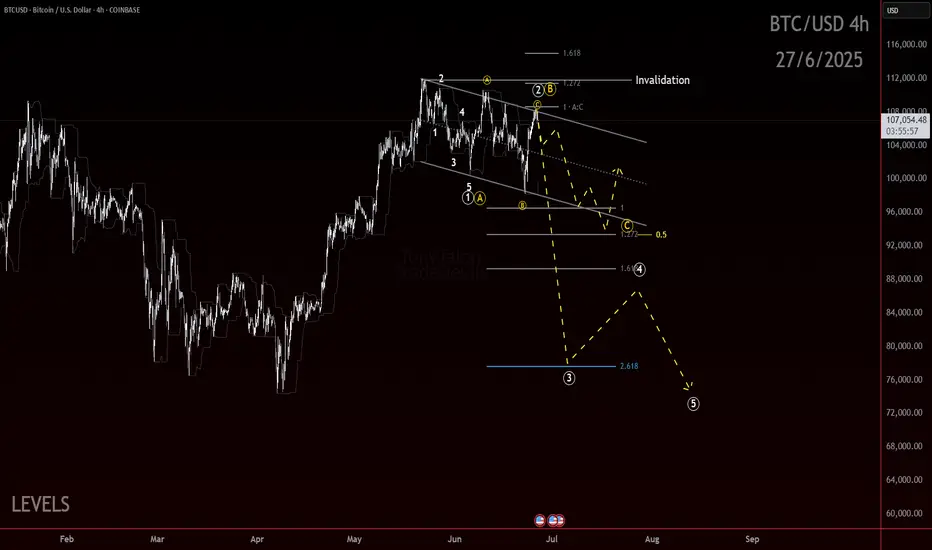

Price has been carving out an unclear correction off the high. The recent structure has many squinting. Is it done or the calm before another wave of selling?

I am weighing two bearish scenarios here. One is more aggressive than the other. But both start with the same idea. No new high before another low.

Let’s start at the top.

The initial move down off the recent high could count as an impulse. Whether that is a wave 1 or a wave A is still up for judgment. Either way, that first leg sets a bearish tone at the larger degree.

Here’s where it gets interesting. The correction since then shows traits of a flat. A running one at the moment.

This opens the door to two active bearish projections:

A wave C collapse, implying a completed A B C correction and a downside resolution.

A wave 3 drop, for a possible top if this is an impulsive sequence.

That is the fork in the road. And it all hinges on the next move.

Right now, the smallest degree impulse off the low is doing some heavy lifting.

If that pivot holds and we only get an internal retracement like a micro wave 2, the door is still open for upside continuation.

But if that impulse gets invalidated, I would expect bears to press. First for a break below 100k, then toward the 95k area.

Here is how to think about it:

Hold the small impulse → Potential upside

Break the impulse base → Wave C or 3 likely underway

Context still leans bearish. Lower highs are still in play. But we are hunting a specific structure to confirm it.

I am weighing two bearish scenarios here. One is more aggressive than the other. But both start with the same idea. No new high before another low.

Let’s start at the top.

The initial move down off the recent high could count as an impulse. Whether that is a wave 1 or a wave A is still up for judgment. Either way, that first leg sets a bearish tone at the larger degree.

Here’s where it gets interesting. The correction since then shows traits of a flat. A running one at the moment.

This opens the door to two active bearish projections:

A wave C collapse, implying a completed A B C correction and a downside resolution.

A wave 3 drop, for a possible top if this is an impulsive sequence.

That is the fork in the road. And it all hinges on the next move.

Right now, the smallest degree impulse off the low is doing some heavy lifting.

If that pivot holds and we only get an internal retracement like a micro wave 2, the door is still open for upside continuation.

But if that impulse gets invalidated, I would expect bears to press. First for a break below 100k, then toward the 95k area.

Here is how to think about it:

Hold the small impulse → Potential upside

Break the impulse base → Wave C or 3 likely underway

Context still leans bearish. Lower highs are still in play. But we are hunting a specific structure to confirm it.

More on the TradeDevils Discord discord.gg/p9bjnpwnMc

Trade Devils University Sensei: tradedevils.com/my-account/?ref=ebquu4

Certified Elliott Wave Analyst Master: t.co/2GQ7uSjJVG?amp=1

Trade Devils University Sensei: tradedevils.com/my-account/?ref=ebquu4

Certified Elliott Wave Analyst Master: t.co/2GQ7uSjJVG?amp=1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

More on the TradeDevils Discord discord.gg/p9bjnpwnMc

Trade Devils University Sensei: tradedevils.com/my-account/?ref=ebquu4

Certified Elliott Wave Analyst Master: t.co/2GQ7uSjJVG?amp=1

Trade Devils University Sensei: tradedevils.com/my-account/?ref=ebquu4

Certified Elliott Wave Analyst Master: t.co/2GQ7uSjJVG?amp=1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.