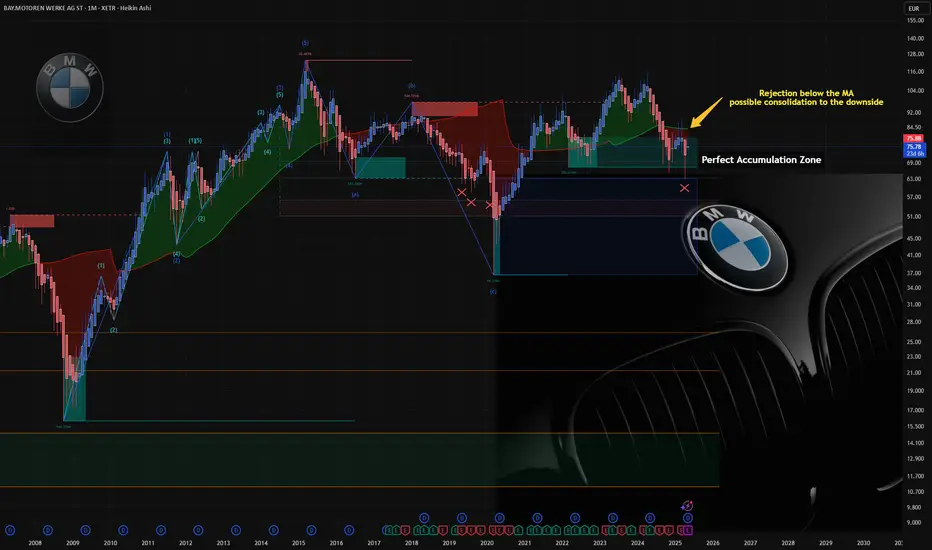

In times of market turbulence, great opportunities often lie hidden beneath temporary setbacks. Recent tariff-related ripples may have rattled BMW’s price, but for those looking to invest for the long haul, this dip is a golden opportunity to buy into one of the world’s most reliable automakers.

https://www.youtube.com/watch?v=bCkl9hIEb6k

Resilient Amid Tariff Turbulence

Global trade frictions and tariff uncertainties have impacted many companies, and BMW is no exception. Yet, unlike many peers that retreat during such times, BMW remains steadfast—confident in its strategy and outlook. With industry insiders predicting that these tariffs are only temporary, BMW’s fundamentals remain ironclad. Its robust global presence and proactive planning have positioned it to weather these short-term shocks and bounce back stronger.

A Diverse, Future-Ready Product Lineup

While some high-profile names in the auto space chase trends with empty promises, BMW consistently delivers. Rather than focusing solely on electric vehicles like Tesla, BMW offers a balanced portfolio:

- Low-Emission Fossil Fuel Cars: Advanced, efficient engines that still serve a significant market segment.

- Hybrid and Electric Vehicles: Designed for the evolving demand for cleaner mobility, these models blend performance with environmental responsibility.

- Pioneering Hydrogen Technology: In collaboration with strategic partners, BMW is blazing a trail in hydrogen-powered vehicles—a potential game changer that ensures adaptability as the energy landscape shifts.

This diverse lineup not only meets current market needs but also positions BMW at the forefront of future mobility, delivering real, tangible products that work.

World-Class Manufacturing and Advanced Robotics

BMW’s reputation for engineering excellence isn’t just about beautiful design—it’s rooted in its state-of-the-art manufacturing. The company has embraced advanced robotics and automation, ensuring precision, efficiency, and consistent quality. With production facilities spanning the globe—including significant plants in the United States—BMW solidifies its stature as a truly international enterprise.

A Stable, Dividend-Paying Investment

In a market that often rewards volatile “meme” stocks and empty promises, BMW stands apart as a beacon of stability. Unlike Tesla, which currently pays no dividends, BMW offers a juicy dividend yield of over 5%, providing investors with regular, attractive returns. This dividend, coupled with its solid operational fundamentals, makes BMW a safe bet—one that rewards shareholders consistently even during turbulent times.

The Time to Invest Is Now

BMW is more than just a carmaker—it’s a symbol of resilience, innovation, and pragmatic progress. While market chatter may cast doubt amid temporary tariff-induced lows, the company’s diversified product mix, global manufacturing footprint, and commitment to delivering real, advanced technology create a compelling investment thesis.

For investors seeking stability, reliability, and the promise of long-term growth, BMW offers an opportunity to ride out the storm and benefit from a future where the company’s innovations in hybrids, electrics, and hydrogen continue to shape mobility worldwide. Now is the time to look beyond short-term market jitters and invest in a legacy built on quality, performance, and consistent returns.

Embrace the opportunity—BMW’s bright future is not just a promise; it’s already in motion.

BMW

BMW  BMW

BMW  TSLA

TSLA  GM

GM  F

F

https://www.youtube.com/watch?v=bCkl9hIEb6k

Resilient Amid Tariff Turbulence

Global trade frictions and tariff uncertainties have impacted many companies, and BMW is no exception. Yet, unlike many peers that retreat during such times, BMW remains steadfast—confident in its strategy and outlook. With industry insiders predicting that these tariffs are only temporary, BMW’s fundamentals remain ironclad. Its robust global presence and proactive planning have positioned it to weather these short-term shocks and bounce back stronger.

A Diverse, Future-Ready Product Lineup

While some high-profile names in the auto space chase trends with empty promises, BMW consistently delivers. Rather than focusing solely on electric vehicles like Tesla, BMW offers a balanced portfolio:

- Low-Emission Fossil Fuel Cars: Advanced, efficient engines that still serve a significant market segment.

- Hybrid and Electric Vehicles: Designed for the evolving demand for cleaner mobility, these models blend performance with environmental responsibility.

- Pioneering Hydrogen Technology: In collaboration with strategic partners, BMW is blazing a trail in hydrogen-powered vehicles—a potential game changer that ensures adaptability as the energy landscape shifts.

This diverse lineup not only meets current market needs but also positions BMW at the forefront of future mobility, delivering real, tangible products that work.

World-Class Manufacturing and Advanced Robotics

BMW’s reputation for engineering excellence isn’t just about beautiful design—it’s rooted in its state-of-the-art manufacturing. The company has embraced advanced robotics and automation, ensuring precision, efficiency, and consistent quality. With production facilities spanning the globe—including significant plants in the United States—BMW solidifies its stature as a truly international enterprise.

A Stable, Dividend-Paying Investment

In a market that often rewards volatile “meme” stocks and empty promises, BMW stands apart as a beacon of stability. Unlike Tesla, which currently pays no dividends, BMW offers a juicy dividend yield of over 5%, providing investors with regular, attractive returns. This dividend, coupled with its solid operational fundamentals, makes BMW a safe bet—one that rewards shareholders consistently even during turbulent times.

The Time to Invest Is Now

BMW is more than just a carmaker—it’s a symbol of resilience, innovation, and pragmatic progress. While market chatter may cast doubt amid temporary tariff-induced lows, the company’s diversified product mix, global manufacturing footprint, and commitment to delivering real, advanced technology create a compelling investment thesis.

For investors seeking stability, reliability, and the promise of long-term growth, BMW offers an opportunity to ride out the storm and benefit from a future where the company’s innovations in hybrids, electrics, and hydrogen continue to shape mobility worldwide. Now is the time to look beyond short-term market jitters and invest in a legacy built on quality, performance, and consistent returns.

Embrace the opportunity—BMW’s bright future is not just a promise; it’s already in motion.

TLDR? Watch the Video

MSTR: youtu.be/h7aZwtoZ3AI?si=c2rh7mdNp_c1qpHh

Tesla BYD: youtu.be/AD45kA1TXwQ?si=jwoSqkLTRPdkFANZ

Platinum: youtu.be/IAiq3x1x72s?si=KbD0LDPDpX4KeLR2

Gold youtube.com/watch?v=sT2v2vyhy7Q&t=10s

MSTR: youtu.be/h7aZwtoZ3AI?si=c2rh7mdNp_c1qpHh

Tesla BYD: youtu.be/AD45kA1TXwQ?si=jwoSqkLTRPdkFANZ

Platinum: youtu.be/IAiq3x1x72s?si=KbD0LDPDpX4KeLR2

Gold youtube.com/watch?v=sT2v2vyhy7Q&t=10s

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

TLDR? Watch the Video

MSTR: youtu.be/h7aZwtoZ3AI?si=c2rh7mdNp_c1qpHh

Tesla BYD: youtu.be/AD45kA1TXwQ?si=jwoSqkLTRPdkFANZ

Platinum: youtu.be/IAiq3x1x72s?si=KbD0LDPDpX4KeLR2

Gold youtube.com/watch?v=sT2v2vyhy7Q&t=10s

MSTR: youtu.be/h7aZwtoZ3AI?si=c2rh7mdNp_c1qpHh

Tesla BYD: youtu.be/AD45kA1TXwQ?si=jwoSqkLTRPdkFANZ

Platinum: youtu.be/IAiq3x1x72s?si=KbD0LDPDpX4KeLR2

Gold youtube.com/watch?v=sT2v2vyhy7Q&t=10s

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.