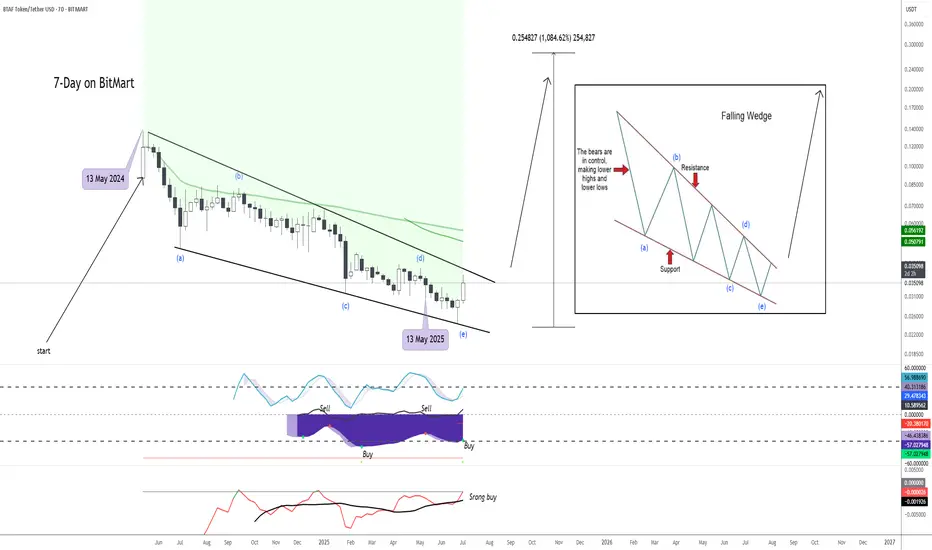

The BTAF Token is showing a notable technical shift after a prolonged downtrend. Over the past 7 months, we’ve observed a classic “falling knife” pattern, which has now decisively broken upward with a sharp rebound of over 50% in price.

This breakout is occurring off key oversold zones, suggesting a potential trend reversal, and an intense accumulation phase is underway.

Key Observations:

📉 Prior 7 months: Steep sell-off consistent with capitulation, forming a low-volume exhaustion pattern.

📈 Last 7 Days: Clean breakout above local resistance levels, driven by increasing volume and buyer dominance.

🧠 Market Sentiment: Beginning to shift from fear to interest, particularly among early adopters and altcoin rotation traders.

🔄 Structure: The chart now reflects early signs of a bullish reversal wave, consistent with Elliott Wave Cycle 1 behavior.

Forward Outlook:

Based on current momentum, algorithmic signals, and anticipated roadmap announcements for the BTAF ecosystem, we forecast a potential 1400% upside over the next 5 months, assuming favorable market continuation.

📌 Reminder: This is not financial advice but a technical outlook based on the current market structure.

This breakout is occurring off key oversold zones, suggesting a potential trend reversal, and an intense accumulation phase is underway.

Key Observations:

📉 Prior 7 months: Steep sell-off consistent with capitulation, forming a low-volume exhaustion pattern.

📈 Last 7 Days: Clean breakout above local resistance levels, driven by increasing volume and buyer dominance.

🧠 Market Sentiment: Beginning to shift from fear to interest, particularly among early adopters and altcoin rotation traders.

🔄 Structure: The chart now reflects early signs of a bullish reversal wave, consistent with Elliott Wave Cycle 1 behavior.

Forward Outlook:

Based on current momentum, algorithmic signals, and anticipated roadmap announcements for the BTAF ecosystem, we forecast a potential 1400% upside over the next 5 months, assuming favorable market continuation.

📌 Reminder: This is not financial advice but a technical outlook based on the current market structure.

Marius Landman

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Marius Landman

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.