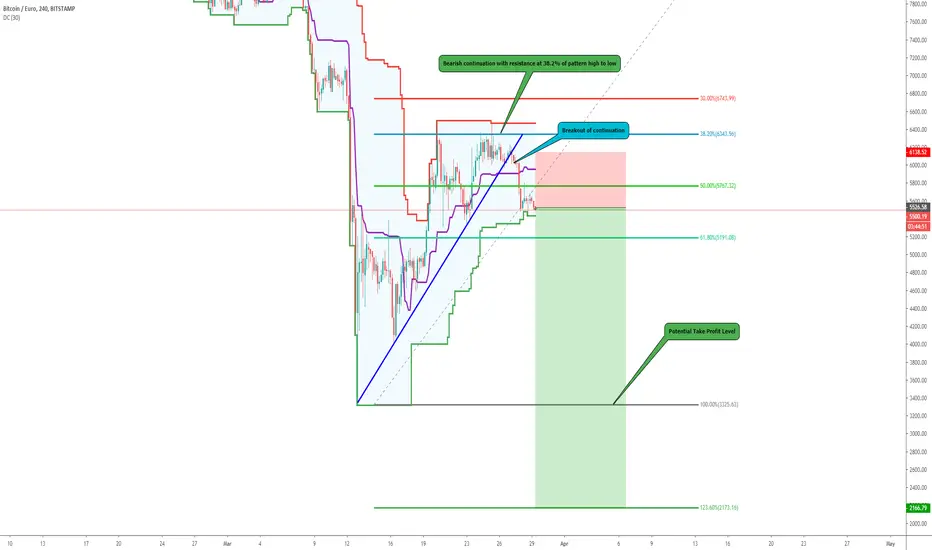

Im taking a short-sell position on BTCEUR as I explained in yesterdays educational post (I believe Crypto is due for more losses based on my technical analysis)

What we have here is a wedge (or contraction in my books) leading to the 38.2% of the recent high to low of the swing of price.

Im targetting 123.6% of that move but will be happy to get out even at 100%... since I am a proactive trader I will monitor price action for any signs of an upmove reversal to collect profits and then if the bearish signs remain I will sell again.

What we have here is a wedge (or contraction in my books) leading to the 38.2% of the recent high to low of the swing of price.

Im targetting 123.6% of that move but will be happy to get out even at 100%... since I am a proactive trader I will monitor price action for any signs of an upmove reversal to collect profits and then if the bearish signs remain I will sell again.

Note

Now by using Multiple Timeframe Analysis I see the following right now: 4H: Bearish continuation breakout with strong bearish momentum (as price is below EMA & DC)

1H: Strong bearish momentum with price using 5EMA as resistance, expecting a push down based on this soon

10M: Nothing special in terms of price action, but we are coming up to potential supports.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.