Morning guys,

On the background of recent news from the Fed where they promised unlimited liquidity injections - intraday chart shape has changed slightly. Although we do not see any reasons yet to review long-term scenario, as we still think that action to 3.3 level is still possible, we need to adjust short-term shape.

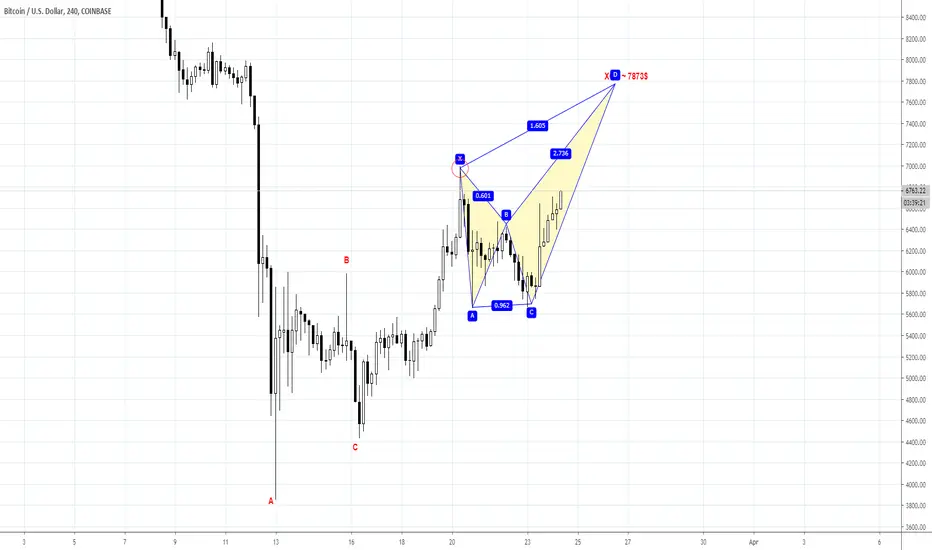

On a background of Fed news, chances on 2-leg upside retracement increases. It means that downside action could start not from here, but from next, 8.0K resistance level. Thus, we cancel right now our 5-5.2$ pattern that we've discussed yesterday and consider upside AB-CD 1.618 target around 7873 + butterfly 1.618 target that stands in the same area. Both targets agrees with daily resistance.

For the bears nothing has changed - they still need to consider 8.0K level for short entry, but the chance to reach this level now is better.

For the bulls it is difficult situation, because they have to decide where to place stop order. Risk/reward will be slightly better than 1:1, wherever you place it. Thus, despite expectation of upside action -it is not simple to find good point where to enter the market.

Finally, keep an eye on 7K level. Our drawing here looks cool - butterfly and other stuff, but price has to break 7K to make it real. Otherwise, it could be "222" Sell instead and price could start dropping again.

On the background of recent news from the Fed where they promised unlimited liquidity injections - intraday chart shape has changed slightly. Although we do not see any reasons yet to review long-term scenario, as we still think that action to 3.3 level is still possible, we need to adjust short-term shape.

On a background of Fed news, chances on 2-leg upside retracement increases. It means that downside action could start not from here, but from next, 8.0K resistance level. Thus, we cancel right now our 5-5.2$ pattern that we've discussed yesterday and consider upside AB-CD 1.618 target around 7873 + butterfly 1.618 target that stands in the same area. Both targets agrees with daily resistance.

For the bears nothing has changed - they still need to consider 8.0K level for short entry, but the chance to reach this level now is better.

For the bulls it is difficult situation, because they have to decide where to place stop order. Risk/reward will be slightly better than 1:1, wherever you place it. Thus, despite expectation of upside action -it is not simple to find good point where to enter the market.

Finally, keep an eye on 7K level. Our drawing here looks cool - butterfly and other stuff, but price has to break 7K to make it real. Otherwise, it could be "222" Sell instead and price could start dropping again.

ForexPeaceArmy BTC analytics :

forexpeacearmy.com/r/author/11/sive-morten-blog

FX, GOLD:

forexpeacearmy.com/community/forums/sive-morten-currencies-and-gold-video-analysis.122/

forexpeacearmy.com/r/author/11/sive-morten-blog

FX, GOLD:

forexpeacearmy.com/community/forums/sive-morten-currencies-and-gold-video-analysis.122/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

ForexPeaceArmy BTC analytics :

forexpeacearmy.com/r/author/11/sive-morten-blog

FX, GOLD:

forexpeacearmy.com/community/forums/sive-morten-currencies-and-gold-video-analysis.122/

forexpeacearmy.com/r/author/11/sive-morten-blog

FX, GOLD:

forexpeacearmy.com/community/forums/sive-morten-currencies-and-gold-video-analysis.122/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.