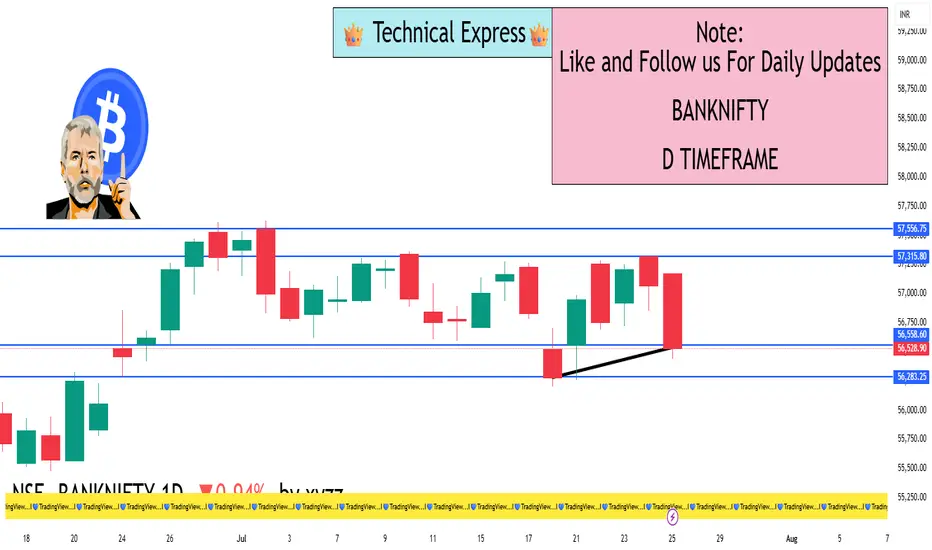

Closing Value: 56,528.90

Net Change: −537.15 points (−0.94%)

Opening Price: 57,034.40

Day’s High: 57,170.70

Day’s Low: 56,439.40

Trend: Bearish

📊 Technical Analysis

✅ Candle Pattern:

A strong bearish candle was formed.

Price opened higher but failed to sustain and closed near the day’s low — a sign of heavy intraday selling.

🔻 Support Zones:

56,400 – Immediate support (also the day's low)

56,000 – Psychological round number

55,750 – Medium-term support (from earlier price consolidation)

🔺 Resistance Zones:

56,800 – Near-term resistance

57,000 – Critical level; needs to be reclaimed for bullish reversal

57,300 – Stronger resistance zone based on recent highs

📈 Indicator Summary:

RSI (Relative Strength Index): Likely below 50, signaling weakening bullish momentum

MACD (Moving Average Convergence Divergence): Bearish crossover remains intact

Volume: Higher than average, suggesting institutional selling pressure

🧠 Market Sentiment:

Bearish sentiment prevailed across major banks including HDFC Bank, ICICI Bank, Axis Bank, Kotak Bank, and SBI

Pressure also visible in PSU banks (like PNB, Bank of Baroda, Canara Bank)

Overall market mood was risk-averse due to global uncertainty and potential interest rate impact

Foreign Institutional Investors (FIIs) continued their selling streak

Traders remain cautious ahead of upcoming quarterly bank results

✅ Conclusion:

Bank Nifty is currently in a short-term downtrend.

If 56,400 breaks decisively, it may head toward 56,000 and 55,750.

For bulls to regain strength, Bank Nifty must cross back above 57,000 with strong volume and momentum.

Net Change: −537.15 points (−0.94%)

Opening Price: 57,034.40

Day’s High: 57,170.70

Day’s Low: 56,439.40

Trend: Bearish

📊 Technical Analysis

✅ Candle Pattern:

A strong bearish candle was formed.

Price opened higher but failed to sustain and closed near the day’s low — a sign of heavy intraday selling.

🔻 Support Zones:

56,400 – Immediate support (also the day's low)

56,000 – Psychological round number

55,750 – Medium-term support (from earlier price consolidation)

🔺 Resistance Zones:

56,800 – Near-term resistance

57,000 – Critical level; needs to be reclaimed for bullish reversal

57,300 – Stronger resistance zone based on recent highs

📈 Indicator Summary:

RSI (Relative Strength Index): Likely below 50, signaling weakening bullish momentum

MACD (Moving Average Convergence Divergence): Bearish crossover remains intact

Volume: Higher than average, suggesting institutional selling pressure

🧠 Market Sentiment:

Bearish sentiment prevailed across major banks including HDFC Bank, ICICI Bank, Axis Bank, Kotak Bank, and SBI

Pressure also visible in PSU banks (like PNB, Bank of Baroda, Canara Bank)

Overall market mood was risk-averse due to global uncertainty and potential interest rate impact

Foreign Institutional Investors (FIIs) continued their selling streak

Traders remain cautious ahead of upcoming quarterly bank results

✅ Conclusion:

Bank Nifty is currently in a short-term downtrend.

If 56,400 breaks decisively, it may head toward 56,000 and 55,750.

For bulls to regain strength, Bank Nifty must cross back above 57,000 with strong volume and momentum.

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.