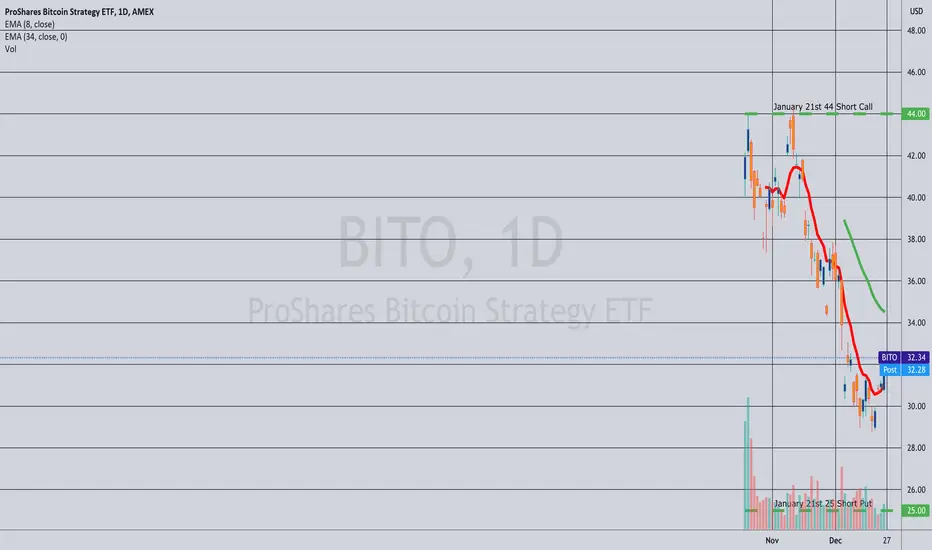

... for an .80 debit.

Comments: Filed this for a 1.60 credit (See Post Below; out here via good-until-cancelled order to take profit at 50% max. .80/$80 profit. 3.3% ROC as a function of buying power effect.

Although implied volatility has contracted a bit, will consider re-upping in the February cycle after New Year's, assuming the strikes above 40 get populated. Currently, the February 18th 40 short call is the highest available strike, with a delta of .29.

Comments: Filed this for a 1.60 credit (See Post Below; out here via good-until-cancelled order to take profit at 50% max. .80/$80 profit. 3.3% ROC as a function of buying power effect.

Although implied volatility has contracted a bit, will consider re-upping in the February cycle after New Year's, assuming the strikes above 40 get populated. Currently, the February 18th 40 short call is the highest available strike, with a delta of .29.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.