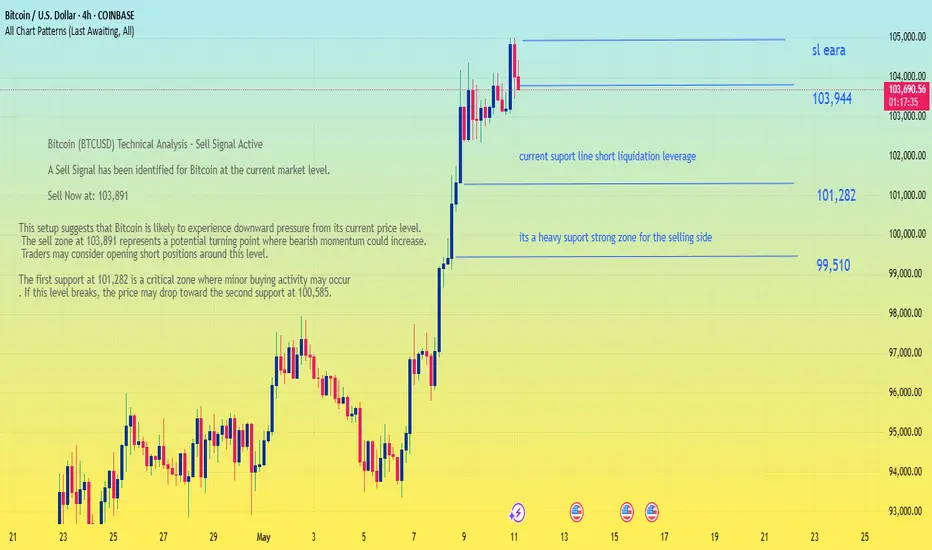

Bitcoin (BTCUSD) Technical Analysis – Sell Signal Active

A Sell Signal has been identified for Bitcoin at the current market level.

Sell Now at: 103,891

Key Support Levels:

First Support: 101,282

Second Support: 100,585

Strong Support: 99,510

This setup suggests that Bitcoin is likely to experience downward pressure from its current price level. The sell zone at 103,891 represents a potential turning point where bearish momentum could increase. Traders may consider opening short positions around this level.

The first support at 101,282 is a critical zone where minor buying activity may occur. If this level breaks, the price may drop toward the second support at 100,585. A further decline below this level could test the strong support at 99,510, which historically has held as a major demand zone.

These levels should be monitored closely, as price reactions around them may provide additional trading opportunities. It is advisable to use risk management tools such as stop-loss orders to protect against unexpected market movements.

Traders should remain updated on macroeconomic news, crypto regulations, and market sentiment, all of which can influence Bitcoin's price trajectory. Additionally, analyzing volume trends and candlestick patterns may enhance the effectiveness of this technical setup.

Always trade with a clear plan, and avoid overleveraging in volatile markets like cryptocurrency.

A Sell Signal has been identified for Bitcoin at the current market level.

Sell Now at: 103,891

Key Support Levels:

First Support: 101,282

Second Support: 100,585

Strong Support: 99,510

This setup suggests that Bitcoin is likely to experience downward pressure from its current price level. The sell zone at 103,891 represents a potential turning point where bearish momentum could increase. Traders may consider opening short positions around this level.

The first support at 101,282 is a critical zone where minor buying activity may occur. If this level breaks, the price may drop toward the second support at 100,585. A further decline below this level could test the strong support at 99,510, which historically has held as a major demand zone.

These levels should be monitored closely, as price reactions around them may provide additional trading opportunities. It is advisable to use risk management tools such as stop-loss orders to protect against unexpected market movements.

Traders should remain updated on macroeconomic news, crypto regulations, and market sentiment, all of which can influence Bitcoin's price trajectory. Additionally, analyzing volume trends and candlestick patterns may enhance the effectiveness of this technical setup.

Always trade with a clear plan, and avoid overleveraging in volatile markets like cryptocurrency.

Trade active

perfectly hiited cheake itBest Analysis xauusd single

t.me/+uAIef7IqwSs4M2Q0

VIP PREMIMUM ANALYSIS ROOM SIGNALS

t.me/+uAIef7IqwSs4M2Q0

t.me/+uAIef7IqwSs4M2Q0

VIP PREMIMUM ANALYSIS ROOM SIGNALS

t.me/+uAIef7IqwSs4M2Q0

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Best Analysis xauusd single

t.me/+uAIef7IqwSs4M2Q0

VIP PREMIMUM ANALYSIS ROOM SIGNALS

t.me/+uAIef7IqwSs4M2Q0

t.me/+uAIef7IqwSs4M2Q0

VIP PREMIMUM ANALYSIS ROOM SIGNALS

t.me/+uAIef7IqwSs4M2Q0

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.