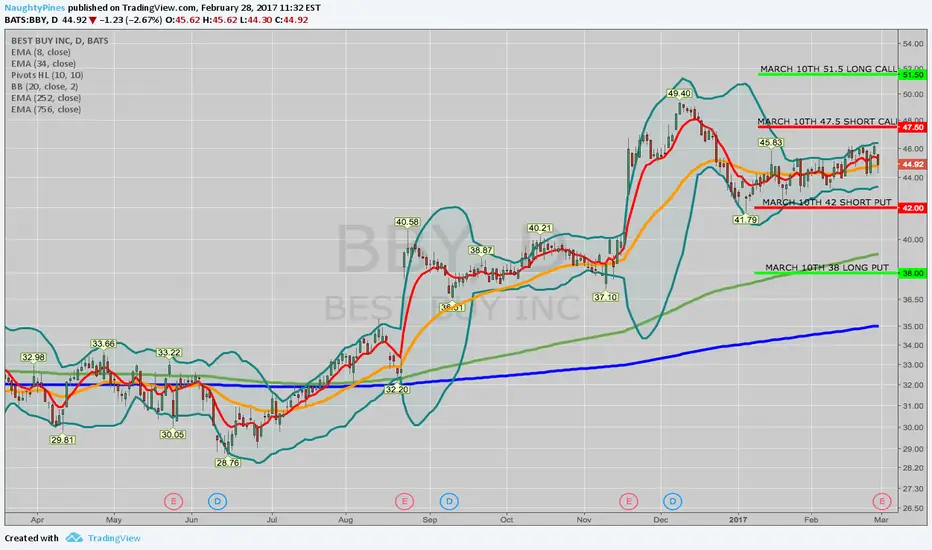

BBY announces earnings tomorrow before market open, so look to put on something today before market close to take advantage of the ensuing volatility contraction. Implied volatility rank is currently at 92 over the preceding six months, with implied volatility just shy of the 50% mark.

I compared and contrasted going with my standard 20-delta iron condor, as well as a full on iron fly. Here, I'm selling the 30-delta shorts as a sort of compromise ... .

Metrics:

Probability of Profit: 57%

Max Profit: $163/contract

Max Loss/Buying Power Effect: $239/contract

Break Evens: 40.39/49.11

Delta: -2.39

Theta: 9.03

I compared and contrasted going with my standard 20-delta iron condor, as well as a full on iron fly. Here, I'm selling the 30-delta shorts as a sort of compromise ... .

Metrics:

Probability of Profit: 57%

Max Profit: $163/contract

Max Loss/Buying Power Effect: $239/contract

Break Evens: 40.39/49.11

Delta: -2.39

Theta: 9.03

Note

I got filled for 1.57 somewhat earlier in the session ... .Note

Covering for 1.02 at the open; .55 ($55) net profit/contract. I took profit at 35% max, since this was a 30 delta.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.