Bft spac company and Paysafe Announce Merger

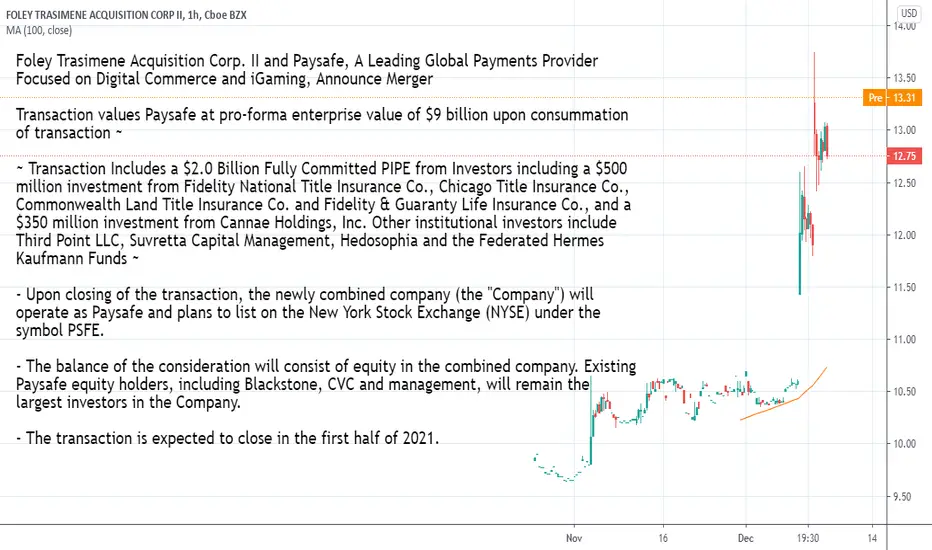

Foley Trasimene Acquisition Corp. II and Paysafe, A Leading Global Payments Provider Focused on Digital Commerce and iGaming, Announce Merger

Transaction values Paysafe at pro-forma enterprise value of $9 billion upon consummation of transaction ~

~ Transaction Includes a $2.0 Billion Fully Committed PIPE from Investors including a $500 million investment from Fidelity National Title Insurance Co., Chicago Title Insurance Co., Commonwealth Land Title Insurance Co. and Fidelity & Guaranty Life Insurance Co., and a $350 million investment from Cannae Holdings, Inc. Other institutional investors include Third Point LLC, Suvretta Capital Management, Hedosophia and the Federated Hermes Kaufmann Funds ~

- Upon closing of the transaction, the newly combined company (the "Company") will operate as Paysafe and plans to list on the New York Stock Exchange (NYSE) under the symbol PSFE.

- The balance of the consideration will consist of equity in the combined company. Existing Paysafe equity holders, including Blackstone, CVC and management, will remain the largest investors in the Company.

- The transaction is expected to close in the first half of 2021.

businesswire.com/news/home/20201207005389/en/Foley-Trasimene-Acquisition-Corp.-II-and-Paysafe-A-Leading-Global-Payments-Provider-Focused-on-Digital-Commerce-and-iGaming-Announce-Merger stock

Transaction values Paysafe at pro-forma enterprise value of $9 billion upon consummation of transaction ~

~ Transaction Includes a $2.0 Billion Fully Committed PIPE from Investors including a $500 million investment from Fidelity National Title Insurance Co., Chicago Title Insurance Co., Commonwealth Land Title Insurance Co. and Fidelity & Guaranty Life Insurance Co., and a $350 million investment from Cannae Holdings, Inc. Other institutional investors include Third Point LLC, Suvretta Capital Management, Hedosophia and the Federated Hermes Kaufmann Funds ~

- Upon closing of the transaction, the newly combined company (the "Company") will operate as Paysafe and plans to list on the New York Stock Exchange (NYSE) under the symbol PSFE.

- The balance of the consideration will consist of equity in the combined company. Existing Paysafe equity holders, including Blackstone, CVC and management, will remain the largest investors in the Company.

- The transaction is expected to close in the first half of 2021.

businesswire.com/news/home/20201207005389/en/Foley-Trasimene-Acquisition-Corp.-II-and-Paysafe-A-Leading-Global-Payments-Provider-Focused-on-Digital-Commerce-and-iGaming-Announce-Merger stock

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.