What are Motivation and Engagement in trading? 🧐

What are Motivation and Engagement in trading?

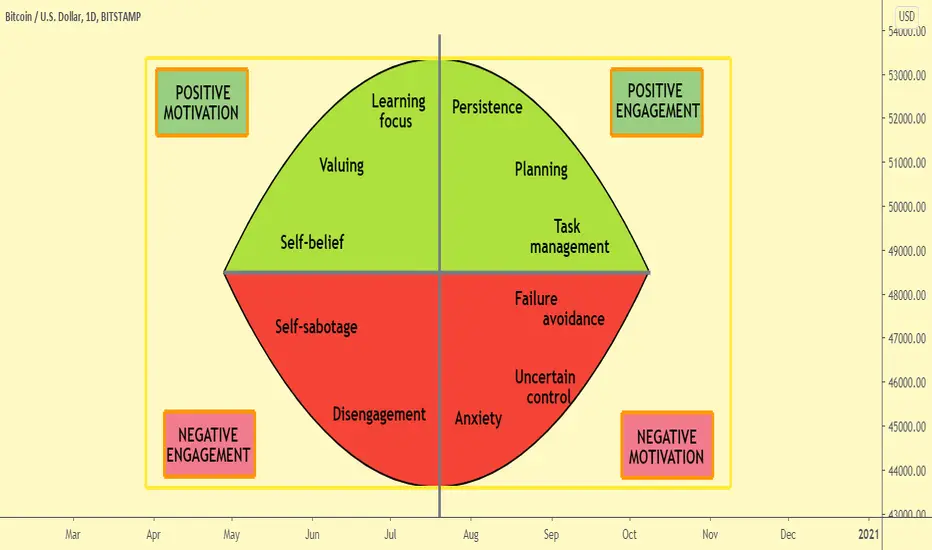

Motivation is defined here as the energy, drive, interest, and inclination to learn and achieve goals.

Engagement is defined here as the behaviours following from this energy, drive, interest, and inclination. Motivation and engagement are desirable ends in themselves (i.e., it is great to be motivated and engaged). Motivation and engagement are also a means to desirable ends such as achievement (i.e., motivation and engagement lead to great things).

There are four areas of motivation and engagement, and 11 facets of motivation and engagement within these four areas.

Positive Motivation

• Self-belief. Self-belief is an essential feature of any successful trader. Belief and confidence in ability to meet challenges you face in the market, and to perform to the best of your ability .

• Valuing. Valuing is the extent to which you believe what you learn is useful, relevant, meaningful and important. You can assess the importance of the deal in a given period of time. Assess risks and possible rewards.

• Learning focus. Traders, who are learning focused are interested in learning, developing new skills, improving, understanding new things, — not just for rewards they become more successful.

I ALWAYS DO ACCESS ON DEVELOPMENT !!!NEVER STOP DEVELOPING !!

Positive Engagement

• Persistence. Persistence is shown by traders when they keep trying to work out an answer or to understand a problem, even if that problem is difficult or challenging.

• Planning (and monitoring). Planning refers to how traders plan assignments, deals. Monitoring refers to the strategies used to keep track of their progress.

• Task management. Task management refers to how traders use their time, organise their timetable, and choose their potential deals.

Negative Motivation

• Anxiety. Anxiety has two parts: worrying and feeling nervous. Worrying is fear about not doing very well , miss an opportunity, losse money etc. Feeling nervous is the uneasy or sick feeling traders get when they think about or do their work.

• Uncertain control. Traders have an uncertain or low sense of control when they are unsure how to do well or how to avoid doing poorly.

• Failure avoidance (or fear of failure). Traders are traing to failure avoidant but the main task is to learn how to control risks in each deal.

Negative Engagement

• Self-sabotage. Traders self-sabotage when they do things that reduce their success at the market. Example: Be afraid to enter a deal too early and enter a deal too late.

• Disengagement. Disengagement happen a trader after several losing trades. The main thing is not to give up, at such moments you need a support of more experienced traders who went through the same feelings.

TO BECOME A SUCCESSFUL TRADER WITH FULLY ENOUGH POSITIVE MOTIVATION AND ENGAGEMENT !!!

What are Motivation and Engagement in trading?

Motivation is defined here as the energy, drive, interest, and inclination to learn and achieve goals.

Engagement is defined here as the behaviours following from this energy, drive, interest, and inclination. Motivation and engagement are desirable ends in themselves (i.e., it is great to be motivated and engaged). Motivation and engagement are also a means to desirable ends such as achievement (i.e., motivation and engagement lead to great things).

There are four areas of motivation and engagement, and 11 facets of motivation and engagement within these four areas.

Positive Motivation

• Self-belief. Self-belief is an essential feature of any successful trader. Belief and confidence in ability to meet challenges you face in the market, and to perform to the best of your ability .

• Valuing. Valuing is the extent to which you believe what you learn is useful, relevant, meaningful and important. You can assess the importance of the deal in a given period of time. Assess risks and possible rewards.

• Learning focus. Traders, who are learning focused are interested in learning, developing new skills, improving, understanding new things, — not just for rewards they become more successful.

I ALWAYS DO ACCESS ON DEVELOPMENT !!!NEVER STOP DEVELOPING !!

Positive Engagement

• Persistence. Persistence is shown by traders when they keep trying to work out an answer or to understand a problem, even if that problem is difficult or challenging.

• Planning (and monitoring). Planning refers to how traders plan assignments, deals. Monitoring refers to the strategies used to keep track of their progress.

• Task management. Task management refers to how traders use their time, organise their timetable, and choose their potential deals.

Negative Motivation

• Anxiety. Anxiety has two parts: worrying and feeling nervous. Worrying is fear about not doing very well , miss an opportunity, losse money etc. Feeling nervous is the uneasy or sick feeling traders get when they think about or do their work.

• Uncertain control. Traders have an uncertain or low sense of control when they are unsure how to do well or how to avoid doing poorly.

• Failure avoidance (or fear of failure). Traders are traing to failure avoidant but the main task is to learn how to control risks in each deal.

Negative Engagement

• Self-sabotage. Traders self-sabotage when they do things that reduce their success at the market. Example: Be afraid to enter a deal too early and enter a deal too late.

• Disengagement. Disengagement happen a trader after several losing trades. The main thing is not to give up, at such moments you need a support of more experienced traders who went through the same feelings.

TO BECOME A SUCCESSFUL TRADER WITH FULLY ENOUGH POSITIVE MOTIVATION AND ENGAGEMENT !!!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.