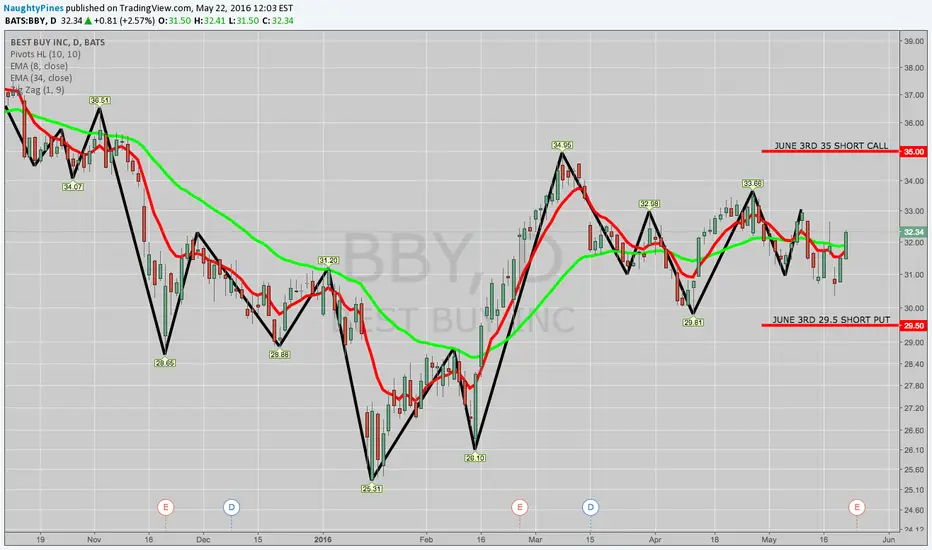

BBY announces earnings on 5/24 (Tuesday) before market open, so look to put on a play shortly before Monday's NY close to take advantage of the implied volatility crush that commonly occurs post-earnings announcement. Here's the preliminary setup, since price may move during the NY session, requiring slight adjustment of the strikes:

BBY June 3rd 29.5/35 short strangle

Probability of Profit: 71%

Max Profit: $104/contract

Max Loss/Buying Power Effect: Undefined/~$371/contract

Note: Look to take this off at 50% max profit.

BBY June 3rd 29.5/35 short strangle

Probability of Profit: 71%

Max Profit: $104/contract

Max Loss/Buying Power Effect: Undefined/~$371/contract

Note: Look to take this off at 50% max profit.

Note

I don't know if volatility ebbed of if the weekend options pricing was off, but I didn't get a fill and wasn't willing to chase.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.