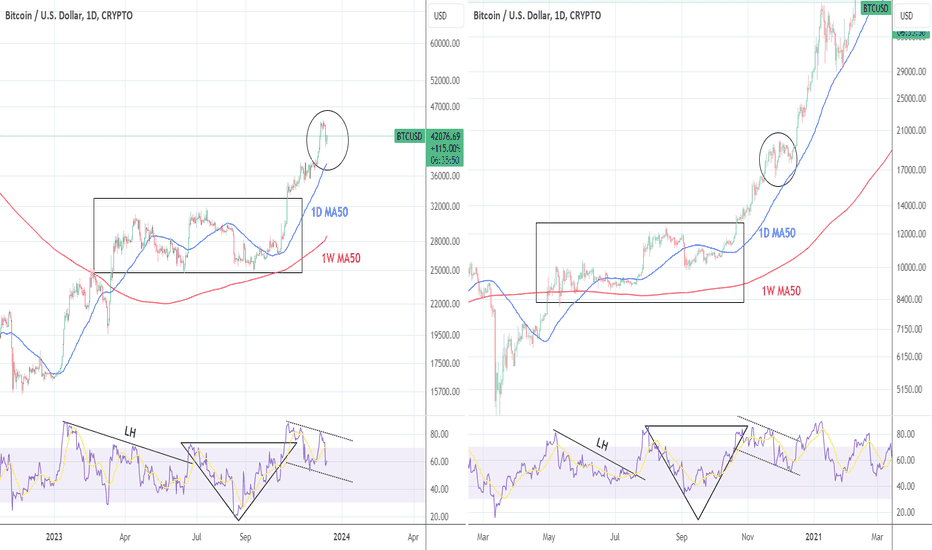

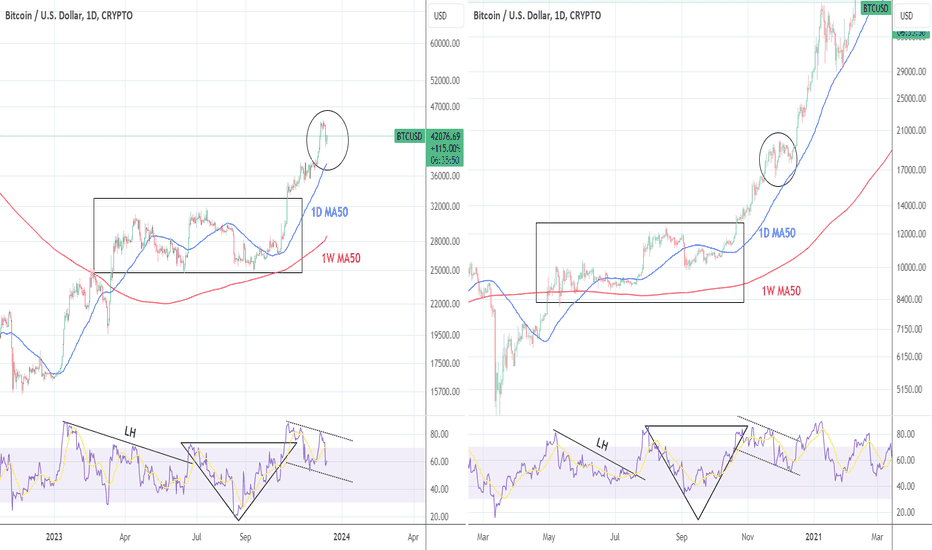

Bitcoin is attempting a key Breakout for the current Cycle while only being moderately bullish on the 1D technical outlook (RSI = 61.310, MACD = 1196.900, ADX = 34.398), which suggests that there is high potential to rise more before a correction. The key breakout is the Pre-rally Breakout that the coin has done in the previous Cycle over the R1 level (counting from the first Lower High of the Bear Cycle) while it was trading between the 0.236-0.382 Fibonacci range of the Channel Up pattern that started in July 2017.

The Cycle's first key breakout has been the Bottom Breakout when the price crossed over the LH trendline of the Bear Cycle after pricing the bottom followed shortly by a break over the 1W MA50. The rally that followed the R1 Breakout in 2020 has been the most aggressive part of the Cycle. A repeat of that sets a target as high as 200k. As unrealistic as it seemed before, the approval of various Bitcoin ETFs yesterday opens certainly opens the way for trillion dollar capital inflows to the market.

See how our prior idea has worked:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

The Cycle's first key breakout has been the Bottom Breakout when the price crossed over the LH trendline of the Bear Cycle after pricing the bottom followed shortly by a break over the 1W MA50. The rally that followed the R1 Breakout in 2020 has been the most aggressive part of the Cycle. A repeat of that sets a target as high as 200k. As unrealistic as it seemed before, the approval of various Bitcoin ETFs yesterday opens certainly opens the way for trillion dollar capital inflows to the market.

See how our prior idea has worked:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Telegram: t.me/investingscope

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Telegram: t.me/investingscope

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.