Updated

btc 12-12 update~ (35k then 150k?)

morning,

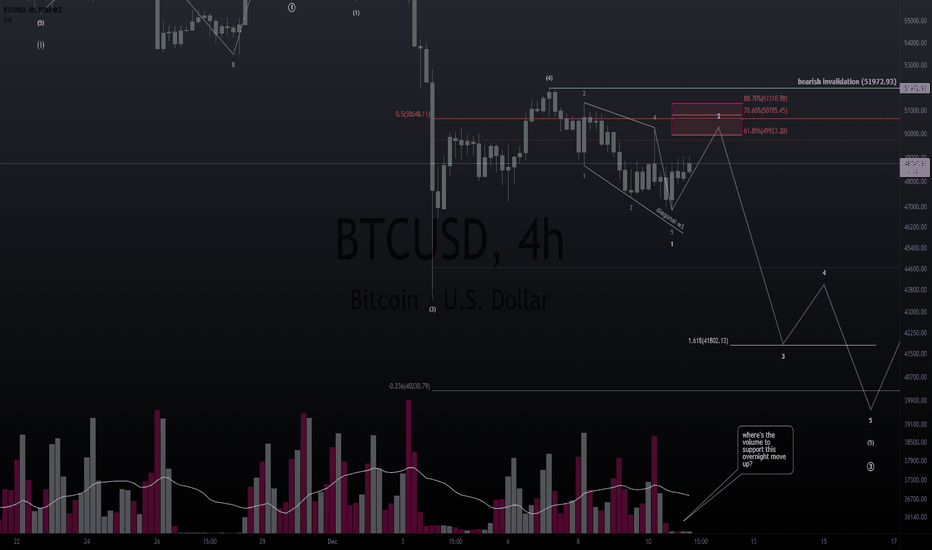

was taking a deep dive into the micro-wave count, and i noticed something very interesting.

we have a vast array of 3's in this local area - indicative of very corrective movement.

w-x-y's come in 3's, and that would beautifully explain the price action that we're currently in.

----

>this case would indicate that we have put in our initial 5 waves down already into the Primary Wave (A).

>with the final fifth of Wave (A) that played out as a classical expanding diagonal, (one of the rarest moves in the markets).

>currently working on a mean retracement into the primary the Wave (B).

>[before the final drop into Wave (C) to complete a deep Wave (2) of a higher degree.

this would be very bullish if we were indeed playing out a 1-2.

wave (2) would land somewhere in the mid 30k range.

wave (3) target would be closer to the 150k region into next year.

wave 2's are notorious for going deep, to shake out those who aren't expecting it - and to reset the oscillators on the larger timeframes before the massive wave 3 impulse that follows after.

ps.

>it is very rare to see 4 red weekly candle closes in a row; here's a few that i've found from historical price action.

>in 2014 - rallied 100% after

>in 2015 - rallied 293% after

>in 2016 - rallied 3355% after

>in 2020 - rallied 1362% after

----

👇

👇

was taking a deep dive into the micro-wave count, and i noticed something very interesting.

we have a vast array of 3's in this local area - indicative of very corrective movement.

w-x-y's come in 3's, and that would beautifully explain the price action that we're currently in.

----

>this case would indicate that we have put in our initial 5 waves down already into the Primary Wave (A).

>with the final fifth of Wave (A) that played out as a classical expanding diagonal, (one of the rarest moves in the markets).

>currently working on a mean retracement into the primary the Wave (B).

>[before the final drop into Wave (C) to complete a deep Wave (2) of a higher degree.

this would be very bullish if we were indeed playing out a 1-2.

wave (2) would land somewhere in the mid 30k range.

wave (3) target would be closer to the 150k region into next year.

wave 2's are notorious for going deep, to shake out those who aren't expecting it - and to reset the oscillators on the larger timeframes before the massive wave 3 impulse that follows after.

ps.

>it is very rare to see 4 red weekly candle closes in a row; here's a few that i've found from historical price action.

>in 2014 - rallied 100% after

>in 2015 - rallied 293% after

>in 2016 - rallied 3355% after

>in 2020 - rallied 1362% after

----

👇

👇

Note

The magic number for an easy short swing 👇kucoin - $51,289.80

binance - $51,295.37

bybit - $51,319.50

ftx - $51,305

Note

posted a video update talking about this setup for anyone interested ~Note

as i mentioned before, i'm not professional or anything - just a guy who plays a violin on the titanic 💥🎻Note

cover some profits here if you got in with me this afternoon, potential for one more hurrah to tag 51k. most likely won't happen, but if it does - that's a re-entry.Note

i'm going to hang back for a few days & let the market show me what it wants. good luck peoples o/i only share a tiny fragment of my ideas on this platform. to view my daily work, join the lunar syndicate 9 👇

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

i only share a tiny fragment of my ideas on this platform. to view my daily work, join the lunar syndicate 9 👇

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.