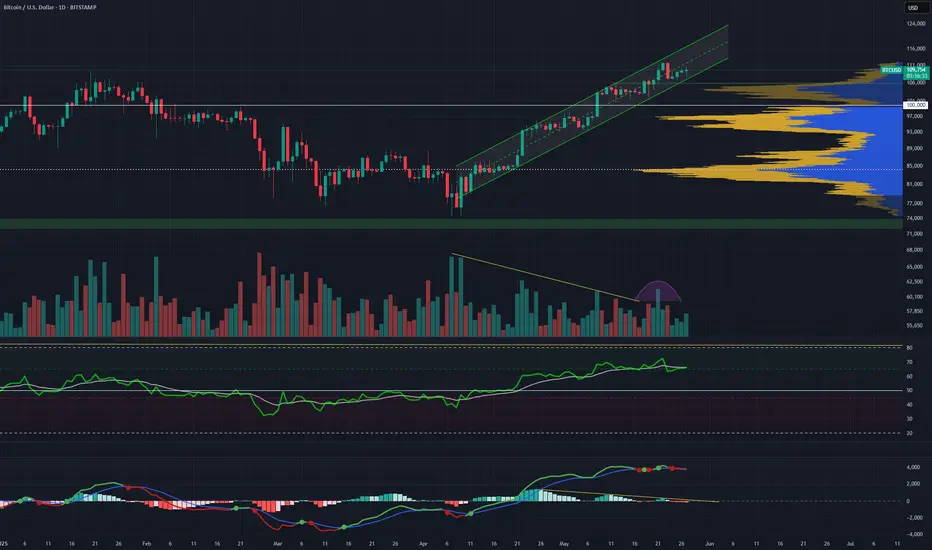

Bitcoin has been in ana scending channel for a while but ever since the new all time high, some things make me doubt we see a continuation of the bull trend in the near term.

-Volume has been declining the entire length of the channel

-We saw a bump in volume but the effort didn't match. A lower volume red candle had the same impact on price.

-The new all time high resulted in a third touch of bearish divergence on the MACD. Also the MA's are showing bearishness.

-The RSI fell below the EMA and is now looking like it's resisting breaking through.

We are clearly in a supply zone and all signs point to absorption and distribution taking place.

104k is the next level that will offer any significant support.

-Volume has been declining the entire length of the channel

-We saw a bump in volume but the effort didn't match. A lower volume red candle had the same impact on price.

-The new all time high resulted in a third touch of bearish divergence on the MACD. Also the MA's are showing bearishness.

-The RSI fell below the EMA and is now looking like it's resisting breaking through.

We are clearly in a supply zone and all signs point to absorption and distribution taking place.

104k is the next level that will offer any significant support.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.