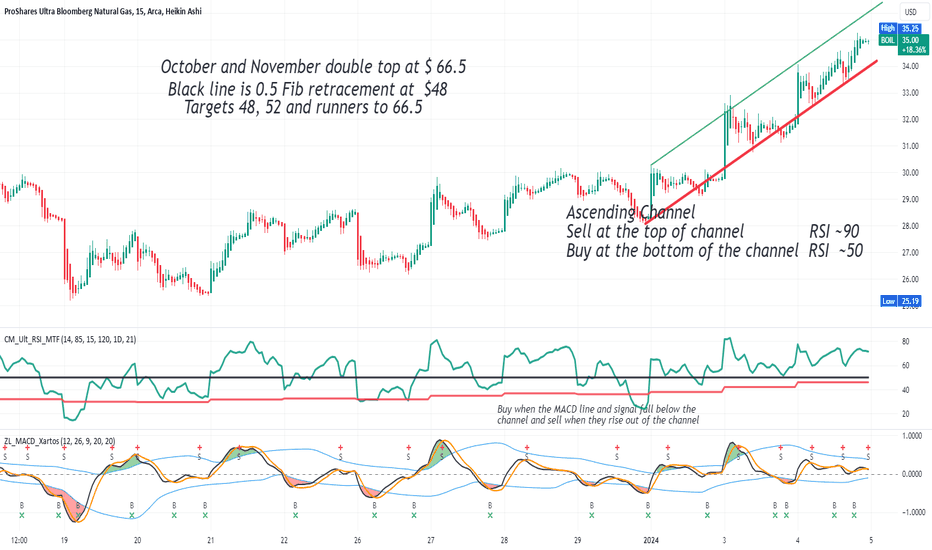

on the 4H chart is showing a round bottom reversal at the bottom of the high voume area

and rose over the POC line of the intermediate-term voume profile. Price now has room for

a 50% move to the top of the high volume area at $ 52. The chart shows the relative

volume indicator supports a long buy as does the dual time frame RSI.

A speculative call option trade would be $60 in 4 months while a safer call option

would be in the money @ $30 in 7-9 weeks. I am also looking at UNG, LNG and XNGUSD on

forex.

and rose over the POC line of the intermediate-term voume profile. Price now has room for

a 50% move to the top of the high volume area at $ 52. The chart shows the relative

volume indicator supports a long buy as does the dual time frame RSI.

A speculative call option trade would be $60 in 4 months while a safer call option

would be in the money @ $30 in 7-9 weeks. I am also looking at UNG, LNG and XNGUSD on

forex.

Trade active

Stock price did 10% in 3 hrs today 11A-2P EST- it was a nice scalp of both the optionsexpiring 1/12 and the stock.

Trade closed: target reached

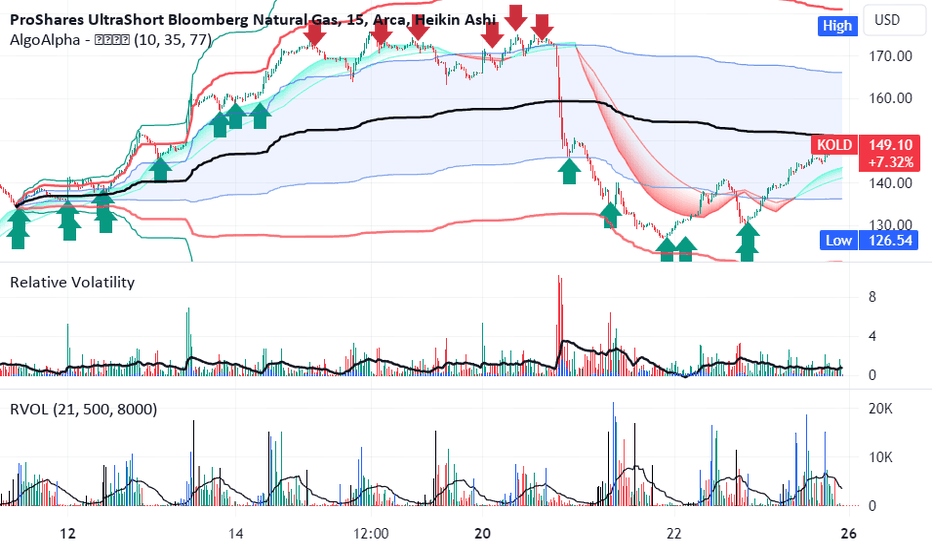

Natural gas prices falling again the correction is over. All long positions are closedand now short natural gas

naturalgasintel.com/as-storage-surplus-swells-natural-gas-futures-fall-and-spot-prices-sputter/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.