Long

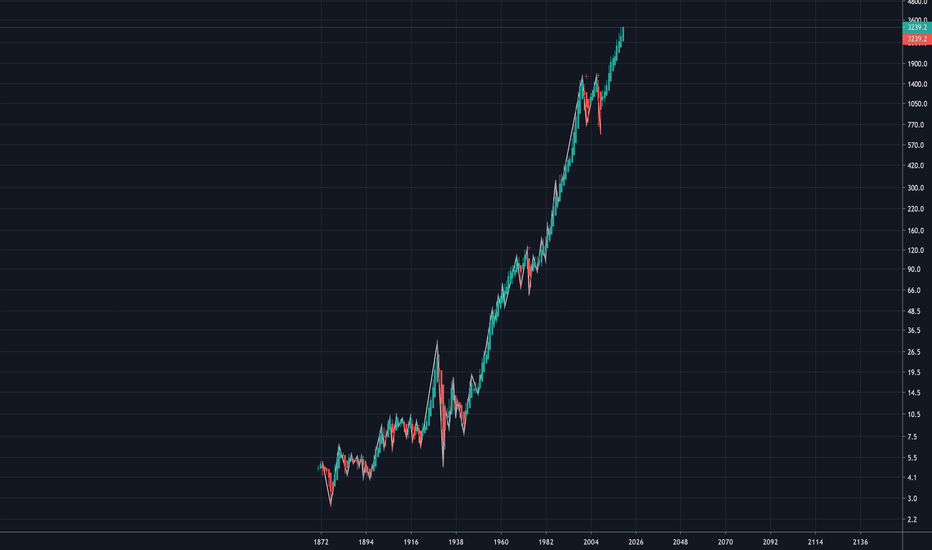

BSV - The Flippening - Part 3 - Strong Buy

$BITFINEX:BSVUSD remains a Strong Buy.

Analysis Method: Fibonacci & Wave Theory

Immideiate Target: $380-$470

Near-Term (30-60 days): $1,400

Please see previous $BITFINEX:BSVUSD analyses for further information

Long story short, COINBASE:BTCUSD was compromised by two competing factions of crypto engineers.

The factions working on the protocol BITSTAMP:BTCUSD couldn't come to an agreement on how to scale COINBASE:BTCUSD .

The disagreement led to COINBASE:BTCUSD being forked resulting in COINBASE:BCHUSD .

But, the factions continued to disagree which resulted in COINBASE:BCHUSD being forked. The fork created POLONIEX:BCHABCUSDT and BITFINEX:BSVUSD .

The disagreements put the 'Nakamoto Consensus' to the ultimate test.

Nakamoto consensus is a name for Bitcoin’s decentralized, pseudonymous consensus protocol. It is considered as Bitcoin’s core innovation and its key to success. The consensus protocol doesn’t require any trusted parties or pre-assumed identities among the participants.

Consensus can be reached by selecting the “longest” chain of valid blocks. In the Bitcoin whitepaper, and some other documentation, it is indicated that the honest chain grows the longest, assuming that 51% or less of the miners are malicious. Therefore, the longest chain can be considered to be the chain with the most invested Proof-of-Work:

In short, Miners use their hash to vote on the Blockchain.

Miners supporting POLONIEX:BCHABCUSDC will move their hash to mine its Blockchain.

Miners supporting BITFINEX:BSVUSD will move their hash to mine its Blockchain.

Before the Fork, BITFINEX:BSVUSD camp had over 70% of Miners hash. (Important)

Last week, Bitcoin Cash (BCH) personalities proposed a 12.5% tax on mining rewards that would ostensibly go to funding network development.

Cointelegraph reported last week on the proposed tax published by Btc.top CEO Jiang Zhuoer. The “infrastructure funding plan” would have miners send 12.5% of mining rewards to an entity in Hong Kong. The co-signing entities repped 27% of hashrates. Most controversially, the proposal included “orphaning” non-compliant miners — the practice of removing blocks from the chain that resembles a 51 percent attack.

Critics underscored the routing of funds to a CORPORATION instead of a nonprofit and the absenting of a voting procedure, which would mean COMPANY OWNERS would control BCH development. Other complaints included CHINESE government interference and profitability since the tax would affect miner revenues.

BCHABC's fate will be determined by Miners. When BCHABC's Hash is gone...Game Over.

Pick-up from previous analysis:

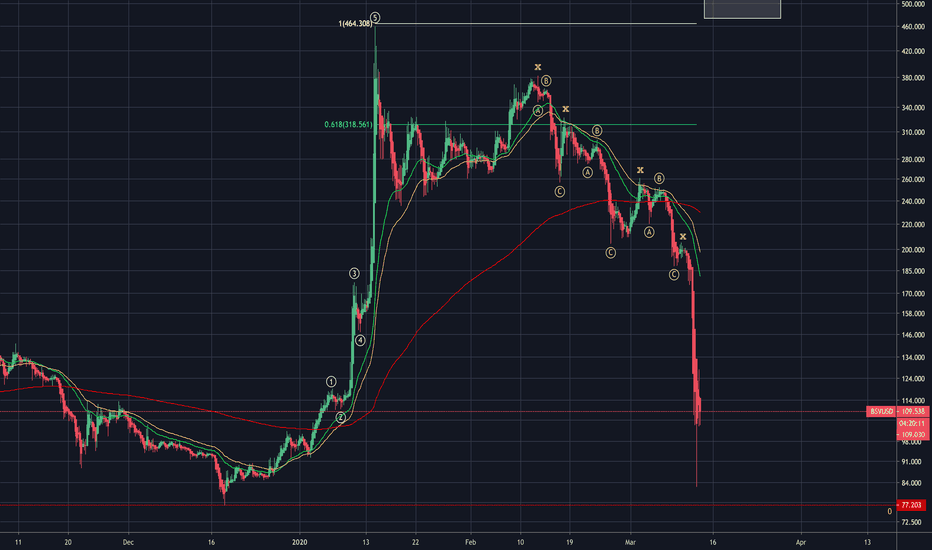

Daily Chart: High Wave 3 underway...

Hourly Chart: Completed Micro-wave 1 & 2

Micro-Wave 3 is underway...

Key Levels: $360 & $380

Will update.

FMW

Analysis Method: Fibonacci & Wave Theory

Immideiate Target: $380-$470

Near-Term (30-60 days): $1,400

Please see previous $BITFINEX:BSVUSD analyses for further information

Long story short, COINBASE:BTCUSD was compromised by two competing factions of crypto engineers.

The factions working on the protocol BITSTAMP:BTCUSD couldn't come to an agreement on how to scale COINBASE:BTCUSD .

The disagreement led to COINBASE:BTCUSD being forked resulting in COINBASE:BCHUSD .

But, the factions continued to disagree which resulted in COINBASE:BCHUSD being forked. The fork created POLONIEX:BCHABCUSDT and BITFINEX:BSVUSD .

The disagreements put the 'Nakamoto Consensus' to the ultimate test.

Nakamoto consensus is a name for Bitcoin’s decentralized, pseudonymous consensus protocol. It is considered as Bitcoin’s core innovation and its key to success. The consensus protocol doesn’t require any trusted parties or pre-assumed identities among the participants.

Consensus can be reached by selecting the “longest” chain of valid blocks. In the Bitcoin whitepaper, and some other documentation, it is indicated that the honest chain grows the longest, assuming that 51% or less of the miners are malicious. Therefore, the longest chain can be considered to be the chain with the most invested Proof-of-Work:

In short, Miners use their hash to vote on the Blockchain.

Miners supporting POLONIEX:BCHABCUSDC will move their hash to mine its Blockchain.

Miners supporting BITFINEX:BSVUSD will move their hash to mine its Blockchain.

Before the Fork, BITFINEX:BSVUSD camp had over 70% of Miners hash. (Important)

Last week, Bitcoin Cash (BCH) personalities proposed a 12.5% tax on mining rewards that would ostensibly go to funding network development.

Cointelegraph reported last week on the proposed tax published by Btc.top CEO Jiang Zhuoer. The “infrastructure funding plan” would have miners send 12.5% of mining rewards to an entity in Hong Kong. The co-signing entities repped 27% of hashrates. Most controversially, the proposal included “orphaning” non-compliant miners — the practice of removing blocks from the chain that resembles a 51 percent attack.

Critics underscored the routing of funds to a CORPORATION instead of a nonprofit and the absenting of a voting procedure, which would mean COMPANY OWNERS would control BCH development. Other complaints included CHINESE government interference and profitability since the tax would affect miner revenues.

BCHABC's fate will be determined by Miners. When BCHABC's Hash is gone...Game Over.

Pick-up from previous analysis:

Daily Chart: High Wave 3 underway...

Hourly Chart: Completed Micro-wave 1 & 2

Micro-Wave 3 is underway...

Key Levels: $360 & $380

Will update.

FMW

Note

Broke $360...Note

Next is $380...Note

After $380...Target Area - $429-$493

Note

This correction sequence should be completed quickly...Note

Timeframe: <5 DaysNote

Looking to break $380...Note

Correction is over...Should be moving towards the targets...

Note

When $380 breaks...price-action will test $360...then go higher towards $470Note

When $470 breaks look to $620Note

Wave 1:low. If you can count a minor 1-2-3-4-5, you have probably seen the completion of a tiny wave 1 in a new cycle. So now you will get ready to buy on the dip.In my experience, wave 1 is rarely a clean formation. The markets tend to build a base after a steep increase/decline, and very often we will get repeated tests of new resistance levels.

Occasionally, the move will resemble a wedge, which is known by a special name: diagonal triangle.

Some traders will use oscillators and divergence studies to gain in confidence. What I do is keep Elliott Wave Principle/Fibonacci Analysis as your main tool, and use other TA tools to support your main view.

Note

We broke through Fib Channel .786 and are testing the $360 level for support.Still need to break $380...this should be imminent.

Estimated Timeframe for the 1st Target Area is 2 days 12 hours...

Note

We have completed Sub-Micro Waves 1,2,3,4...Sub-Micro Wave 5 should begin momentarily...

Waves 1 + 3 trended near equality...

Wave Rule - 1/3 Waves will extend

Looking for Sub-Micro Wave 5 to extend and break $380!

Note

Fib Channel .786 is now support. Note: Minuscule Wave 5 Extended

Note

Time to break $380...Note

Sub-Waves 1 & 3 trended toward equality (+6.98%)Note

S-Wave 5 should be greater than 6.98%Note

Immediate Target Hit.Note

High was $382.xx. After hitting the immediate target, the price-action broke down...

Note

Above: Daily Chart Update.Note

If you implemented Wave Sequence STOPs you made out quite well with this pullback.Note

Will provide further analysis shortly.Note

Above: 5 Min Chart - RecoveryNote

We have had a Reflex with a 5 Wave Sequence3rd Wave Extended

Note

Sub-Micro Sequence Wave 1 & Wave 2 were 'normal'Note

We broke $380 but not strong enough to keep the rally going without a correction sequence. Near-Term Target is still in place.

Note

I hit a STOP at $346.00Note

Looking for a breakout in less than 5 days...Note

$355-$398...Looking for an extended 3rd Wave since the lower degree was extended.

Note

We should be moving towards Sub-Wave 3 Target Area very soon.Note

Looking for $398 to be taken out in this next wave...Note

Estimate for S-Wave 3 to begin moving higher: <6 hours

Target Area: $355-$398

Note

6 Hour timeframe got extended due to a complex correction...Note

Target Area: $346-$389Note

We should be getting extremely close to a new wave sequence higher!Note

Corrections should be over.Note

3 Corrections...Note

Breakout is imminent...Note

Almost Game Over...Things are speeding up...

Note

Interest Rates are collapsing...Note

Powerful people do not want Crypto to take off...When it does, there will be no stopping it.

Note

We did form a Mini Wave Sequence...But, it failed.

Note

My guess is a hash dump...Note

Both STOPs were triggered...SOFT = 50% Position

HARD = 100% Position

Note

Anyone ask why the hype about the COVID-19?Note

Wall to Wall new coverage? Quarantine? Pandemic?Compare and contrast Influenza Vs. COVID 19...

Note

So far, the new coronavirus, dubbed COVID-19, has led to more than 75,000 illnesses and 2,000 deaths, primarily in mainland China. But that's nothing compared with the flu, also called influenza. In the U.S. alone, the flu has already caused an estimated 26 million illnesses, 250,000 hospitalizations and 14,000 deaths this season, according to the Centers for Disease Control and Prevention (CDC).Note

The Fed is in one hell of a situation...Note

755 Days = 18.15%Note

547 Days = 6.32% (Without REPO)Note

197 Days - Billions of Liquidity Daily = 20.07% (W/ REPO)Note

Research firm Reorg reported that 2019 was the busiest year for chapter 11 filings since it started tracking them in 2015. For chapter 11 cases filed by companies with more than $100 million in liabilities, the filing frequency increased 24% from 2018. One hundred fourteen companies with liabilities exceeding $100 million filed for chapter 11 protection in 2019, compared to 87 in 2018. The most cases were filed in the energy sector, followed by the consumer discretionary and health care sectors.Note

The report from the 36-member Organisation for Economic Co-operation and Development (OECD) highlighted that compared to previous credit cycles, today’s trove of outstanding corporate bonds is of lower overall credit quality.This may render the non-financial corporate sector and broader economy more vulnerable to the negative effects of an economic downturn.

Note

The volume of corporate debt hit an all-time high of $13.5 trillion at the end of 2019, but the overall quality of bonds fell below levels seen before the global financial crisis, according to a new OECD report.Note

Corporate Debt and Record CEO Resignations...hand in hand?Note

IPSASB consults on revenue and transfer expenses standardsThe International Public Sector Accounting Standards Board (IPSASB) is consulting on three inter-connected exposure drafts which are intended to pioneer new approaches to accounting for some of the most significant transactions of public sector entities

Defining Your Role in Implementing New Revenue Recognition

It's 2020, time for FASB’s Accounting Standards Codification 606 to kick in. Is your firm ready to handle it?

Note

In this publication, we’ve summarized the new accounting standards with mandatory[1] effective dates in the first quarter of 2020 for public entities, as well as new standards that take effect in annual 2019 financial statements for nonpublic entities. Those effective dates reflect the FASB’s recent decision to defer certain major standards. We have also included links to BDO’s guidance on each pronouncement.Note

Boeing's CEO is out. Here are the 37 most dramatic exits in a record-breaking year for CEO departures.During the first three quarters of 2019, 1,160 CEOs left their positions, according to the staffing firm Challenger, Gray, & Christmas.

This figure exceeds the number of CEOs who departed during the same nine-month span at the height of the 2008 recession (which saw 1,132 CEO departures).

The tech sector has seen the second-highest number of CEO departures, with 154 executives in that industry leaving their positions.

In the first week of December, four CEOs announced their resignations: Susan Desmond-Hellmann at the Bill & Melinda Gates Foundation, Oscar Munoz at United Airlines, Larry Page at Alphabet, and Mark Okerstrom at Expedia.

The latest departure is Boeing CEO Dennis Muilenburg, who resigns amid fallout from two plane crashes that occurred under his tenure.

Salesforce co-CEO Keith Block steps down

Disney's Bob Iger Is Out In Big CEO Shakeup

Note

businessinsider.com/biggest-ceo-departures-wework-juul-ebay-warner-bros-metlife-2019-10Over 1,160 CEOs out...WHY?

Note

Think GE...Notorious for nailing Earnings exactly for years, now to find out it is struggling to survive...

Note

We have bottomed here.Note

No real resistance till $380.Note

Above 5 Second Wave CountNote

5 Second Wave Count & Corrections...New Wave should begin now...

Note

Want to see Crypto start to rally...Note

If you want you could put a stop under $204...Note

I still believe we have bottomed here...Correction was weak...

Note

NEWS TODAY: FED MUST CUT TO STOP PANDEMIC?!INSANITY

Note

Worst Drop in HISTORY because a Flu like virus has infected .0001% of the population.Note

Ebola? Market Drop?SARS? Market Drop?

Note

The Central Banks...OUT OF AMMO.

In my opinion...

Note

Interest Rate Check:snipboard.io/o3Bra0.jpgNote

Above: Daily Chart UpdateNote

This is a crossroad in history...Note

Centralized Authority that controls Monetary Policy is on its last breath...Note

We are witnessing the collapse of the Federal Reserve.The 'Business News' is almost laughable...

If anyone can tell me how a rate cut can stop a 'Pandemic' I would love to hear it...

Note

Reminder: No significant resistance until $380...Note

BSV is breaking out...Micro-Wave Leading Diagonal formed...

Still anticipating a 'spike'...

Note

If Cryptocurrency breaks out it kills the 'virus' story...Note

Correction sequence almost complete...Note

I don't like this price-action...Seems like it is being forced down...

Note

We have very strong support here...Note

Immediate Target: $272-$304Timeframe: <5 Days

Note

BSV The Flippening Part 4 - Coming SoonNote

Federal Reserve Note - On life support...About to have a cardiac arrest...

Note

The Cryptocurrency Protocol that scales with low transaction fees will dominate the New Monetary Order...The world will be multi-protocol...

Note

X = Complex SequenceWe had another ABC Correction (ZigZag)

The Correction looks to be over.

Note

5 Min Chart (Micro/Sub Wave Sequence)Note

In approximately 1 Day and 21 Hours we should hit the immediate target price area which is between $270-$300...Note

Anticipating a major breakout in less than 5 days...Note

Global Markets are entering unprecedented territory...Note

Price is being squeezed...Note

Above: 5 Second Wave CountNote

Minuscule correction is ending...Note

Just wait till Central Banks start buying...They will be forced too...

Note

About $11 trillion of corporate, sovereign, and securitized bonds in 24 currency markets trades at negative yields, comprising about 20 percent of the value in these markets.Note

Global Deposit Rates:snipboard.io/WBp6lj.jpg

Note

Fib Time Marker: 8 MAR 20 15:47 hit...Note

Micro-Wave Failed...Sold off in 3 Waves (Weak)

Price is being squeezed...

Optics of Market Crash and Crypto Market Boom (Not Ideal)

Sellers will have to cover very soon...

Note

Immediate Target of $270-$300 remains...Timeframe remains...

Note

SP500 V. TOTAL (Crypto Market) V. BSVNote

We are watching the Old (rigged) Monetary System fail.Note

Wait for it...Note

Watch the Narrative shift when the Crypto Markets move higher and the Stock Market moves lower...Very few people understand what is occurring...

Note

Squeeze should be coming off...Note

Almost 26 days of being squeezed lower...Note

It will be like a rubber band when it comes off...Note

Just as one could get a complex correction in the form of a double zigzag, one could also get a complex combination of two flats! Not surprisingly Elliott called it a double flat! (If you get a combination of three flats, it will be called a triple flat) Just like a normal flat will have as its internal waves a 3-3-5 pattern, so also each of the two flats that combine using an X wave in between will also have a 3-3-5 pattern.Note

There are four main categories of corrective waves: Zigzags, Flats, Triangles and Combinations.Note

An important clue is when an complex correction appears either after wave 1 or wave 3, (i.e. if either wave 2 or wave 4 is an irregular correction) then the next impulse wave will be very strong. For example, if wave 1 and 3 were normal waves, and wave 4 was an irregular correction, you can almost be certain that wave 5 will be an extended.Note

Note Extended S-Wave 3...Note

Price-Action Broke...Selling into support...

Note

ZigZag Correction...5-3-5

Note

March 7 - I said I expect a Strong Breakout in Less than 5 days...March 12th is the 5 day mark...

Note

Smart Money IndexSmart money index (SMI) or smart money flow index is a technical analysis indicator demonstrating investors' sentiment. The index was invented and popularized by money manager Don Hays.[1] The indicator is based on intra-day price patterns.[2]

The main idea is that the majority of traders (emotional, news-driven) overreact at the beginning of the trading day because of the overnight news and economic data. There is also a lot of buying on market orders and short covering at the opening. Smart, experienced investors start trading closer to the end of the day having the opportunity to evaluate market performance.[citation needed] Therefore, the basic strategy is to bet against the morning price trend and bet with the evening price trend. The SMI may be calculated for many markets and market indices (S&P 500, Dow Jones, etc.)

Interpretation:

The SMI sends no clear signal whether the market is bullish or bearish. There are also no fixed absolute or relative readings signaling about the trend. Traders need to look at the SMI dynamics relative to that of the market. If, for example, SMI rises sharply when the market falls, this fact would mean that smart money is buying, and the market is to revert to an uptrend soon. The opposite situation is also true. A rapidly falling SMI during a bullish market means that smart money is selling and that market is to revert to a downtrend soon. The SMI is, therefore, a trend-based indicator.

Note

HODL...Great buying opportunity...

The Thesis: Monetary System (Credit System) will fail and Crypto will become the new credit system...

Reminder: Crypto has a set supply...

Note

This is pure panic, irrational selling...Crypto is a Complete 180 degrees from the current credit system...

Crypto will not fail...

Note

I mine BSV...My earnings tripled during this downturn which leads me to believe someone, most likely China dumped a large amount of hash. It seems like there is an all out effort to suppress the crypto market.

coin.dance/blocks/hashrate

Economics should kick-in which would lead to a very sharp recovery...

coin.dance/

Note

BTC hash rate went from 158,000 PH to 95,000 PH...Note

That is a hell of a lot of hash...Note

Above: ProfitabilityNote

Block Size: snipboard.io/g9rDLK.jpgNote

Link: BSV - The Flippening - Part 4 - Strong BuyRelated publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.