to ensure premiums are cheaper.

- Implement a disciplined stop-loss strategy to manage risk and protect profits efficiently.

Summary & Conclusion:

The movement on 9th October will largely depend on the opening scenario. A gap-up could face resistance around 51,639, while a flat opening offers potential for trading a breakout above 51,075. In the case of a gap-down, watch for support around 50,400 and 50,071. Proper risk management, especially when trading options, will be crucial to navigate through market volatility.

Disclaimer: I am not a SEBI-registered analyst. The views shared are for educational purposes only. Traders should conduct their own analysis or consult a financial advisor before making trading decisions.

On 8th October 2024, Nifty Bank Index displayed a consolidation pattern after initial recovery from recent lows , remaining within a tight range, with expected key resistance levels above 51,245 and support around 50,685 for intraday. The chart highlights a "No Trade Zone", suggesting indecision and a possible buildup for a breakout. Traders need to focus on the next decisive move either above the resistance or below the support to gauge the direction for 9th October 2024.

Trading Plan for 9th October 2024:

- Gap Up Opening (200+ points above):

If the Nifty Bank Index opens with a significant gap-up, crossing 51,245, it would be entering the resistance zone. The key levels to watch are 51,639 and 51,814. A strong breakout above 51,814 can trigger a fresh bullish momentum, but rejection from 51,639 could lead to profit-booking.

Targets: 51,639, 51,814

Stop Loss: Below 51,245 on an hourly candle close basis

Risk Management: Wait for a retracement toward 51,245 before entering long trades to avoid being trapped near the resistance. Tighten your stop losses around the resistance area to protect profits.

Risk Tip: Use in-the-money call options for gap-up openings to minimize risk and limit capital exposure. Avoid out-of-the-money options to mitigate time decay losses.

- Flat Opening (Within 50,685 - 51,075 range):

In case of a flat opening, price action around 51,024 to 51,075 will be critical. A breakout above 51,075 may lead to a rally toward 51,245, while a failure to break could see a retracement toward 50,685.

Targets: 51,245, 51,639

Stop Loss: Below 50,685 on an hourly candle close basis

Risk Management: For flat openings, use tight risk control as volatility may increase. Enter trades only after a clear breakout or breakdown is confirmed to avoid whipsaws.

Risk Tip: Use option strategies like bull call spreads or selling out-of-the-money options to manage risk in a flat opening scenario. - Gap Down Opening (200+ points below):

If Nifty Bank opens with a gap down below 50,685, watch the key support level at 50,400 and 50,071. A breakdown below 50,071 could extend the downtrend, targeting 49,923. Any recovery above 50,400 could present a quick scalping opportunity toward 50,685.

Targets: 50,685 on recovery, 50,400, 50,071 on further downside

Stop Loss: Below 50,400

Risk Management: Avoid entering long trades immediately in case of a gap down. Wait for a clear confirmation of recovery or reversal to enter trades. Manage risk by using stop losses closely aligned with key support levels.

Risk Tip: For gap-down scenarios, consider protective puts or hedged positions to guard against further declines. Focus on limiting your risk exposure by keeping position sizes small.

Risk Management Tips for Options Trading:

- Avoid over-leveraging in volatile market conditions. Stick to predefined risk strategies like spreads and collars.

- Monitor implied volatility (IV) to prevent buying overpriced options. Enter trades when IV is lower to ensure premiums are cheaper.

- Implement a disciplined stop-loss strategy to manage risk and protect profits efficiently.

Summary & Conclusion:

The movement on 9th October will largely depend on the opening scenario. A gap-up could face resistance around 51,639, while a flat opening offers potential for trading a breakout above 51,075. In the case of a gap-down, watch for support around 50,400 and 50,071. Proper risk management, especially when trading options, will be crucial to navigate through market volatility.

Disclaimer: I am not a SEBI-registered analyst. The views shared are for educational purposes only. Traders should conduct their own analysis or consult a financial advisor before making trading decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.