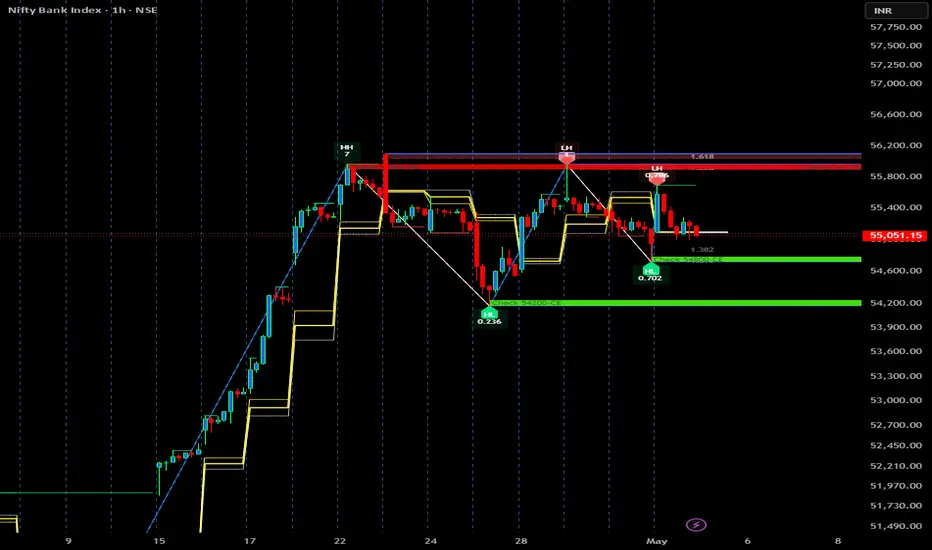

Bank Nifty Technical Outlook:

Bank Nifty is currently forming a lower high and higher low pattern, indicating a symmetrical triangle formation. The trading range is getting increasingly narrower, suggesting that a decisive breakout is imminent on either side.

Downside Scenario:

If Bank Nifty breaks down below 54,200, we could see a retracement towards the 52,930 – 52,300 levels, where multiple virgin CPRs (Central Pivot Ranges) are present, potentially acting as support zones.

Traders should closely monitor price action near the current range boundaries for confirmation of direction.

Bank Nifty is currently forming a lower high and higher low pattern, indicating a symmetrical triangle formation. The trading range is getting increasingly narrower, suggesting that a decisive breakout is imminent on either side.

Downside Scenario:

If Bank Nifty breaks down below 54,200, we could see a retracement towards the 52,930 – 52,300 levels, where multiple virgin CPRs (Central Pivot Ranges) are present, potentially acting as support zones.

Traders should closely monitor price action near the current range boundaries for confirmation of direction.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.