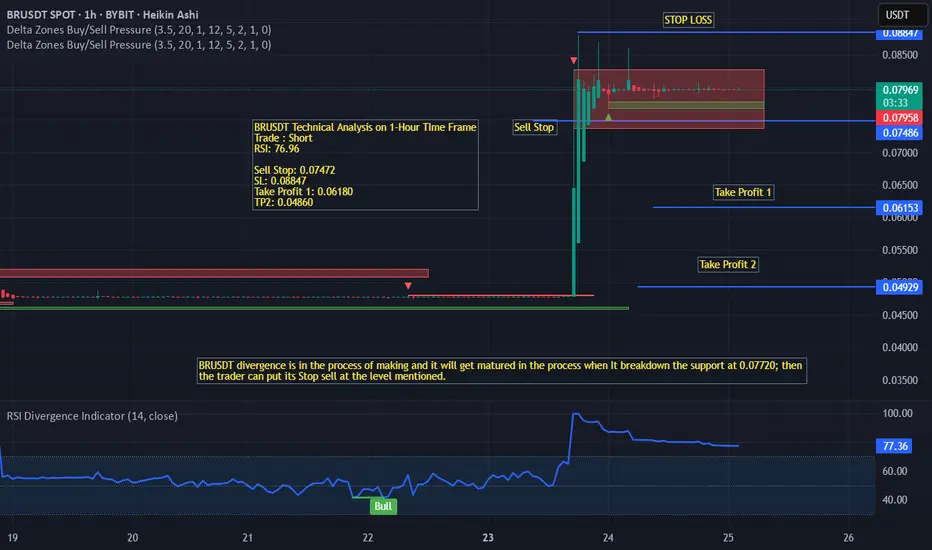

BRUSDT is currently forming a potential bearish divergence while trading in a tight consolidation range near resistance. The RSI is elevated at 76.96, indicating overbought conditions and signaling a potential reversal setup.

A short position is suggested with a Sell Stop order at 0.07472.

Stop Loss: 0.08847 (above resistance zone)

Take Profit 1 (TP1): 0.06180

Take Profit 2 (TP2): 0.04860

The red box indicates price compression after a strong upward spike, signaling potential exhaustion. Confirmation for the short setup is expected upon a breakdown of key support at 0.07720, which would mature the bearish divergence.

Momentum indicators are flattening, and the RSI has started showing signs of divergence despite price holding highs. If price breaks below the 0.07720 level, selling pressure may increase, validating the short trade idea.

Traders should monitor closely and wait for confirmation before execution.

A short position is suggested with a Sell Stop order at 0.07472.

Stop Loss: 0.08847 (above resistance zone)

Take Profit 1 (TP1): 0.06180

Take Profit 2 (TP2): 0.04860

The red box indicates price compression after a strong upward spike, signaling potential exhaustion. Confirmation for the short setup is expected upon a breakdown of key support at 0.07720, which would mature the bearish divergence.

Momentum indicators are flattening, and the RSI has started showing signs of divergence despite price holding highs. If price breaks below the 0.07720 level, selling pressure may increase, validating the short trade idea.

Traders should monitor closely and wait for confirmation before execution.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.