Intro (15th Oct 2024 Bank Nifty Movement):

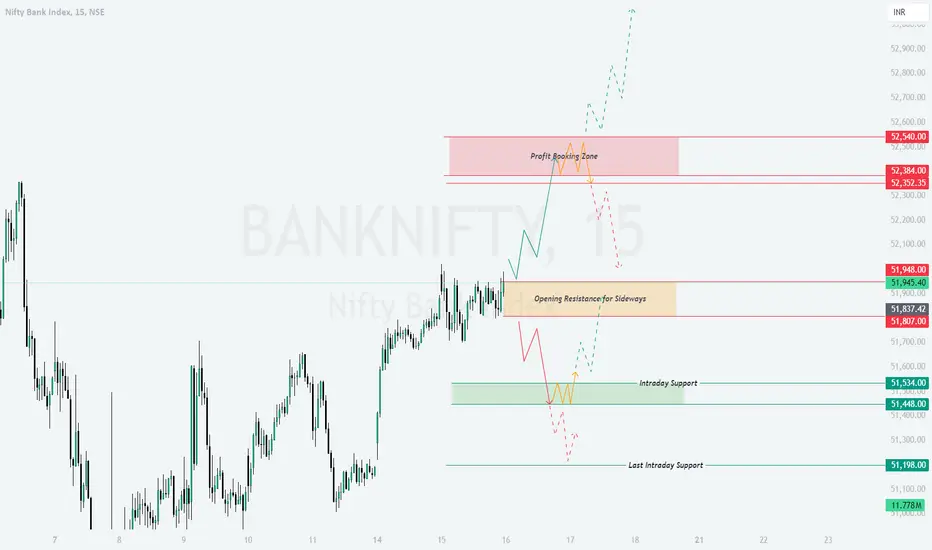

On the previous trading day, Bank Nifty showed a consolidation pattern after a fall and tested important resistance levels around 51,948. This area acted as a barrier for an upside move, and price struggled around this zone. On the downside, intraday support levels around 51,700 held, which provided a bounce. The market is now positioned at a key junction, and the price action on 16th October will depend heavily on the opening scenarios. Let's explore potential plans for Gap Up, Flat, and Gap Down openings.

---

Trading Plan for 16th October 2024:

On the previous trading day, Bank Nifty showed a consolidation pattern after a fall and tested important resistance levels around 51,948. This area acted as a barrier for an upside move, and price struggled around this zone. On the downside, intraday support levels around 51,700 held, which provided a bounce. The market is now positioned at a key junction, and the price action on 16th October will depend heavily on the opening scenarios. Let's explore potential plans for Gap Up, Flat, and Gap Down openings.

---

Trading Plan for 16th October 2024:

- Gap Up Opening (200+ points):

- If Bank Nifty opens above 52,200, we can expect it to test the resistance zone near 52,540, which is a potential profit booking area.

- A bullish breakout may occur above 52,540. If sustained for 15 minutes, look for long opportunities with a target of 52,800.

- Keep a stop-loss below 52,200 in case of a reversal.

- If rejected from 52,540, expect a pullback to the 51,948 opening resistance. Consider a short trade here with a target of 51,807. - Flat Opening:

- In case of a flat opening around 51,948 (previous day's close), expect a sideways movement initially.

- A breakout above 52,000 can lead to a quick test of the 52,352–52,540 zone. Look for buy opportunities if volume supports the breakout.

- Below 51,807, consider shorting with an intraday target of 51,534 as the market may follow a range-bound movement.

- Maintain a tight stop-loss just below 51,900 to manage risk in case of false moves. - Gap Down Opening (200+ points):

- For a gap-down opening below 51,600, the market will likely test the support zone of 51,534 or even the last intraday support of 51,198.

- A bounce from 51,534 could trigger a buying opportunity, with a target back towards 51,807–51,948.

- In case 51,534 is broken, aggressive selling could push the market lower to 51,198, and traders can look for short setups below this level.

- Keep a stop-loss above 51,600 for a safer downside trade.

---

Risk Management Tips for Options Trading:

- Use position sizing wisely. Do not risk more than 2-3% of your total capital on a single trade.

- For buying options, prefer deep in-the-money (ITM) contracts for better delta, especially in trending markets.

- Always hedge your positions when uncertainty arises, such as buying protective puts or calls to safeguard against unexpected moves.

- Trail your stop-loss as soon as the market moves in your favor, especially in volatile conditions.

- Avoid trading options in sideways markets to prevent premium decay losses from time decay (Theta).

---

Summary and Conclusion:

- Bank Nifty is at a crucial level, with resistance at 51,948 and strong support at 51,534. For 16th October, a lot depends on the opening scenario. In the case of a gap-up or flat opening, focus on long opportunities if the 52,200 level holds. A gap-down opening could present short setups as the market tests lower support.

- Intraday traders should be cautious around key resistance and support levels, as these areas could result in strong rejections or breakouts.

- Managing risk efficiently through proper stop-loss placement and position sizing will be critical to avoid unnecessary losses.

---

Disclaimer: I am not a SEBI registered analyst. The information provided here is for educational purposes only and should not be considered as financial advice. Trade at your own risk, and consult with a professional financial advisor before making any trading decisions.

---

This plan combines technical analysis with a logical approach to various market scenarios. You can adjust as per market sentiment closer to the opening!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.