Long

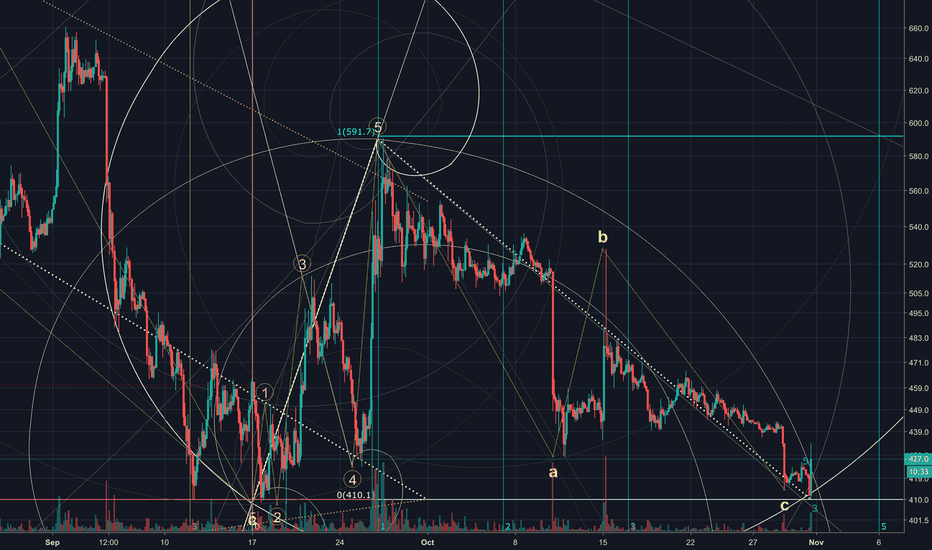

BCH-Fibonacci/Wave Analysis-Leading Diagonal-Apex

$BITFINEX:BCHUSD is forming the apex of the leading diagnoal.

This Idea is to track the price-action coming out of the the leading diagonal.

For Further Analysis see related idea.

Review:

BITFINEX:BCHUSD 7.62% has been in a bear market since reaching an all-time high in December 2017 (273 days ago).

1. Primary Wave Sequence (Green)

-Wave 1: +347.02%

-Wave 3: +899.29%

-Wave 5: +382.22%

- 133 Days

2. Correction Sequence (Yellow)

-A Wave: 5 Waves (Pink) (-84.87%)

-B Wave: 3 Waves (+197.89%)

-C Wave: 5 Waves (Orange) (-77.95%)

-Fib. Extension (5-A-B)

3. Fibonacci Extension: Wave 1 & Wave 2

4. Wave Sequence Price Increase: 2,290.84%

- $215.00/$4,104.30

- 133 Days

5. Wave 2 Price Decrease= 90.06%

- $4,104.30/$407.90

- 273 Days

6. Fibonacci Time Extension: Wave 1/Wave 5 (Yellow)

The Beginning:

Idea: BCH-BREAKOUT-Imminent

The Correction ended at $426.40 with a sharp reflex followed by a Micro-Wave sequence.

The Micro-Wave was a lower degree Wave 1 & Wave 2.

The 3rd Wave extended over 700% of Wave 1 & Wave 2.

The 4th Wave Correction resulted in what Elliot called a 'diagonal triangle'.

There are two main types of diagonal triangles. One is where the two boundaries of the triangle converge and the other where they diverge. The second type is known as Expanding Diagonal Triangles. Irrespective of whether they are converging or expanding diagonal triangles, if they occur in the first wave position, where they are known as ‘leading diagonal triangle’, the internal waves are made up of 5-3-5-3-5 sub waves. If they occur in the fifth wave position, they are known as ‘ending diagonal triangles’ and the internal waves are made up of 3-3-3-3-3 sub waves. For example, in an uptrend, the ending point of the fourth wave diagonal triangle will be near or even above the top of the third wave. Then all of a sudden, when the ‘e’ wave of the triangle is finished, price will break even higher and the fifth wave will race upwards.

The corrective sequence occurred in the Wave A position making it a leading diagonal .

When it occurs in Wave A position, it becomes a leading diagonal triangle, and when it occurs at the Wave C position, it is an ending diagonal triangle.

A diagonal triangle differs from a regular (horizontal) triangle in that it slopes in the direction of the trend. So when the eventual break out happens, the next move will be in the opposite direction.

The third wave traveled a considerable distance in a short space of time, and the diagonal triangle itself appeared sloping in the direction of the major trend which hints that the 5th Wave will extend.

The internal waves of the correction were 5-3-5.

The correction was also complex by having 2 correction sequences of ABCDE.

Instead of breaking higher the move broke down and consolidated further and formed a larger leading diagonal.

The next wave sequence is estimated to last 259 days till July 1st, 2019.

Cheers!

-AB

This Idea is to track the price-action coming out of the the leading diagonal.

For Further Analysis see related idea.

Review:

BITFINEX:BCHUSD 7.62% has been in a bear market since reaching an all-time high in December 2017 (273 days ago).

1. Primary Wave Sequence (Green)

-Wave 1: +347.02%

-Wave 3: +899.29%

-Wave 5: +382.22%

- 133 Days

2. Correction Sequence (Yellow)

-A Wave: 5 Waves (Pink) (-84.87%)

-B Wave: 3 Waves (+197.89%)

-C Wave: 5 Waves (Orange) (-77.95%)

-Fib. Extension (5-A-B)

3. Fibonacci Extension: Wave 1 & Wave 2

4. Wave Sequence Price Increase: 2,290.84%

- $215.00/$4,104.30

- 133 Days

5. Wave 2 Price Decrease= 90.06%

- $4,104.30/$407.90

- 273 Days

6. Fibonacci Time Extension: Wave 1/Wave 5 (Yellow)

The Beginning:

Idea: BCH-BREAKOUT-Imminent

The Correction ended at $426.40 with a sharp reflex followed by a Micro-Wave sequence.

The Micro-Wave was a lower degree Wave 1 & Wave 2.

The 3rd Wave extended over 700% of Wave 1 & Wave 2.

The 4th Wave Correction resulted in what Elliot called a 'diagonal triangle'.

There are two main types of diagonal triangles. One is where the two boundaries of the triangle converge and the other where they diverge. The second type is known as Expanding Diagonal Triangles. Irrespective of whether they are converging or expanding diagonal triangles, if they occur in the first wave position, where they are known as ‘leading diagonal triangle’, the internal waves are made up of 5-3-5-3-5 sub waves. If they occur in the fifth wave position, they are known as ‘ending diagonal triangles’ and the internal waves are made up of 3-3-3-3-3 sub waves. For example, in an uptrend, the ending point of the fourth wave diagonal triangle will be near or even above the top of the third wave. Then all of a sudden, when the ‘e’ wave of the triangle is finished, price will break even higher and the fifth wave will race upwards.

The corrective sequence occurred in the Wave A position making it a leading diagonal .

When it occurs in Wave A position, it becomes a leading diagonal triangle, and when it occurs at the Wave C position, it is an ending diagonal triangle.

A diagonal triangle differs from a regular (horizontal) triangle in that it slopes in the direction of the trend. So when the eventual break out happens, the next move will be in the opposite direction.

The third wave traveled a considerable distance in a short space of time, and the diagonal triangle itself appeared sloping in the direction of the major trend which hints that the 5th Wave will extend.

The internal waves of the correction were 5-3-5.

The correction was also complex by having 2 correction sequences of ABCDE.

Instead of breaking higher the move broke down and consolidated further and formed a larger leading diagonal.

The next wave sequence is estimated to last 259 days till July 1st, 2019.

Cheers!

-AB

Note

Near-Term Target: $800-$730 (30-90 days)Long-Term Target: $2800 (180 days)

Note

Main Question that comes to my mind is do we breakout of the Leading Diagonal Now...Or Consolidate further into the Apex

Note

High Probablity of Breaking out...Elliot Rule...

Wave 3 CANNOT be the Shortest Wave...

Note

TRADE: BUY: $475

SELL: $530

BUY: $475

Note

Trade Targets are NOT exact. The Trade is for Wave B & C.Wave B should come very close to Terminal Wave 3. Wave C should bottom at Terminal Wave B. I’m

Note

Wave B is Always 3 sub-wavesNote

Here comes the trade...Note

Always be on alert for Extensions...Note

Time to break the Leading Triangle?Note

5 tiny sub-waves in Wave C?Note

New Trade: Sell at Wave 5 TerminalNote

Next 36 hours the wave sequence will be complete.Note

Above: Extending S1Note

Should beginning the move momentarily...Note

Smaller leading diagonal within larger leading diagonalNote

Almost at the pinnacle of the leading diagonalNote

Time for Take-off?Note

3rd sub-wave of the higher degree 3rd should be starting now.Note

Above: Fib Spiral intersect from Cycle Wave A and BNote

Marks the end of Cycle Wave CorrectionNote

Or aka Wave CNote

STOPNote

Lower Degree - TealHigher Degree - Green

Note

Higher Degree:Wave 3 Target - $606-$650

Wave 5 Target - $735-$800

Note

Above: Nearing the Apex.Note

Breakout Imminent!Note

Above: Complex Correction: FLAT + ZIGZAGNote

Selling should be over or getting close...Note

Live updates to make sure I am right about this moveNote

Target Hit.Note

A few more ticks to go...Note

$436 is next targetNote

Gap opening...Note

Price-Action looks good.Analysis Stands.

Stay the course.

Note

Wave 5 is looking to extendNote

Scenario 1 : 5th Wave Extends Scenario 2 : Correction

STOP can be placed firmly at $430.49 (Coinbase)

Note

Scenario 2 occurred, no impact on analysis. Cheers!

-AB

Note

Reminder: Wave 1 can be sloppy...Note

Higher Degree Wave did not fail. The image where I noted where my analysis would failed if the $422 level was crossed.Note

Excuse typing errors please on my phone.Note

Analysis still stands.Stay the course.

Note

Wouldn't be surprised at all if BCH just shoots upwards.Note

Above: Higher Degree WaveNote

Above: Firm Stop $424.99 (Coinbase) & Retrace levelsNote

Price-Action is showing a leading DiagonalNote

The only formation that can violate Elliot's Wave laws. Wave 2 can never exceed the start of Wave 1

Wave 4 cannot overlap the price area of Wave 1

Wave 3 Cannot be the shortest impulse Wave

Note

Breakout should be imminent...Note

Lower Degree Wave 5 ExtendedHigher Degree Wave 5 SHOULD Extend

Note

Lower Degree Wave 1 & 2 near completionNote

I will be updating throughout the day...Note

Wave 3 Target hit.Note

Wave 3 Extension imminent.Note

It’s amazing, every time BCH tries to rally a seller(s) come in to block. What the...Note

Note to Seller(s): You Will Not Win!!!!Note

Sellers can only surpress price down for so long...it is NOT definite.Note

Wave 4 should terminate near Wave 1 terminal.Note

Still expecting an Extended 5th WaveNote

Price-Action looking very strong...Is it time for the Big Move?

Note

Fib Spiral 1: Wave 3 - Wave 4 = Target for Wave 5 Fib Spiral 2: Wave 5 (Sub-Wave 1) - Wave 4 = Timeline for Wave 5 (Sub-Wave 3) to begin

Note

Approx. 4 hours till next leg higher.Note

The main difference between Wave 3 extensions and Wave 5 extensions is that Wave 5 extensions take longer to complete.Note

Hoping this Sequence will break us out of the leading diagonal!Note

Reminder: This is Higher Degree Wave 3 beginningNote

Higher Degree Wave 1 & 2 (Yellow)Note

Elliot Rule: Wave 3 CANNOT be the shortest wave!Note

Higher wave near-term targets are Fib Extension level 1 & 1.618Note

Reminder: No way to guarantee where extensions end.Note

Please give me a like if you find this analysis to be useful!Note

The BIG move imminent...Note

Review: 1. Higher Degree Wave 3 Beginning

2. Lower Degree Wave

- Wave 1 - Leading Diagonal (Normal)

- Wave 3 - Passed 1.618 but failed to extend

- Wave 5 - EXTENDING

Note

Plan to open a new idea as soon as we break this leading diagonalNote

Bare Minimum Wave 3 has to reach $606.Note

Micro-Wave Sequence complete.Sell and buy back at Wave 1 Terminal.

Note

Waves are like Russian Nesting DollsNote

Trade opportunity! If you do not want to trade the correction, place a firm stop just under the beginning of Wave 1

Note

Reminder: Wave 2 can retrace up to 100% of Wave 1. The most common retrace is between Sub-Wave 1 Terminal and Sub-Wave 2 Terminal. I have represented this with the Red Fib Spirals.Note

Wave 2 Corrections are usually in the ZigZag Formation (5-3-5).Note

This is where you would sell...Watch out for the extensions...

Note

Price-Action Broke 1.236 LevelWatch 1.382 and 1.618 Next...

Looks like the 5th Wave Extension is not over.

Are the shorts starting to cover?

Note

Fib Spiral Intersections are Key.Green Circle shows two Fib Spirals intersecting...

This is how I read Fib Spirals...

Note

Looks like Major Rally is Straight Ahead...Note

$562 level is still pointing out to me...Note

Looks like one more move down to between $447 & $444 then get ready for the next leg higher which should be to at least $520.Note

Above: S1 & S2Note

Counting Waves is an Art not exact science...Note

ZigZag Correction should be ending now...Note

Above: Extending Higher Degree Wave 1 Not HIGHEST DEGREE (Still in larger WAVE 3)

Note

Here is Wave 2 Bottom.Now we are going higher...

Note

Above: Sub-Wave SequenceNote

Above:Added Extension Trigger

Added Wave Sequence

Note

5th Wave was NormalNote

Correction should be ending momentarily...Note

Correction was FLAT (3-3-5)Note

Prepare for the ‘Big’ move...These levels will likely not be seen again...

Buy what you can here.

Note

Will update shortly.Note

Wave 1 extended then pulled back...Stop Triggered.

Opportunity to pick up more BCH.

Analysis still stands.

Note

Wave 2 came down in a 3 wave sequence which implies a Flat CorrectionNote

Wave 2 Correction CompleteNote

6HR ViewAdded Fib Extension (1&2)

Note

Wave C needs to complete 5 Sub-Waves in order to be complete.Note

Price-Action Update:Note

Breakout imminentNote

Expect Wave 5 to Extend.Note

Above: Fib Time of Wave 1Note

10 mins or so left...Note

Looks like we are going to have a correction sequenceNote

Wave A bottomed in 5 Sub-Waves which tells us its a ZigZag correctionNote

Wave B usually travels back up to the .618 level of Wave A.Note

Wave C is always 5 sub-waves and bottoms between the 1 & 1.618 fib. Extension level from waves A & BNote

Hypothetical ActionNote

#SlowwalkerNote

Micro-WaveWave 1 is Normal

Wave 3 extended

Wave 5 Normal

Expect higher degree 3 extension

Note

Look for correction to end near 1.382/1.618Note

This wave (3) should extendNote

Fib extension 1 & 2Note

Wave 3 should pass 1.618 or $442Note

Notice all The Fib Spiral IntesectionsNote

Wave is tends to be a sloppy formationNote

Above: Yellow Box: Failed Wave

Now: beginning a new micro-wave formation

*please excuse typing while on my phone.

Stay the course!

Note

Above:Teal: Primary Wave - Sub-Wave Sequence

Red: ABC Correction

Orange: Primary Wave 1 & 2

Note

Above: Hypothetical ActionNote

We have to be getting close...Note

Note the Red Spiral IntersectionNote

Getting really close to breaking out...Note

Tiny Sub Wave 3 beginningNote

S1 & S3 we’re near equality Expect 5th Wave to extend

Note

Wave 5 broke .618 from Fib Extension 0-3-4 which implies it’s extending. Also, it broke the channel line from Terminal wave 1 and Terminal wave 3Note

We are reaching the end of the leading diagonal...The next move high should begin at any moment...

Micro-Wave Sequence & ABC Correction ending now..

Note

Correction close to endingNote

Price should not go below S1(0)Note

Take emotion out and trust the analysisNote

Reminder: Its extremely difficult to count 1-3 minute wave sequences. Counting waves is more of an Art than Science. Waves can change and waves can fail. If I do see a change in the formation I will update the idea asap. For example, if I originally said it’s a ZigZag Correction but it’s actually a Flat correction I will update the idea to notify the change in the price-action. Just wanted to let this be known and it is the main reason why I provide so many price-action updates.

Stay the course...we are getting close to the finish line!

Note

You could place a STOP near S1(0)Note

My stop is at $424.89Note

Expecting BCH to takeoff anytime...Note

Analysis is about to be proven correct...Note

Ye o little faith...Note

Last chance to load up on BCH!Note

If I don’t post a comment with a chart update I’m just showing the price-action and making sure it is still ‘following’ or ‘riding’ a spiral.Nothing more and nothing less...

I would notify with comment if there was a change in the analysis.

Note

$476.90Note

Add Fib Extension to Sub-Wave 1 & 2Note

See the Leading Diagonal?Note

Beautiful Chart Above...Fibonacci and Wave Theory

Note

Sub-Wave Sequence CompleteNote

Ignore stop above.Note

Sub-Wave 3 was NormalNote

Who dumped 5,000 BCH? Stench of Manipulation...

Note

Higher Degreee has not completely failed...Note

IF we go below 407.65, analysis will fail...Note

Wave 2 CANNOT go below the price area of Wave 1.Note

If Wave Theory is correct we should be ok...Note

Just double checked the Wave counts.Note

Fib Time 5 marks the end of a Wave Sequence (1-5 Waves + ABC Correction).Note

ZigZag (5-3-5) instead of Flat (3-3-5)Note

Analysis StandsNote

I think it is safe to say we are at the Apex.Note

Above: Log FormatNote

It should be getting close to time to tell whether this idea will be proven correct or fail.Note

BCH/BTC HAS BOTTOMED! Been over the analysis many times....we can only go higher...Note

Corrected the Wave Count...Wave 1 Extended

Wave 3 Normal

Wave 5 Normal

Expect higher degree Wave 1 To extend...

Note

Wave 3 of this Sequence will hit $440 if the theory stands...Note

BCH/BTC will sooner or later be like a rocket launchNote

Should be going higher in approx. 9 mins...Note

2.618 is a level that keeps appearing in my analysis...Likely level for Terminal Wave 3

Note

Pink Sequence - Hypothetical ActionNote

Do or die time!Note

Will this analysis fail or be right...Just tell me!

Note

Just to know that I'm not placing the Fib Spiral randomly. Above is the Wave count as I see it.Note

Wave 3 Terminal: $440-438Note

Higher Degree Wave 2 completely finished. Higher Degree Wave 3 is beginning...

Note

Higher Degree Target:$6500Note

Now the goal is to get rich along the way and trade the Sub-Waves to Higher Degree 3rd Terminal then Sell into the 4th Wave.Note

Heavy hitters on deckNote

Wait for it...Batters on deck...

Note

Heavy Hitters...The Rush...

Climax...

Everyone thought it was going lower...

Note

New idea coming soon...Note

Strong MACD crossoverNote

Breakout imminent...Note

Wall Street money incoming...Note

Wave 3 was Normal.Expect extended 5th.

Note

Wave Failed....Don't Panic...

Note

This will start a Wave SequenceNote

Upside Down ABC CorrectionNote

Only used 'ABC' because there is no other '123' SequenceCorrection: 3-3-5

Note

Ahh so close....Hurry up BCH!

Note

I spoke a little soon when I said BCH Cycle Wave 2 was completely finished...It's ALMOST!

Need this Last C Wave which will turn into a Wave Sequence.

Note

99.99% Positive my analysis is correct...Note

Damn, it feels good to be right...Note

New idea will be finished soon...1 hour or so...

Note

<deleted>Note

New Idea Above!Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.